What Are The Best Companies To Invest In Shares Currently_ - Quora 4n336g

This document was ed by and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this report form. Report 2z6p3t

Overview 5o1f4z

& View What Are The Best Companies To Invest In Shares Currently_ - Quora as PDF for free.

More details 6z3438

- Words: 759

- Pages: 3

Niyam Vora, B.E Electronics and Communication Engineering (2017) Answered Fri

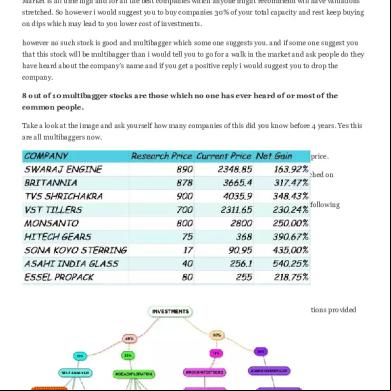

Market is all time high and for all the best companies which anyone might recommend will have valuations stretched. So however i would suggest you to buy companies 30% of your total capacity and rest keep buying on dips which may lead to you lower cost of investments. however no such stock is good and multibagger which some one suggests you. and if some one suggest you that this stock will be multibagger than i would tell you to go for a walk in the market and ask people do they have heard about the company’s name and if you get a positive reply i would suggest you to drop the company. 8 out of 10 multibagger stocks are those which no one has ever heard of or most of the common people. Take a look at the image and ask yourself how many companies of this did you know before 4 years. Yes this are all multibaggers now. yes this image is real. i do have each of above mentioned shares at the exact same purchase price. but to be honest at the time of purchase i didnt know that this amount of returns will be fetched on investment in the shares so all i did was divide my investments in to following chart. to the groups mentioned in the following image i would request you to go throught the following instructions. telegram in search bar search for DARKHORSESTOCKS and INCOGNITOSTOCKS and the group. the companies shown in the above image may vary from time to time. (i am personally holding all the companies mentioned in the above image, the recommendations provided does no constitute an advise for investment) Other than that i would suggest you to look for ASHOK LEYLAND EID PARRY ETC. 1.5k Views · 2 Upvotes Upvoted

2

Downvote

Comment

Jitesh Dhawan, I am seasoned investor & have experience of more than 9 yrs Answered Jul 3

1. JHS Svendgaard - (from FMCG space) the makers of toothpaste (including Dant Kanti from Patanjali), they supply to all major companies dealing in ayurvedic category 2. CMI Ltd - (from cables space) Speciality cable company is still not in limelight despite getting huge order flows on regular basis..check out their website for more details. You may like to check another company - Ram Ratna wires too, they are also strong player which is still not in limelight. 3. Shetron Ltd. - (from packaging space) it’s one company which can turn into big player….already has big clients include titan, glaxo smithline, cadbury etc. (best part is even promoters are increasing stake in it), even at CMP Rs 57–58, it’s a steal 4. Nila Infra ltd - (from Infrastructure space) - it’s one company i track since last week and found it really worthy of investment. (Nila Infrastructures clocks 22% growth in standalone revenues for year ended March 31, 2017), even on 21 June 2017 - Nila Infra bags work order worth Rs 251.6 mn from AMC, in April 2017 - Nila Infrastructure bags projects worth Rs 30 cr from GSRTC..order flows are increasing means future outlook is really strong. 5. Tourism Finance Corp - (from NBFC Space) - No need of introduction of this company (even Rakesh Jhunjhunwala is invested into this). It’s worth to check this one. 6. Archidply Industries - (from Plywood Space) - this stock is already recommended by many agencies and investors. The stock is still a small cap, so it has long way to go. The story will get unfolded once this small cap gem gets into the eyes of big investors. Disclosure - I am not a Equity Analyst, the above mentioned stocks are just my views, it’s not buy/sell recommendations. Do your own research before investing. 9.1k Views · 22 Upvotes Upvote 22

Downvote Comment

Chintan Amlani, Company Secretary and Compliance Officer (2016-present) Answered Jul 3

This is purely suggestive list, it is not guaranteed one but i would invest with horizon of 1–3 years in following scripts; 1. Coal India - at price of Rs. 248 (High Dividend) 2. RECL - at Price of Rs. 172 (High Dividend Yield) 3. PFC - at price of Rs. 124 (High Dividend Yield) 4. HUDCO - at price of Rs. 67 (Undervalued as Compared to Peers) 5. NMDC - at price of Rs. 112 (High Dividend + Undervalued)

6. Sintex - at Price of Rs. 24.50 (Trading at Low) 7. Hindzinc - at price of Rs. 265 (Cash Rich Company)

Market is all time high and for all the best companies which anyone might recommend will have valuations stretched. So however i would suggest you to buy companies 30% of your total capacity and rest keep buying on dips which may lead to you lower cost of investments. however no such stock is good and multibagger which some one suggests you. and if some one suggest you that this stock will be multibagger than i would tell you to go for a walk in the market and ask people do they have heard about the company’s name and if you get a positive reply i would suggest you to drop the company. 8 out of 10 multibagger stocks are those which no one has ever heard of or most of the common people. Take a look at the image and ask yourself how many companies of this did you know before 4 years. Yes this are all multibaggers now. yes this image is real. i do have each of above mentioned shares at the exact same purchase price. but to be honest at the time of purchase i didnt know that this amount of returns will be fetched on investment in the shares so all i did was divide my investments in to following chart. to the groups mentioned in the following image i would request you to go throught the following instructions. telegram in search bar search for DARKHORSESTOCKS and INCOGNITOSTOCKS and the group. the companies shown in the above image may vary from time to time. (i am personally holding all the companies mentioned in the above image, the recommendations provided does no constitute an advise for investment) Other than that i would suggest you to look for ASHOK LEYLAND EID PARRY ETC. 1.5k Views · 2 Upvotes Upvoted

2

Downvote

Comment

Jitesh Dhawan, I am seasoned investor & have experience of more than 9 yrs Answered Jul 3

1. JHS Svendgaard - (from FMCG space) the makers of toothpaste (including Dant Kanti from Patanjali), they supply to all major companies dealing in ayurvedic category 2. CMI Ltd - (from cables space) Speciality cable company is still not in limelight despite getting huge order flows on regular basis..check out their website for more details. You may like to check another company - Ram Ratna wires too, they are also strong player which is still not in limelight. 3. Shetron Ltd. - (from packaging space) it’s one company which can turn into big player….already has big clients include titan, glaxo smithline, cadbury etc. (best part is even promoters are increasing stake in it), even at CMP Rs 57–58, it’s a steal 4. Nila Infra ltd - (from Infrastructure space) - it’s one company i track since last week and found it really worthy of investment. (Nila Infrastructures clocks 22% growth in standalone revenues for year ended March 31, 2017), even on 21 June 2017 - Nila Infra bags work order worth Rs 251.6 mn from AMC, in April 2017 - Nila Infrastructure bags projects worth Rs 30 cr from GSRTC..order flows are increasing means future outlook is really strong. 5. Tourism Finance Corp - (from NBFC Space) - No need of introduction of this company (even Rakesh Jhunjhunwala is invested into this). It’s worth to check this one. 6. Archidply Industries - (from Plywood Space) - this stock is already recommended by many agencies and investors. The stock is still a small cap, so it has long way to go. The story will get unfolded once this small cap gem gets into the eyes of big investors. Disclosure - I am not a Equity Analyst, the above mentioned stocks are just my views, it’s not buy/sell recommendations. Do your own research before investing. 9.1k Views · 22 Upvotes Upvote 22

Downvote Comment

Chintan Amlani, Company Secretary and Compliance Officer (2016-present) Answered Jul 3

This is purely suggestive list, it is not guaranteed one but i would invest with horizon of 1–3 years in following scripts; 1. Coal India - at price of Rs. 248 (High Dividend) 2. RECL - at Price of Rs. 172 (High Dividend Yield) 3. PFC - at price of Rs. 124 (High Dividend Yield) 4. HUDCO - at price of Rs. 67 (Undervalued as Compared to Peers) 5. NMDC - at price of Rs. 112 (High Dividend + Undervalued)

6. Sintex - at Price of Rs. 24.50 (Trading at Low) 7. Hindzinc - at price of Rs. 265 (Cash Rich Company)