Cst Form 1 1j2d5i

This document was ed by and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this report form. Report 2z6p3t

Overview 5o1f4z

& View Cst Form 1 as PDF for free.

More details 6z3438

- Words: 1,065

- Pages: 6

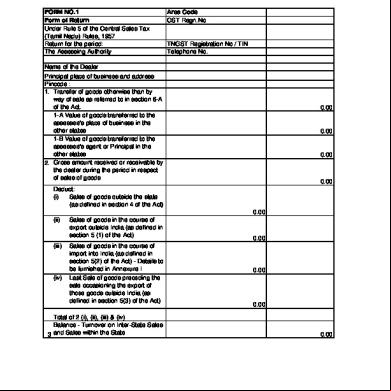

FORM - 1 Form of Return under Rule (5) of the Central Sales Tax (Tamil Nadu) Rules, 1957 FORM NO.1 Form of Return Under Rule 5 of the Central Sales Tax (Tamil Nadu) Rules, 1957 Return for the period: The Assessing Authority

Area Code CST Regn.No

TNGST Registration No / TIN Telephone No.

Name of the Dealer Principal place of business and address Pincode : 1. Transfer of goods otherwise than by way of sale as referred to in section 6-A of the Act. 1-A Value of goods transferred to the assessee's place of business in the other states 1-B Value of goods transferred to the assessee's agent or Principal in the other states 2. Gross amount received or receivable by the dealer during the period in respect of sales of goods

0.00

0.00

0.00

0.00

Deduct: Sales of goods outside the state (i) (as defined in section 4 of the Act) 0.00 (ii)

Sales of goods in the course of export outside India (as defined in section 5 (1) of the Act)

(iii)

Sales of goods in the course of import into India (as defined in section 5(2) of the Act) - Details to be furnished in Annexure I Last Sale of goods preceding the sale occasioning the export of those goods outside India (as defined in section 5(3) of the Act)

(iv)

Total of 2 (i), (ii), (iii) & (iv) Balance - Turnover on Inter-State Sales 3 and Sales within the State

0.00

0.00

0.00

0.00

Deduct - Turnover on Sales within the State 4. Balance - Turnover on inter-State Sales Deduct: Cash discount allowed according (i) to the practice normally prevailing in the trade and cost of freight delivery or installation when such cost is separately charged. (ii)

Tax Collections deducted according to section 8-A (1) (a)

Sale price repaid to purchasers in respect of goods returned by them according to section 8-A (1)(b) of the Act Total of 4 (i), (ii) and (iii) 5 Balance- Total turnover on inter-State Sales 5-A Turnover on of subsequent sales to ed dealers exempt under section 6(2) of the act Details to be furnished in Annexure II (iii)

5-B

Turnover in goods exempt from tax under section 8 (2-A) of the Act(Commodity wise turnover should be furnised)

5-C Turnover exempt under section 8(5) of the Act (Commodity wise turnover should be furnished) Total of 5-A, 5-B and 5-C Balance Turnover on of Sales 6. taxable under the act

0.00 0.00 0.00

0.00 0.00

0.00 0.00

0.00

0.00

0.00 0.00 0.00

GOODS WISE BREAKUP OF TURNOVER ON OF SALES TAXABLE UNDER THE ACT APPENDIX - I - DECLARED GOODS S. No.

Name of the Commodity

Commo Rate of Taxable Turnover Tax Due dity Tax Code

APPENDIX II - OTHER GOODS

Total 1. Tax payable as per return in Form 1 2. (a) Adjustment of Advance tax/Refund (b) Entry tax, if any paid (c) Input tax Credit available in Form 1 of the Tamilnadu Vat Rules,2007 Total 3. Balance to be paid or Excess carried forward to next month

Rs.

Tax Collected

4. Payment Details: S L N o

Amount

Crossed cheque / Crossed DD / Crossed Banker's Cheque No & Date

1

Total

(in Words) Rupees

Bank

Bank Code

DECLARATION 1. I/We declare that to the best of my/our knowledge and belief, the information furnished in the above statement is true and complete. 2. I/We declare that I/we am/are authorised by proprietor/deed of partnership/resolution of the Board of Directors of the Company to sign the return 3. I/We further declare that I/we am/are fully aware of the provisions of rule 5 of the Central Sales Tax (Tamil Nadu) Rules 1957, that the amount of balance of tax as per this return shall become due on the date of receipt of this return by you or on the last date prescribed and shall be recovered in accordance with the provisions of the Act without notice of demand to me/us. Place Date

Note : -

Signature: Name: Status and relationship to the dealer: (1) The turnover details required in the above appendices should be furnished commodity wise. (2) Commodity code in column No.3 need not be filled in by the dealer.

Bill of lading Sl No. number and date

(1)

Place Date

(2)

Name of the Commodity

(3)

Name and address of the foreign seller Purchase from whom these Invoice No. goods were and Date purchased

(4)

(5)

Status and relationship to the dealer:

Value of goods purchased

(6)

Bill of entry number and Name of the date (Please ship and Invoice No. Date of specify name and & date of the endorsement whether bill Value of the address of sale in the of bill of of entry was goods sold the shipping course of lading for home company/age import consumption nt or ware housing) (7)

Signature: Name:

(8)

(9)

(10)

(11)

Name and address of the

Clearing agent

Buyer

(12)

ANNEXURE II - DETAILS OF TURNOVER CLAIMED AS EXEMPTED UNDER GOODS 6(2) OF THE ACT

Sl No.

LR/RR number and date

Name of the Commodity

Name and address of the seller from whom these goods were purchased

(1)

(2)

(3)

(4)

Purchase Invoice No. and Date

Value of goods purchased

(5)

(6)

Date of landing of Name and Date of Transit Value of the the place of address of endorsement Invoice No. goods sold dealer the Carrier of the LR/RR & date Rs. effecting the transit sale (7)

(8)

(9)

(10)

(11)

Name and address of the buyer

(12)

ANNEXURE - III - STOCK TRANSFERS

Sl No.

Form JJ under TN VAT Rules, 2007, Stock transfer Invoice/ Memo/Challan No. & Date

Goods Vehicle Number

Sl No.

Form JJ under TN VAT Rules, 2007/ Delivery

Goods Vehicle Number

Place Date

Lorry receipts / Railway receipts Number & Date

Description of Goods

Quantity

Approximate Value (Rs.)

TIN and CST Form"F" number under the Full address and telephone Reg. No. CST (Registration) and No. if any of the place of with date, of (Turnover) Rules, 1957 and Business in the other State other State date if it has been received

ANNEXURE - IV - FOR CONSIGNMENT SALES Lorry Description Name and Full address of TIN and CST Form"F" number under the Approximate Quantity Value (Rs.) receipts / of Goods the consignee in other State Reg. No. CST (Registration) and

Status and relationship to the dealer:

Signature: Name:

Area Code CST Regn.No

TNGST Registration No / TIN Telephone No.

Name of the Dealer Principal place of business and address Pincode : 1. Transfer of goods otherwise than by way of sale as referred to in section 6-A of the Act. 1-A Value of goods transferred to the assessee's place of business in the other states 1-B Value of goods transferred to the assessee's agent or Principal in the other states 2. Gross amount received or receivable by the dealer during the period in respect of sales of goods

0.00

0.00

0.00

0.00

Deduct: Sales of goods outside the state (i) (as defined in section 4 of the Act) 0.00 (ii)

Sales of goods in the course of export outside India (as defined in section 5 (1) of the Act)

(iii)

Sales of goods in the course of import into India (as defined in section 5(2) of the Act) - Details to be furnished in Annexure I Last Sale of goods preceding the sale occasioning the export of those goods outside India (as defined in section 5(3) of the Act)

(iv)

Total of 2 (i), (ii), (iii) & (iv) Balance - Turnover on Inter-State Sales 3 and Sales within the State

0.00

0.00

0.00

0.00

Deduct - Turnover on Sales within the State 4. Balance - Turnover on inter-State Sales Deduct: Cash discount allowed according (i) to the practice normally prevailing in the trade and cost of freight delivery or installation when such cost is separately charged. (ii)

Tax Collections deducted according to section 8-A (1) (a)

Sale price repaid to purchasers in respect of goods returned by them according to section 8-A (1)(b) of the Act Total of 4 (i), (ii) and (iii) 5 Balance- Total turnover on inter-State Sales 5-A Turnover on of subsequent sales to ed dealers exempt under section 6(2) of the act Details to be furnished in Annexure II (iii)

5-B

Turnover in goods exempt from tax under section 8 (2-A) of the Act(Commodity wise turnover should be furnised)

5-C Turnover exempt under section 8(5) of the Act (Commodity wise turnover should be furnished) Total of 5-A, 5-B and 5-C Balance Turnover on of Sales 6. taxable under the act

0.00 0.00 0.00

0.00 0.00

0.00 0.00

0.00

0.00

0.00 0.00 0.00

GOODS WISE BREAKUP OF TURNOVER ON OF SALES TAXABLE UNDER THE ACT APPENDIX - I - DECLARED GOODS S. No.

Name of the Commodity

Commo Rate of Taxable Turnover Tax Due dity Tax Code

APPENDIX II - OTHER GOODS

Total 1. Tax payable as per return in Form 1 2. (a) Adjustment of Advance tax/Refund (b) Entry tax, if any paid (c) Input tax Credit available in Form 1 of the Tamilnadu Vat Rules,2007 Total 3. Balance to be paid or Excess carried forward to next month

Rs.

Tax Collected

4. Payment Details: S L N o

Amount

Crossed cheque / Crossed DD / Crossed Banker's Cheque No & Date

1

Total

(in Words) Rupees

Bank

Bank Code

DECLARATION 1. I/We declare that to the best of my/our knowledge and belief, the information furnished in the above statement is true and complete. 2. I/We declare that I/we am/are authorised by proprietor/deed of partnership/resolution of the Board of Directors of the Company to sign the return 3. I/We further declare that I/we am/are fully aware of the provisions of rule 5 of the Central Sales Tax (Tamil Nadu) Rules 1957, that the amount of balance of tax as per this return shall become due on the date of receipt of this return by you or on the last date prescribed and shall be recovered in accordance with the provisions of the Act without notice of demand to me/us. Place Date

Note : -

Signature: Name: Status and relationship to the dealer: (1) The turnover details required in the above appendices should be furnished commodity wise. (2) Commodity code in column No.3 need not be filled in by the dealer.

Bill of lading Sl No. number and date

(1)

Place Date

(2)

Name of the Commodity

(3)

Name and address of the foreign seller Purchase from whom these Invoice No. goods were and Date purchased

(4)

(5)

Status and relationship to the dealer:

Value of goods purchased

(6)

Bill of entry number and Name of the date (Please ship and Invoice No. Date of specify name and & date of the endorsement whether bill Value of the address of sale in the of bill of of entry was goods sold the shipping course of lading for home company/age import consumption nt or ware housing) (7)

Signature: Name:

(8)

(9)

(10)

(11)

Name and address of the

Clearing agent

Buyer

(12)

ANNEXURE II - DETAILS OF TURNOVER CLAIMED AS EXEMPTED UNDER GOODS 6(2) OF THE ACT

Sl No.

LR/RR number and date

Name of the Commodity

Name and address of the seller from whom these goods were purchased

(1)

(2)

(3)

(4)

Purchase Invoice No. and Date

Value of goods purchased

(5)

(6)

Date of landing of Name and Date of Transit Value of the the place of address of endorsement Invoice No. goods sold dealer the Carrier of the LR/RR & date Rs. effecting the transit sale (7)

(8)

(9)

(10)

(11)

Name and address of the buyer

(12)

ANNEXURE - III - STOCK TRANSFERS

Sl No.

Form JJ under TN VAT Rules, 2007, Stock transfer Invoice/ Memo/Challan No. & Date

Goods Vehicle Number

Sl No.

Form JJ under TN VAT Rules, 2007/ Delivery

Goods Vehicle Number

Place Date

Lorry receipts / Railway receipts Number & Date

Description of Goods

Quantity

Approximate Value (Rs.)

TIN and CST Form"F" number under the Full address and telephone Reg. No. CST (Registration) and No. if any of the place of with date, of (Turnover) Rules, 1957 and Business in the other State other State date if it has been received

ANNEXURE - IV - FOR CONSIGNMENT SALES Lorry Description Name and Full address of TIN and CST Form"F" number under the Approximate Quantity Value (Rs.) receipts / of Goods the consignee in other State Reg. No. CST (Registration) and

Status and relationship to the dealer:

Signature: Name: