This document was ed by and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this report form. Report 2z6p3t

Overview 5o1f4z

& View S&p Global Platts Lng Daily Volume 16/issue 213/october 29, 2019 as PDF for free.

More details 6z3438

- Words: 10,190

- Pages: 14

LNG DAILY Volume 16 / Issue 213 / October 29, 2019

Key Drivers / Market Highlights MOC: 3 entities posted 2 bids and 3 offers ■■Sakhalin issues sell tender for Dec 11 loading ■■CFE issues buy tender for Nov 16-17 delivery ■■GAIL issues buy tender for Nov 17-25 delivery ■■Ichthys sell tender heard awarded at high $5 FOB for Nov 18-23 loading ■■BOTAS issues buy tender for a strip of cargoes from 2020-2023 ■■Deals heard into Europe at TTF-$0.60/MMBtu for Nov ■■European trader outlook bearish for December

Shipping Market Highlights ■■Shinshu

Maru diverted to load JERA FOB cargo early November Aurora heard fixed by Shell ■■PetroChina heard seeking vessel for multi-month charter ■■Arctic

News headlines ■■European

LNG regas back above 300 million cu m during Monday’s gas day...................................................................................................... 5

■■BP

sees global LNG supply glut persisting until 2022........................... 7 LNG touts modular approach, second-mover advantage................................................................................................. 7

■■Commonwealth

stories........................................................................................ 10-11

Contents ■■Market

Commentary................................................................................ 2 ■■Price Comparisons................................................................................... 3 ■■Recent Tenders and Strips...................................................................... 4 ■■News.......................................................................................................... 5 ■■Shipping Prices......................................................................................... 6

Shipping rates, Oct 29 Asia Pacific Atlantic

$/day AARXT00 120,000 AASYC00 130,000

Ballast rate AAXTN00 150% AAXTM00 150%

Daily Cumulative averages and monthly averages Oct 29 ($/MMBtu) JKM DES West India DES Mediterranean DES Northwest Europe FOB EAM FOB GCM JKM Yen conversion

www.platts.com

Cumulative monthly average (Dec) Previous month average (Nov)

6.157 -0.111

AAOVQ00

AAOVS00 6.688 AAOVS03 5.826

Platts daily LNG markers ($/MMBtu)

■■Asia

■■More

JKM TM

➧

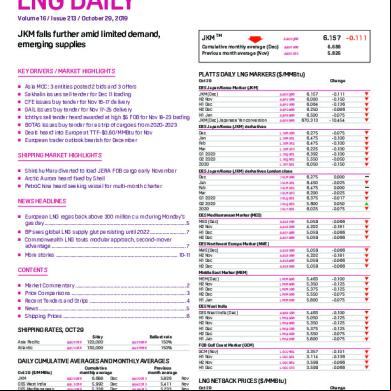

JKM falls further amid limited demand, emerging supplies

Cumulative Previous monthly average month average AAOVS00 6.688 Dec AAOVS03 5.826 Nov AALIC00 5.992 Dec AAWIC03 5.411 Nov AADCU00 5.336 Dec AASWC03 5.233 Nov AASDF00 5.311 Dec AASDE03 5.116 Nov LEAMT00 4.920 Nov LEAMS31 4.120 Oct LGGCN00 4.236 Nov LGGCM31 4.074 Oct AAOVT00 726.622 Dec AAOVT03 627.482 Nov

www.twitter.com/PlattsGas

Oct 29 Change DES Japan/Korea Marker (JKM) JKM (Dec) AAOVQ00 6.157 -0.111 H2 Nov AAPSU00 6.000 -0.150 H1 Dec AAPSV00 6.064 -0.136 H2 Dec AAPSW00 6.250 -0.086 H1 Jan AAPXA00 6.500 -0.075 JKM (Dec) Japanese Yen conversion AAOVR00 670.313 -10.454 DES Japan/Korea (JKM) derivatives Dec LJKMO00 6.275 -0.075 Jan LJKMO01 6.475 -0.100 Feb LJKMO02 6.475 -0.100 Mar LJKMO03 6.225 -0.100 Q1 2020 LJKQR01 6.392 -0.100 Q2 2020 LJKQR02 5.550 -0.050 2020 LJKYR01 6.050 -0.150 DES Japan/Korea (JKM) derivatives London close Dec JKLMO00 6.275 0.000 Jan JKLMO01 6.450 -0.025 Feb JKLMO02 6.475 0.000 Mar JKLMO03 6.200 -0.025 Q1 2020 JKLQR01 6.375 -0.017 Q2 2020 JKLQR02 5.600 0.050 2020 JKLYR01 6.025 -0.075 DES Mediterranean Marker (MED) MED (Dec) AASXY00 5.059 -0.066 H2 Nov AASXZ00 4.202 -0.181 H1 Dec AASYA00 5.059 -0.066 H2 Dec AASYB00 5.059 -0.066 DES Northwest Europe Marker (NWE) NWE (Dec) AASXU00 5.059 -0.066 H2 Nov AASXV00 4.202 -0.181 H1 Dec AASXW00 5.059 -0.066 H2 Dec AASXX00 5.059 -0.066 Middle East Marker (MEM) MEM (Dec) LMEMA00 5.463 -0.100 H2 Nov LMEMB00 5.350 -0.125 H1 Dec LMEMC00 5.375 -0.125 H2 Dec LMEMD00 5.550 -0.075 H1 Jan LMEME00 5.800 -0.075 DES West India DES West India (Dec) AARXS00 5.463 -0.100 H1 Nov LMEAA00 5.050 -0.125 H2 Nov LMEAB00 5.350 -0.125 H1 Dec LMEAC00 5.375 -0.125 H2 Dec LMEAD00 5.550 -0.075 H1 Jan LMEAE00 5.800 -0.075 FOB Gulf Coast Marker (GCM) GCM (Nov) LGCSM01 3.357 -0.101 H1 Nov LUGCA01 3.114 -0.136 H2 Nov LUGCB02 3.599 -0.066 H1 Dec LUGCC03 3.599 -0.066

▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼

— —

▼ ▼ ▼ ▲ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼

LNG netback prices ($/MMBtu) Oct 29 AARXR00 5.060 FOB Australia FOB Middle East AARXQ00 4.900 DES Brazil Netforward LEBMH01 5.179 FOB Singapore AARXU00 5.187

Change 0.040 -0.100 -0.066 -0.101

▲ ▼ ▼ ▼

LNG Daily

October 29, 2019

Market Commentary

Platts LNG Asia JKM Rationale The S&P Global Platts JKM for December cargoes was assessed 11.1 cents/ MMBtu lower on the day at $6.157/MMBtu Tuesday on a competitive offer during the Platts Market on Close assessment process.

JKM falls further amid limited demand, emerging supplies London—Spot Asia LNG prices fell further amid healthy supplies and subdued demand from end-s in the region. The S&P Global Platts JKM for December cargoes was assessed 11.1 cents/MMBtu lower from Friday at $6.157/MMBtu Tuesday on a competitive offer during the Platts Market on Close assessment process. Bearish sentiment continued within the market as December supplies emerged in the market, while Asian end-s already maintained comfortable inventory levels despite approaching peakdemand season. “As far as I know, no Japanese end-s are approaching us or other sellers for winter stockpiling,” a Japanese trader said. While market participants awaited demand from other Asian countries, additional demand from Chinese and South Korean ends was not prevalent on Tuesday. In the bilateral market, a Japanese trading house was heard to have sold a December 22-26 cargo to a portfolio player at the low $6.00/MMBtu recently. On tender results, Ichthys LNG’s sell-tender for November 18-23 loading was heard awarded at the high $5.00/MMBtu on a FOB basis, according to market participants. The tender closed on Friday. Further details of the tender remained limited at the time of publication. On newly issued tenders, Russia’s Sakhalin Energy was heard to have issued a sell tender for December 11 loading. The tender closes on Thursday. Indian end- GAIL issued a buy tender for November 17-25 delivery to west coast India. The tender closes on October 29 with same-day validity. Elsewhere, Mexico’s CFE issued a buy tender for November 16-17

Platts assessed H1 and H2 December at $6.064/MMBtu and $6.250/MMBtu, respectively, with a half-monthly contango structure of 18.6 cents/MMBtu. Value on December 12 was assessed at $6.09/MMBtu, below BP’s offer at $6.10/ MMBtu for December 11-13 delivery, with a GHV of 1030-1130 Btu/cu ft and volume of 3.4 Tbtu. The same entity bid at $5.80/MMBtu for December 13-17 delivery, with a GHV of 1065-1150 Btu/cu ft and volume of 3.3 Tbtu. The bid was normalized down by 5 cents/MMBtu for higher GHV limiting supply sources against the JKM specification. DGI’s bid for December 20-24 was excluded from Tuesday’s assessment process. This rationale applies to symbol(s)

Platts LNG US FOB Gulf Coast Daily Rationale The FOB Gulf Coast Marker (GCM) for November was assessed at $3.357/ MMBtu. In the absence of transactional data, DES JKM (H1) and NWE (H2) yield the best netback for an exporter of US LNG based on prevailing market values. This rationale applies to symbol(s)

Platts LNG European Assessment Rationale The Northwest Europe Marker (NWE) for December was assessed at $5.059/ MMBtu, at a $0.20/MMBtu discount to the equivalent TTF forward contract. The Mediterranean Marker (MED) for December was assessed at $5.059/MMBtu, at a $0.20/MMBtu discount to the equivalent TTF forward contract. This rationale applies to symbol(s)

delivery to Manzanillo on a DES basis. The tender also closes on Thursday. Further ahead in the market, Turkey’s BOTAS issued a buy tender for a strip of cargoes from 2020 to 2023. This tender closes on November 9, and is valid until November 30. During the Platts MOC process on Tuesday, DGI, BP and Vitol posted two bids and three offers for December delivery. Meanwhile in Europe, market participants remain bearish in their (continued on page 5)

Reported Atlantic bids, offers and trades ($/MMBtu) Date Seller Loading

Buyer Basis Loading Window Offer/Bid Notes Best Bids/Offers Oct 29 Gate, Netherlands DES H2 Dec TTF-0.40 bid Oct 29 Gate, Netherlands DES H2 Dec TTF-0.45 bid

Reported North Asian bids, offers and trades ($/MMBtu) Date

Buyer Destination Seller Source Basis Delivery period Bid/Offer Notes Best Bids/Offers Oct 29 BPSG JKTC DES Dec 13-Dec 17 5.80 bid MOC VITOLSG JKTC DES Dec 16-Dec 20 5.80 bid MOC Oct 29 Oct 29 JKC DGI DES Dec 22-Dec 26 6.30 offer MOC JKTC DGI DES Dec 22-Dec 26 6.35 offer MOC Oct 29 Oct 29 JKTC BPSG DES Dec 11-Dec 13 6.10 offer MOC Last 5 trades NE Asia Oct 25 Yudean Dapeng LNG Vitol DES Dec 2-6 6.05 Oct 24 JKTC Sakhalin LNG Russia DES Nov 26 loading mid-$6s Oct 17 VITOLSG JKTC GUNVOR DES Dec 13-17 7.10 MOC Oct 15 North Asia Oman DES Dec 3 Around 6.50 Oct 15 Shell JKTC Brunei LNG DES Dec 2-4 Around 6.50

© 2019 S&P Global Platts, a division of S&P Global Inc. All rights reserved.

2

LNG Daily

October 29, 2019

Asia/Middle East ($/MMBtu), Oct 29

Europe ($/MMBtu), Oct 29

DES Japan/Korea Marker (JKM) JKM (Dec) JKM (H2 Nov) JKM (H1 Dec) JKM (H2 Dec) JKM (H1 Jan) Asian Dated Brent (16:30 Singapore) JKM vs Henry Hub futures JKM vs NBP futures JKM vs TTF JKM vs Asian Dated Brent (16:30 Singapore) JKM vs MED (16:30 London) JKM vs NWE (16:30 London)

AAOVQ00 6.157 AAPSU00 6.000 AAPSV00 6.064 AAPSW00 6.250 AAPXA00 6.500 ADBAA00 10.42 AAPRZ00 3.554 AAPSA00 0.607 LNTFJ00 0.898 AAPSB00 -4.261 ALNGB00 1.098 ALNGA00 1.098

FOB East Atlantic Marker (EAM) EAM (Nov) EAM (H1 Nov) EAM (H2 Nov) EAM (H1 Dec) Dated Brent (16:30 London) EAM vs Henry Hub futures EAM vs NBP futures EAM vs Dated Brent (16:30 London) EAM vs MED EAM vs JKM EAM vs ARA fuel oil

LEAMM01 4.700 LEAMH01 4.70 LEAMH02 4.70 LEAMH03 5.10 ADBAB00 10.53 LEHHM01 2.085 LENPM01 0.061 LEADB00 -5.834 LESWE00 -0.359 LEJKM01 -1.457 LEARA00 -4.970

DES Japan/Korea (JKM) derivatives Dec Jan Feb Mar Q1 2020 Q2 2020 2020

LJKMO00 6.275 LJKMO01 6.475 LJKMO02 6.475 LJKMO03 6.225 LJKQR01 6.392 LJKQR02 5.550 LJKYR01 6.050

FOB Middle East FOB Middle East

AARXQ00 4.900

DES Mediterranean Marker (MED) MED (Dec) MED (H2 Nov) MED (H1 Dec) MED (H2 Dec) Dated Brent (16:30 London) MED vs Henry Hub futures MED vs TTF MED vs NBP futures MED vs Dated Brent (16:30 London) MED vs NWE MED vs JKM

AASXY00 5.059 AASXZ00 4.202 AASYA00 5.059 AASYB00 5.059 ADBAB00 10.53 AASYF00 2.378 LNTFS00 -0.200 AASYH00 -0.401 AASYJ00 -5.475 ALNSA00 0.000 AASYM00 -1.098

DES West India DES West India (Dec)

AARXS00 5.463

FOB Australia (netback) JKM (Dec) (-) Freight FOB Australia

AAOVQ00 6.157 AAUSA00 1.10 AARXR00 5.06

Key gas price benchmarks Japan JCC LNG (Jul) Japan JCC LNG (Aug)

LAKPN00 9.54 Final LAKPM00 10.12 Estimated

Platts Dutch TTF Nov Dec

GTFWM10 4.502 GTFWM20 5.259

DES Northwest Europe Marker (NWE) NWE (Dec) NWE (H2 Nov) NWE (H1 Dec) NWE (H2 Dec) Dated Brent (16:30 London) NWE vs Henry Hub futures NWE vs TTF NWE vs NBP futures NWE vs Dated Brent (16:30 London) NWE vs MED NWE vs JKM NWE as a % of NBP

AASXU00 5.059 AASXV00 4.202 AASXW00 5.059 AASXX00 5.059 ADBAB00 10.53 AASYE00 2.378 LNTFN00 -0.200 AASYG00 -0.401 AASYI00 -5.475 AASYK00 0.000 AASYL00 -1.098 AASYD00 92.65

Competing fuel prices JCC crude oil (Jul) ($/b) JCC crude oil (Aug) ($/b) HSFO 3.5% sulfur 180 CST FOB Singapore NEAT Coal Index Minas crude oil Naphtha CFR Japan

AAKOP00 67.32 Final AAKOM00 67.38 Estimated LUAXZ00 6.91 JKTCB00 3.077 LCABO00 10.032 LNPHJ00 11.210

Competing fuel prices Northwest Europe fuel oil CIF ARA 15-60 day thermal coal

LAEGR00 9.67 CSAAB00 2.30

Notes: Japan JCC value shows latest available CIF price published by the Ministry of Finance, converted to US dollars per MMBtu. All other values reflect Platts most recent one-month forward assessments for each product in each region, converted to US dollars per MMBtu. JKM Marker, SWE LNG and NWE LNG average the assessments of the two half-months comprising the first full month of forward delivery. Asian LNG assessments assessed at Singapore market close 0830 GMT, European LNG assessment assessed at London market close 1630 UK time. NYMEX Henry Hub futures and ICE NBP futures values taken at Singapore market close and London market close. ICE NBP futures converted from Pence/Therm to $/MMBtu. Asian Dated Brent crude oil assessed at Asian market close 0830 GMT and converted from $/barrel to $/MMBtu. Detailed assessment methodology is found on www.platts.com.

South America ($/MMBtu), Oct 29 DES Brazil Netforward DES Brazil (Nov) DES Brazil vs NWE Fuel Oil Derivative DES Brazil vs DES MED LNG DES Brazil vs Dated Brent DES Brazil vs Henry Hub (16:30 London) DES Brazil vs JKM (16:30 London) DES Brazil vs NBP (16:30 London)

LEBMH01 5.179 LAARM01 -4.491 LASWM01 0.120 LADBM01 -5.355 LAHHM01 2.564 LAJKM01 -0.978 LABPM01 0.540

FOB Gulf Coast Marker (GCM) GCM (Nov) GCM (H1 Nov) GCM (H2 Nov) GCM (H1 Dec) Americas Dated Brent (13:30 Houston) Dated Brent (16:30 London) WTI (13:30 Houston) GCM vs JKM GCM vs EAM GCM vs Henry Hub futures GCM vs TTF GCM vs NBP futures GCM vs Americas Dated Brent (13:30 Houston) GCM vs Dated Brent (16:30 London) GCM vs WTI (13:30 Houston) GCM vs USGC HSFO

LGCSM01 3.357 LUGCA01 3.114 LUGCB02 3.599 LUGCC03 3.599 ADBAC00 10.488 ADBAB00 10.53 ADBAD00 9.576 LGMJM01 -2.800 LGMEA00 -1.343 LGMHM01 0.760 LNTFG00 -1.145 LGMNM01 -1.282 AGCMA00 -7.131 LGMDB00 -7.177 LGMWT00 -6.219 LGMFO00 -2.223

Competing fuel prices US Gulf Coast high sulfur fuel oil New York Harbor 1%S fuel oil

LUAXJ00 5.47 LUAXD00 10.07

Futures ($/MMBtu), Oct 29

Marine Fuel LNG Bunker, Oct 29 $/MMBtu $/mt Singapore LNBSG00 11.625 LNBSM00 449.225 Eur/MWh $/mt Rotterdam LNBRT00 19.325 LNBRM00 243.106 MMBtu to $/mt factor: 38.643; MWh to $/mt factor: 11.322.

© 2019 S&P Global Platts, a division of S&P Global Inc. All rights reserved.

North America ($/MMBtu), Oct 29

3

NYMEX HH Singapore close ICE NBP Singapore close NYMEX HH London close ICE NBP London close NYMEX HH US close

(Nov) (Nov) (Nov 19) (Nov 19) (Nov 19)

AAPSD00 2.495 (Dec) AAPSF00 4.818 (Dec) AASYN00 2.615 (Dec 19) AASYR00 4.639 (Dec 19) NMNG001 2.597 (Dec 19)

AAPSE00 2.603 AAPSG00 5.550 AASYO00 2.681 AASYS00 5.460 NMNG002 2.639

LNG Daily

October 29, 2019

Recent tenders and strips Tender/ strip Issuer/location October 29

Tender type

(Loading) or delivery period

Slots/ cargoes Opening

Closing date

Validity

Tender

PGNiG - Poland

Buy

5 DES

24-Oct-19

24-Oct-19

Tender

Sakhalin - Sakhalin

Sell

1 DES

24-Oct-19

25-Oct-19

Tender

Tender

Guangdong Dapeng Buy LNG - China Ichthys LNG Sell Ichthys LNG BOTAS - Turkey Buy

01-Jan-20 31-Mar-20 (26-Nov-19 26-Nov-19) 02-Dec-19 06-Dec-19 (18-Nov-19 23-Nov-19) 01-Jan-20 31-Dec-23

Tender

Sakhalin - Sakhalin

Sell

Tender

GAIL - India

Buy

Tender

CFE - Manzanillo

Buy

Tender

JERAGM - Japan

Buy

Tender

Ichthys LNG Ichthys LNG APLNG - Australia

Sell

Tender

Tender Tender

Sell

Tender

Reliance Energy Buy Hazira NLNG - Nigeria LNG Sell

Tender

Novatek - Yamal

Sell

Tender

Oman LNG - Oman

Sell

Tender

Pakistan LNG - Port Buy Qasim Brunei LNG - Brunei Sell

Tender Tender Tender Tender

Angola LNG - Angola Sell LNG BHP - North West Sell Shelf Angola LNG - Angola Sell LNG

11-Dec-19 11-Dec-19 17-Nov-19 25-Nov-19 16-Nov-19 17-Nov-19 01-Jan-20 31-Mar-20

(06-Nov-19 06-Nov-19) 01-Dec-19 15-Dec-19 27-Nov-19 29-Nov-19 (05-Nov-19 07-Nov-19) 01-Dec-19 31-Mar-20 03-Dec-19 03-Dec-19 01-Jan-20 31-Dec-29 01-Dec-19 05-Dec-19 14-Nov-19 16-Nov-19 (19-Nov-19 21-Nov-19) 01-Oct-19 30-Nov-19

Results

Notes

heard awarded mid-6

1 DES

Heard awarded at 6.05 to Vitol

1 FOB

25-Oct-19

70 DES

09-Nov-19 30-Nov-19 10 cargoes for 2020-2021 20 cargoes in 2021-2022 40 cargoes in 2022-2023 31-Oct-19

1 DES

29-Oct-19

1 DES

29-Oct-19

1 DES

31-Oct-19

8 DES

24-Oct-19

1 FOB

15-Oct-19

17-Oct-19

1 FOB

Heard awarded high 5s FOB

29-Oct-19

25-Oct-19 Requirement heard for 0.5 million mt for delivery from January to March 2020. Tender heard to be linked to JKM Prices. 17-Oct-19 Closing Oct 17, 15:00 Tokyo Time, Heard awarded at high $5/MMBtu Valid Oct 17, 19:00 Tokyo time to low $6/MMBtu FOB Heard awarded mid-high $5/MMBtu

1 DES

17-Oct-19

17-Oct-19

1 FOB

17-Oct-19

18-Oct-19

4 DES

14-Oct-19

1 DES

15-Oct-19

1 cargo/month, delivered to Europe.

Heard fully awarded on a TTF-linked basis. Heard awarded around $6.50/ MMBtu Heard cancelled

15-Oct-19

15-Oct-19

240 DES

18-Jul-19

1 DES

15-Oct-19

18-Oct-19 240 cargoes to be delivered over a ten year period 16-Oct-19

Heard awarded at $6.50/MMBtu

10-Oct-19

11-Oct-19 No further than Singapore

Heard sold to India.

1 FOB

11-Oct-19

1 DES

16-Oct-19

11-Oct-19 heard awarded to BP at $5.05-5.20/ MMBtu FOB 17-Oct-19

04-Oct-19

COMPETITIVE FUELS ASIA ($/MMBtu)

COMPETITIVE FUELS EUROPE ($/MMBtu)

20

20

15

Naphtha CFR Japan Minas FOB Indonesia

10

15

Northwest Europe fuel oil

10

NWE LNG

SWE LNG

Fuel oil 180 FOB Singapore 5

0 Oct-18

JKM LNG

Dec-18

Feb-19

Apr-19

Jun-19

Aug-19

0 Oct-18

Oct-19

Source: S&P Global Platts

© 2019 S&P Global Platts, a division of S&P Global Inc. All rights reserved.

ARA coal 5

Dec-18

Feb-19

Source: S&P Global Platts

4

Apr-19

Jun-19

Aug-19

Oct-19

LNG Daily

October 29, 2019

outlook for the rest of the year amid unive fundamentals. A London-based trader said there remains a strong volume offered for December delivery into Europe, noting around five vessels being marketed to them currently. The source said they have a slot for late December which they are in no hurry to book as they still anticipate more bearish price movements to come. The trader said they were bidding for late December delivery into Northwest Europe at TTF-$0.40/MMBtu to -$0.45/MMBtu. The source said ultimately, the market will be weather driven, but on current fundamentals and Asian prices coming back down, they are expecting bearishness to persist in Europe. “Storage is full across Europe,” the trader said. Market participants are expecting a strong flow of arrivals in coming weeks as cargoes which were floated in order to play the contango back in Q3 begin to arrive into Europe. The Platts December TTF contract fell $0.066/MMBtu on-day to $5.259/MMBtu Tuesday. Another London-based trader said they heard deals concluded recently as low as TTF-$0.60/MMBtu for November delivery. Algerian volumes were heard offered into the Mediterranean for spot delivery at weak prices also, the source reported. Market participants continue to report a lack of over the Northwest European market in the Mediterranean. “The market is too long for it (Med) to be a ,” a third London-based trader said. In shipping, Shinshu Maru is slated to load from Arzew on November 4, according to shiptracker and will lift a JERA FOB cargo, according to two sources. The vessel diverted from Brazil four days ago. Arctic Aurora was heard fixed by Shell. Hire rate heard was

$100,000/day. No further details were heard. PetroChina was heard seeking a vessel for four to six months charter starting Q4-19. — Masanori Odaka, Piers De Wilde

News

European LNG regas back above 300 million cu m during Monday’s gas day ■■303

million cu m regas during Monday’s gas day daily figure recorded since May 23 ■■Potential for November LNG regas to climb ■■Highest

London—European LNG regasification rose back above the 300 million cu m/d mark for the first time in over five months during Monday’s gas day and looks set to potentially rise further in the short-term, data from S&P Global Platts Analytics and National Grid showed. LNG regas in Europe (Belgium, , Italy, the Netherlands, Poland, Portugal, Spain and the UK) hit 303 million cu m during Monday’s gas day, the highest daily amount since May 23, the data showed. Regas jumped during Monday’s gas day amid higher demand across the region due to temperatures across Northwest Europe falling below average for that time of year, boosting LDZ demand, climbing from the October 1-27 average of 227 million cu m/d. Indeed, regas levels in Spain and Italy were largely unchanged from the end of the previous working week at 55 million cu m and 33 million cu m, respectively, with warmer conditions seen across the southern

LNG Daily is published daily by Platts, a division of S&P Global, ed office: 55 Water Street, 37th Floor, New York, N.Y. 10038. Officers of the Corporation: Charles E. Haldeman, Jr., Non-Executive Chairman; Doug Peterson, President and Chief Executive Officer; Ewout Steenbergen, Executive Vice President, Chief Financial Officer; Steve Kemps, Executive Vice President, General Counsel

LNG DAILY Houston Ingrid Furtado, Luke Stobbart Phone: +1-713-655-2275

Platts President Martin Fraenkel

The names “S&P Global Platts” and “Platts” and the S&P Global Platts logo are trademarks of S&P Global Inc. Permission for any commercial use of the S&P Global Platts logo must be granted in writing by S&P Global Inc.

Singapore Global Director: Ciaran Roe Kenneth Foo, Fan Shi Yun, Masanori Odaka, Srijan Kanoi Phone: +65-6530-6467 London Desmond Wong, Wyatt Wong, Piers de Wilde Phone: +44-207-176-3506 Email [email protected]

Advertising Tel: +1-720-264-6618

© 2019 S&P Global Platts, a division of S&P Global Inc. All rights reserved.

Manager, ment Sales Bob Botelho

To reach Platts: E-mail: [email protected]; North America: Tel:800PLATTS-8; Latin America: Tel:+54-11-4121-4810; Europe & Middle East: Tel:+44-20-7176-6111; Asia Pacific: Tel:+65-6530-6430

(continued on page 7)

limited to, any warranties of merchantability or fitness for a particular purpose or use as to the Data, or the results obtained by its use or as to the performance thereof. Data in this publication includes independent and verifiable data collected from actual market participants. Any of the Data should not rely on any information and/or assessment contained therein in making any investment, trading, risk management or other decision. S&P Global Platts, its s and their third-party licensors do not guarantee the adequacy, accuracy, timeliness and/or completeness of the Data or any component thereof or any communications (whether written, oral, electronic or in other format), and shall not be subject to any damages or liability, including but not limited to any indirect, special, incidental, punitive or consequential damages (including but not limited to, loss of profits, trading losses and loss of goodwill). ICE index data and NYMEX futures data used herein are provided under S&P Global Platts’ commercial licensing agreements with ICE and with NYMEX. You acknowledge that the ICE index data and NYMEX futures data herein are confidential and are proprietary trade secrets and data of ICE and NYMEX or its licensors/suppliers, and you shall use best efforts to prevent the unauthorized publication, disclosure or copying of the ICE index data and/or NYMEX futures data.

You may view or otherwise use the information, prices, indices, assessments and other related information, graphs, tables and images (“Data”) in this publication only for your personal use or, if you or your company has a license for the Data from S&P Global Platts and you are an authorized , for your company’s internal business use only. You may not publish, reproduce, extract, distribute, retransmit, resell, create any derivative work from and/or otherwise provide access to the Data or any portion thereof to any person (either within or outside your company, including as part of or via any internal electronic system or intranet), firm or entity, including any subsidiary, parent, or other entity that is d with your company, without S&P Global Platts’ prior written consent or as otherwise authorized under license from S&P Global Platts. Any use or distribution of the Data beyond the express uses authorized in this paragraph above is subject to the payment of additional fees to S&P Global Platts.

Permission is granted for those ed with the Copyright Clearance Center (CCC) to copy material herein for internal reference or personal use only, provided that appropriate payment is made to the CCC, 222 Rosewood Drive, Danvers, MA 01923, phone +1-978-7508400. Reproduction in any other form, or for any other purpose, is forbidden without the express prior permission of S&P Global Inc. For article reprints : The YGS Group, phone +1-717-505-9701 x105 (800-501-9571 from the U.S.).

S&P Global Platts, its s and all of their third-party licensors disclaim any and all warranties, express or implied, including, but not

For all other queries or requests pursuant to this notice, please S&P Global Inc. via email at [email protected].

© 2019 S&P Global Platts, a division of S&P Global Inc. All rights reserved.

5

LNG Daily

October 29, 2019

Shipping Prices Shipping rates, Oct 29

Freight route costs, Oct 29 ($/MMBtu)

$/day

Asian discharge ports

Asia Pacific day rate Atlantic day rate

Japan/Korea South China/Taiwan West India Middle East AAUUA00 1.68 AAUSH00 1.48 AAUSP00 0.44 Australia (Dampier) AAUSA00 1.10 AAUSI00 0.89 AAUSQ00 1.06 1.11 ACABB00 1.21 ACABC00 1.69 Australia (Gladstone) ACABA00 Bontang AOJKA00 0.76 AOCTA00 0.56 AOWIA00 1.03 0.79 ABCTA00 0.49 ABWIA00 0.96 Bintulu ABJKA00 Singapore ASJKA00 0.86 ASCTA00 0.56 ASWIA00 0.73 0.75 ATCTA00 0.65 ATWIA00 1.22 Tangguh ATJKA00 Trinidad via Suez AAUSB00 4.17 AAUSJ00 3.93 AAUSR00 2.80 2.83 AAUZB00 3.42 Trinidand via Panama AAUXB00 Trinidad* AAUZC00 2.83 AAUZD00 3.42 3.27 AAUSK00 2.92 AAUSS00 2.19 Nigeria AAUSC00 Algeria AAUSD00 3.07 AAUSL00 2.84 AAUST00 1.78 3.51 AAUSM00 3.16 AAUSU00 2.09 Belgium AAUSE00 Peru AAUSF00 2.38 AAUSN00 2.72 AAUSV00 2.98 0.46 AAUSO00 0.66 AAUSW00 1.64 Russia AAUSG00 Spain ACAAA00 3.21 ACAAB00 2.86 ACAAC00 1.91 4.00 ACAAI00 3.53 ACAAJ00 2.55 Norway ACAAH00 USGC* LAUVA00 2.94 LAUVB00 3.53 LAUVC00 3.03 USGC via Panama LAUVI00 2.94 LAUVL00 3.53 USGC via Suez LAUVJ00 4.52 LAUVM00 4.04 LAUVO00 3.03 4.53 LAUVN00 4.16 LAUVP00 3.61 USGC via Cape LAUVK00

AARXT00 120,000 AASYC00 130,000

$/MMBtu PLF1 Middle East-Japan/Korea PLF2 Middle East-NWE PLF3 Trinidad-NWE

AAUUA00 1.68 AAUTE00 1.99 AAUUC00 1.12

SHIPPING RATES ($1000s/DAY) 200

150 Asia Pacific Atlantic

100

50

EMEA discharge ports 0 Oct-18

Dec-18

Feb-19

Apr-19

Jun-19

Aug-19

Oct-19

Source: S&P Global Platts

Shipping calculator, Oct 29 Australia- Middle East Japan/Korea India Ship size (mt) Trip length (days) Carrier day rate ($/day) Day rate cost ($/MMBtu) Boil-off cost Bunker fuel ex-wharf 380 CST ($/mt) Fuel oil cost ($/MMBtu) Cost of voyage ($/MMBtu)

Podcasts

72980.77 9 120000 0.84 0.12 380.00 0.05 1.10

72980.77 3 120000 0.34 0.04 315.75 0.02 0.44

Keeping you up to speed on the big-picture trends affecting energy and commodities

Americas discharge ports US Atlantic Coast Argentina Brazil 2.55 AAUTS00 2.23 ACAAP00 2.59 Middle East AAUTK00 Australia (Dampier) AAUTL00 3.07 AAUTT00 2.27 ACAAQ00 2.74 Australia (Gladstone) ACABF00 2.98 ACABH00 1.97 ACABG00 2.43 Trinidad AAUTM00 0.71 AAUTU00 1.30 ACAAR00 0.91 Nigeria AAUTN00 1.74 AAUTV00 1.51 ACAAS00 1.33 Algeria AAUTO00 1.13 AAUTW00 1.63 ACAAT00 1.45 Belgium AAUTP00 1.01 AAUTX00 1.83 ACAAU00 1.65 Peru AAUTQ00 2.58 AAUTY00 1.05 ACAAV00 1.60 Russia AAUTR00 3.91 AAUTZ00 2.88 ACAAW00 4.03 Spain ACAAE00 0.95 ACAAF00 1.65 ACAAG00 1.37 Norway ACAAM00 1.13 ACAAN00 2.17 ACAAO00 2.10 USGC* LAUVG00 1.97 LAUVH00 1.57 *Most economic. All values calculated based on prevailing spot market values during the day for LNG, bunker fuel and ship chartering. No route cost is calculated for Zeebrugge to NW Europe, or Spain to SW Europe. Other routes appear blank on days when a public holiday in one or another location means underlying values are not published. Detailed assessment methodology, including assumed route times and underlying values, is found on www.platts.com.

Click here for more!

© 2019 S&P Global Platts, a division of S&P Global Inc. All rights reserved.

South West Europe North West Europe Kuwait/UAE 1.72 AAUTE00 1.99 LMEMM00 0.26 Middle East AAUSX00 Australia (Dampier) AAUSY00 2.58 AAUTF00 2.87 LMEMN00 1.28 Australia (Gladstone) ACABD00 3.23 ACABE00 3.53 ACABI00 1.91 Trinidad AAUSZ00 1.15 AAUUC00 1.12 LMEMP00 2.58 Nigeria AAUTA00 1.36 AAUTG00 1.44 LMEMQ00 2.44 Algeria AAUTB00 0.32 AAUTH00 0.60 LMEMR00 1.58 Belgium AAUTC00 0.52 LMEMS00 2.00 Peru AAUTD00 2.58 AAUTI00 2.66 LMEMT00 3.22 Russia AAUUB00 3.19 AAUTJ00 3.38 LMEMU00 2.29 Spain ACAAD00 0.52 LMEMV00 1.71 Norway ACAAK00 0.85 ACAAL00 0.51 LMEMW00 2.34 USGC* LAUVD00 1.49 LAUVE00 1.46 LMEMX00 2.93 USGC via Suez LMEMY00 2.93 USGC via Cape LMEMZ00 3.50

6

LNG Daily

October 29, 2019

BP reported $2.6 billion a non-cash impairment charge during the third quarter after selling off US legacy shale gas assets for less than it had on its books. BP agreed the sale of its Alaskan business to Hilcorp for $5.6 billion in August and said it planned to divest four packages of legacy US shale gas assets. Gilvary said the asset sales were prompted by BP’s outlook on US gas prices “Strategically we were looking to get out of these assets and we’ve chosen to proceed.” Gilvary said further US gas asset sales will continue in the fourth quarter with the potential for further impairment charges from the sales. — Robert Perkins

part of Europe. LNG regas so far in October across Europe stood at a total of 6.43 Bcm, already higher than the 5.699 Bcm seen during October 2018, and looks set to increase further once the November delivery period kicks in. Data from Platts Analytics showed that no fewer than 33 LNG cargoes were potentially due to arrive at European LNG liquefaction terminals before the middle of November, and with LNG stocks in tank nudging 4 Bcm of natural gas equivalent at the beginning of Week 44, regas looks set to have to increase in order to make room for the fresh arrivals. — Gary Hornby

BP sees global LNG supply glut persisting until 2022 ■■US

■■Offsite component construction mirror’s Yamal LNG project in Russia ■■Site

development, tank construction can occur simultaneously

Arlington— Privately held Commonwealth LNG sees its late entrance in a crowded field of US LNG developers as an advantage, with officials saying they can apply lessons learned from the first wave of LNG export projects toward a low-cost approach that will put it ahead of its rivals. But the LNG facility that the company’s export venture in Louisiana most resembles is not among the projects concentrated on the US Gulf Coast — it’s the Yamal LNG plant in Siberia.

Podcast

LNG exports to suffer from price slump already “full” with LNG imports

■■Europe

London—The global LNG supply glut will likely continue to weigh on prices and US export flows until 2022 when market for LNG will start to rebalance, BP chief financial official Brian Gilvary said Tuesday. Spot gas prices in Asia and Europe have nosedived in 2019 amid a wave of new LNG plants coming onstream and subdued gas demand growth in Asia. In Europe, gas storage sites have been filling to capacity at the time as coal-to-gas switching fuel switch has maximized. “The UK is full on LNG right now. Europe is full on LNG imports. We do not anticipant that all of the gas that was planned to be exported from the US will be able to hit a demand market any time soon,” Gilvary said on a quarterly earnings call. “You are looking at the back end of 2021 to see this massive supply overhang clear out...gas feels pretty bearish right now. You will see some exports out of the US but not anywhere near the capacity that has been built.” With US spot Henry Hub gas prices currently trading around $2.2/ MMBtu, Gilvary said the economics of much US LNG moving to Europe were not workable. “Although there is no question that US gas is still the lowest cost production in the world, it us going to hard for it find a market in the next two years probably,” Gilvary said.

© 2019 S&P Global Platts, a division of S&P Global Inc. All rights reserved.

Commonwealth LNG touts modular approach, second-mover advantage

7

COMMODITY FOCUS

Stay up to speed on the big-picture trends affecting energy and commodities, even when you’re away from your desk. Tune in to our Commodities Focus Podcast to hear our reporters, editors and analysts discuss key global news and pricing issues across commodity markets. All our podcasts are available to for free via our website and the iTunes store.

Visit spglobal.com/platts/en/market-insights/podcasts

LNG Daily

October 29, 2019

As PAO Novatek did in developing Yamal in Russia, Commonwealth LNG plans for offsite construction of its facility’s six natural gas liquefaction trains and other major components, the company’s controller, Nick Eusepi, said in an interview. The benefit of this modular approach would be a lower cost and faster turnaround time on construction, he said. “We are basically mirroring the Yamal project,” Eusepi said. “The market is tough; the customers and off-takers have fatigue from all the projects, and they are somewhat on the sideline just waiting things out. We think our low-cost, flexible approach does put us ahead of the line, though.” It was only in August that Commonwealth LNG submitted its formal application for a federal permit to build the 8.4 million metric ton/year LNG export terminal and an d feedgas pipeline interconnect in Cameron Parish, Louisiana. The project is competing against some others that already have permits and deals lined up with potential offtakers. But Commonwealth LNG said the amount of time to build its project — around three years as opposed to the usual four — puts it on track to come online in early 2024, when a potential global LNG supply crunch is anticipated. Commonwealth LNG recently received a notice of environmental

review from the Federal Energy Regulatory Commission that suggested the agency could be ready to make a decision on whether to approve the project by the end of 2020. The company is now targeting a final investment decision in early 2021 (19-502). “We are coming in later, but we are not finishing much later than everyone else,” Eusepi said. “We still fall right in the middle of that second wave demand cycle. A little late to the game, but not really late to the game.” The construction approach would use modular LNG facilities developed by TechnipFMC, a designer and builder of LNG projects that worked on Yamal LNG. TechnipFMC signed an engineering service contract with Commonwealth LNG in 2018. Commonwealth LNG has not finalized an engineering, procurement and construction contract. Commonwealth LNG is a subsidiary of an investment vehicle owned by businessman Paul Varello, a veteran of the engineering and construction sector. In a significant difference from other US LNG projects, Commonwealth LNG’s plans call for even the LNG storage tanks to be built away from the project site. This will allow the developer to build the tanks and do site preparation at the same time, which would be an important innovation in handling a key timeline constraint for LNG projects, said energy

NYMEX Henry Hub gas futures contract closings, Oct 29 Month Platts Symbol High Low Close Change Previous Day’s Previous Day’s Volume Open Interest MNNG001 2.640 2.449 2.597 0.151 24377 22,756 Month 01 Nov 2019 MNNG002 2.704 2.555 2.639 0.084 129987 328,162 Month 02 Dec 2019 MNNG003 2.784 2.647 2.724 0.077 16586 232,341 Month 03 Jan 2020 MNNG004 2.735 2.605 2.678 0.072 4708 83,403 Month 04 Feb 2020 MNNG005 2.597 2.482 2.547 0.064 6045 140,299 Month 05 Mar 2020 MNNG006 2.342 2.273 2.313 0.038 6784 87,050 Month 06 Apr 2020 MNNG007 2.318 2.254 2.293 0.035 1335 74,233 Month 07 May 2020 MNNG008 2.353 2.303 2.330 0.033 457 25,358 Month 08 Jun 2020 MNNG009 2.396 2.356 2.373 0.031 468 22,037 Month 09 Jul 2020 MNNG010 2.402 2.351 2.383 0.030 209 23,950 Month 10 Aug 2020 MNNG011 2.390 2.354 2.369 0.030 184 20,202 Month 11 Sep 2020 MNNG012 2.418 2.366 2.397 0.029 1424 46,866 Month 12 Oct 2020 MNNG013 2.486 2.453 2.464 0.025 177 18,512 Month 13 Nov 2020 MNNG014 2.653 2.610 2.632 0.025 243 15,925 Month 14 Dec 2020 MNNG015 2.767 2.726 2.747 0.024 130 13,768 Month 15 Jan 2021 MNNG016 2.721 2.692 2.705 0.024 150 7,034 Month 16 Feb 2021 MNNG017 2.596 2.573 2.580 0.019 99 9,068 Month 17 Mar 2021 MNNG018 2.319 2.284 2.305 0.016 191 8,845 Month 18 Apr 2021 MNNG019 2.290 2.275 2.281 0.017 131 3,981 Month 19 May 2021 MNNG020 2.328 2.287 2.319 0.021 151 2,280 Month 20 Jun 2021 MNNG021 2.365 2.353 2.360 0.025 169 2,147 Month 21 Jul 2021 MNNG022 2.379 2.363 2.369 0.024 78 1,519 Month 22 Aug 2021 MNNG023 2.362 2.350 2.356 0.023 6 1,084 Month 23 Sep 2021 MNNG024 2.386 2.372 2.380 0.021 6 2,853 Month 24 Oct 2021 MNNG025 2.453 2.430 2.448 0.018 0 1,487 Month 25 Nov 2021 MNNG026 2.632 2.628 2.630 0.020 88 1,996 Month 26 Dec 2021 MNNG027 2.753 2.742 2.753 0.018 0 3,177 Month 27 Jan 2022 MNNG028 2.730 2.678 2.720 0.014 0 1,095 Month 28 Feb 2022 MNNG029 2.601 2.585 2.601 0.011 0 1,305 Month 29 Mar 2022 MNNG030 2.354 2.354 2.354 0.019 0 1,580 Month 30 Apr 2022 MNNG031 2.331 2.331 2.331 0.013 0 452 Month 31 May 2022 MNNG032 2.365 2.340 2.360 0.004 0 372 Month 32 Jun 2022 MNNG033 2.402 2.402 2.402 0.006 0 173 Month 33 Jul 2022 MNNG034 2.417 2.417 2.417 0.009 0 195 Month 34 Aug 2022 MNNG035 2.354 2.354 2.411 0.011 0 237 Month 35 Sep 2022 MNNG036 2.445 2.445 2.445 0.019 0 636 Month 36 Oct 2022 MNNG000 451,591 1,208,606 Total

© 2019 S&P Global Platts, a division of S&P Global Inc. All rights reserved.

8

LNG Daily

October 29, 2019

© 2019 S&P Global Platts, a division of S&P Global Inc. All rights reserved.

9

LNG Daily

October 29, 2019

analyst Katie Bays, co-founder of research and consulting firm Sandhill Strategy. This could lend predictability in cost and schedule to the project’s competitiveness in the race for a final investment decision. “There is a path for them being able to do that,” Bays said. “The big issues are not their model or regulation — it’s financing and the commercial environment. It’s roughly the same hurdle for them as it is for every other company that is nothing more than an idea ... Capital is just anemic. And that is a huge risk for basically every project that doesn’t have a balance sheet and a huge advantage for all of the projects that do.” Adding to the uncertainty for the LNG sector is the trade war between the US and China, which is expected to be the world’s biggest importer of LNG within a decade. As it stands, Commonwealth LNG could take a final investment decision on the $4.8 billion project if it contracts about 7 million mt/y of the offtake, Eusepi said. The company in June announced the g of a nonbinding agreement with a subsidiary of global commodity trader Gunvor Group that could lead to a 15-year sale-andpurchase agreement for 1.5 million mt/y of LNG. The deal is Commonwealth LNG’s only public commercial commitment. Bays said the shorter duration of the contracts Commonwealth LNG is marketing, compared with the typical 20-year deals, is another factor that distinguishes the project in the field of independent LNG developers. The low cost of the project enables Commonwealth LNG to offer these shorter-term deals, Eusepi said. Other of the Gunvor deal, including the price structure or links to gas indexes, were not disclosed. But as the company pursues additional deals, it is not committed to any single pricing structure or index, Eusepi said. “We’ve got a little bit signed up so far, but by no means all that we need to to get the project to go,” Eusepi said. “But we are confident that we are going to get there, and hopefully, by the end of the year, we have got some more announcements coming out.” — Corey Paul, S&P Global Market Intelligence

Power of Siberia gas pipeline primed to begin Chinese exports ■■Russia’s

Gazprom ‘has completed filling’ the pipeline link with China ‘the next stage’ ■■Development forms part of 38 Bcm/year supply deal ■■Cross-border

London—Gazprom has completed filling the Power of Siberia pipeline within its Russian borders, the state-owned company said Tuesday, and will soon be pressurizing the cross-border link with China ahead of the first exports to the country. Natural gas from the Chayandinskoye field in Yakutia was used to pressurize the pipeline, with gas stocked up to the border metering station in the Blagoveshchensk region of Russia, with the next stage of commissioning to entail filling the cross-border link with China running through the Amur river. “The linear part of the pipeline is prepared for the start of pipeline deliveries of Russian gas to China,” Gazprom said in a statement.

© 2019 S&P Global Platts, a division of S&P Global Inc. All rights reserved.

10

Upon completion of commissioning activities, the production and transport will form part of a 30-year purchase and sale agreement for Russian gas via the Power of Siberia agreed in May 2014. This agreement makes provisions for 38 Bcm/year of exports from Russia to China to be achieved. The Power of Siberia will transport natural gas from the Irkutsk and Yatkutia production areas for delivery to Russian customers in the Far East and China. Gazprom confirmed that commissioning is underway for the development of the Chayandinskoye field, and that drilling “is in full swing” at the Kovykta field in the Irkutsk region, expected to export through the Power of Siberia in early-2023. The project is expected to lessen Russia’s dependence on Europe as its primary export market, and generate a new revenue stream for the state-owned company. — Neil Hunter

Spain increases December LNG intake 13% to 3.2 million cu m ■■Storage

levels in Nov approach 100% volume drops 14% from nomination ■■Dec pipeline nominations greater than LNG ■■Nov

Barcelona—Spain has nominated 22 deliveries of LNG for December, an increase of 13% year on year to 3.2 million cu m of liquid, data published Monday by gas grid operator Enagas showed. The increase is offset by a similar-sized decline in scheduled deliveries in November, with high gas storage levels. For November, Spain has canceled five nominated deliveries — one apiece at the terminals of Barcelona, Cartagena, Huelva, Bilbao and Mugardos — with incoming volume trimmed by 14% to 2.9 million cu m. Underground stocks of stored gas are scheduled to rise to 33.1 TWh at the end of November from 31.5 TWh at the start of the month, or to 99.7% full from 95%. Stored LNG levels will average 19.8 TWh during November, or 85% full. For December, gas in long-term storage is nominated to fall to 31.7 TWh at the end of the month from 33.0 TWh at the start, on increased demand for heating. Stored LNG is seen lower than November, averaging 18.2 TWh or 78% full. In November, LNG is scheduled to supply 21.4 TWh into the grid, up 1.1 TWh from last month’s initial nomination. Pipeline gas volume is scheduled at a net 18.8 TWh, with 14.5 TWh coming from Algeria and 4.8 TWh from Europe. Exports to Portugal are scheduled at 414 GWh. The total is an increase from nominated volume of 16.9 TWh, with the increase met largely by higher imports from Northwest Europe via . Spanish gas demand in November has been revised 0.6 TWh higher to 39.8 TWh. Storage injections will absorb 1.6 TWh of the incoming gas, and truck loading 1.2 TWh. For December, initial nominations are for 18.7 TWh of LNG sendout

LNG Daily

October 29, 2019

Spain: lng nominations Cargoes Volume Change (’000 cu m) (’000 cu m) November 2019: Final schedule vs nominations Barcelona Cartagena Huelva Bilbao Sagunto Mugardos Total

5 702 -48 1 136 -163 5 881 0 5 667 -141 2 308 -4 1 164 -112 19 2,858 -468

December: Initial nominations Barcelona Cartagena Huelva Bilbao Sagunto Mugardos Total

6 824 43 2 320 -66 6 833 58 4 571 -6 3 466 466 1 160 -132 22 3,174 363

Source: Enagas

and 20.5 TWh of pipeline gas. If the totals are unchanged, it would be the first month since February that piped volume is greater than LNG sendout. Storage withdrawals are nominated at 1.4 TWh. Demand in December is seen at 41.7 TWh, Enagas said. — Henry Edwardes-Evans, Gianluca Baratti

PV Gas starts constructing Vietnam’s first LNG terminal, secures funding Hanoi—State-controlled PetroVietnam Gas began construction of the Thi Vai LNG terminal, and also signed financing deals for the first phase of the project to import natural gas into Vietnam, it said on Monday. The Thi Vai terminal will have a capacity of 1 million mt/year in its first phase, and is scheduled to start operations in 2022. Its capacity will be raised to 3 million mt/year by 2023 in the second phase of development. The project will cost $285 million for the first phase with 30% of investment capital being financed by PV Gas and the remaining 70% from loans, PV Gas said, adding that Thi Vai will be the first LNG terminal in Vietnam. “It is a strategic project because it represents an important of step of Vietnam in ensuring national energy security. The supply of LNG will help meet the rising demand of LNG in the domestic market,” according to the statement. On Monday, PV Gas signed deals to borrow $80 million from HSBC and two Taiwanese banks — Mega Bank and Taipei Fubon Bank. The Vietnamese gas distribution company also entered into agreements to borrow Vietnamese Dong 2.1 trillion ($81.2 million) from two Vietnamese banks - Southeast Asia Commercial t Stock Bank and Vietnam Export Import Bank. PV Gas did not elaborate on details of the contribution from each bank and where the remaining funds will come from. PV Gas awarded an engineering, procurement and construction contract to build the Thi Vai terminal to South Korea’s Samsung C&T Corp and PetroVietnam Technical Services Corp on June 24. On the same date, it signed an agreement to supply LNG from Thi Vai

© 2019 S&P Global Platts, a division of S&P Global Inc. All rights reserved.

11

to PetroVietnam Power’s proposed Nhon Trach 3 and Nhon Trach 4 power plants in southern Dong Nai province with a capacity of 600 MW each. In 2014, PV Gas signed two framework LNG sale and purchase agreements with Russia’s Gazprom Marketing & Trading and Shell for deliveries into Thi Vai LNG terminal. This was followed by two preliminary LNG supply agreements with Virginia-based AES Group and Alaska Gasline Development Corp in November 2017. — Eric Yep, Newsdesk-Vietnam

Mitsui eyes added LNG offtake, equity stake in North American LNG ■■Up

to 1 million mt/year from Baja California project Mitsui in MOU to extend LNG partnership

■■Sempra,

Washington—The US’ Sempra Energy and Japan’s Mitsui have extended their partnership in North American LNG export development, announcing a non-binding memorandum of understanding Monday for Mitsui to participate in a second phase of the Cameron LNG project in Louisiana and a possible future expansion of the Energia Costa Azul project in Baja California, Mexico. The MOU contemplates Mitsui buying up to one-third of available capacity from the Cameron LNG Phase 2 expansion, as well as Mitsui’s potential offtake of about 1 million mt/year of LNG and a possible equity stake in a future phase expansion of the western Mexico project, the companies said in a statement. The two companies already are partners in the first, roughly 12 million mt/year phase of Cameron LNG. That Sempra-led project is a t venture of San Diego-based Sempra, ’s Total and Mitsui — a company tly owned by Japan’s Mitsubishi and NYK. The first train at Cameron LNG in Hackberry, Louisiana, began commercial operation in August, with the second and third trains expected to start production the first and second quarters of 2020. Phase 2 entails two more trains and up to two storage tanks, and has already been approved by the Federal Energy Regulatory Commission.

Advancing heads of agreement As to ECA LNG, Sempra IEnova previously signed a heads of agreement in November 2018 with Total, Mitsui and Tokyo Gas for

LNG Daily

October 29, 2019

the full export capacity of Phase I, which is expected to produce 2.4 million my/year of LNG upon entering service in 2023. Mitsui is negotiating to finalize a sales-and-purchase agreement of 800,000 mt/ year from that phase. But a final investment decision on the project has been delayed until the first quarter of 2020, IEnova said October 24, as it continued to iron out details of the project’s engineering, procurement and construction bidding process, its offtake contracting as well as regulatory permitting. The future ECA expansion would add more trains and envisions export capacity of about 12 million mt/year.

Feedgas questions Supplying feedgas to the proposed Costa Azul LNG export facility is likely one of the key obstacles to a positive FID. While the existing import facility is currently interconnected to existing pipelines, those pipelines often run full due to demand in the Southern California

markets, according to S&P Global Platts Analytics. Therefore, any LNG project will need to either secure firm pipeline capacity from existing capacity holders or assess the possibility of further midstream expansions. In unveiling the MOU, Sempra LNG President Justin Bird said the preliminary agreement “signals continued momentum in the growing US LNG export market, while reinforcing the unique competitive advantage Sempra offers customers seeking LNG export capabilities from the Gulf Coast, as well as the West Coast of North America.” Motoyasu Nozaki, managing director of Mitsui’s Energy Business Unit II, said, “The agreement will contribute to expanding Mitsui’s uniquely diversified supply portfolio worldwide.” Beyond those two projects, Sempra has proposed to build an LNG export facility in Port Arthur, Texas. It has received FERC approval and reached a preliminary deal with Saudi Aramco in May that calls for the state-run oil company to take a 25% stake in the project. — Maya Weber, Ross Wyeno

SUBSCRIBER NOTES Platts proposes to change LNG freight fuel assumptions S&P Global Platts is proposing to change the fuel assumptions used in its LNG freight route costs, effective January 2, 2020.

number of days * Platts Asia Pacific Ballast Rate (AAXTN00) + loading and discharge days) / number of round-trip days

This proposal comes on the back of market highlighting recent changes in fuel usage on LNG carriers, in part due to the incoming IMO 2020 rules, but linked also to more competitive LNG prices as well.

Platts Atlantic Day Rate (AASYC00) * (laden leg number of days + ballast leg number of days * Platts Atlantic Ballast Rate (AAXTM00) + loading days and discharge days + Canal-transit days) / number of round-trip days

Platts is proposing to change the assumption on fuel-consumption to boil-off gas-only. In other words LNG freight calculations will no longer reference fueloil. Given the existing assumption of 100mt/day at 17 knots, this means 5,200 MMBtu/day of fuel requirement met entirely by boil-off gas. The LNG price assessment used as the basis of the fuel cost assumption would be Platts JKM (AAOVQ00).

And for the USGC – NWE TCR: Platts Atlantic Day Rate (AASYC00) * (laden leg number of days + ballast leg number of days * Platts Atlantic Ballast Rate (AAXTM00) + loading days and discharge days) / number of round-trip days.

This proposal would not alter the other assumptions used to underpin its LNG freight route costs. The other assumptions would remain: modern conventional TFDE vessel, with a vessel capacity of 155,000-180,000 cu m, standardized to 165,000 cu m; boil-off: 0.12%/day while laden and 0.09% while ballasting. Please send , questions and comments to [email protected] and [email protected] by November 15, 2019. For written comments, please provide a clear indication if comments are not intended for publication by Platts for public viewing. Platts will consider all comments received and will make comments not marked as confidential available upon request. Platts to launch Time Charter Rates for major LNG shipping routes S&P Global Platts will launch three Time Charter Rates (TCR) for key LNG shipping routes from November 1, 2019. On the back of from market participants, Platts will begin publishing TCR price assessments for Australia (Dampier) – Japan (Futtsu), US Gulf Coast (Sabine ) – Japan (Futtsu) and US Gulf Coast (Sabine ) – Northwest Europe (Zeebrugge). These will reflect round-trip economics for key shipping routes in the global LNG shipping market. The LNG TCR price assessments will be published under the following names and symbols: LNG Time Charter Rate Australia-Japan $/day (ATCRA00) LNG Time Charter Rate USG-Japan $/day (ATCRC00) LNG Time Charter Rate USG-Northwest Europe $/day (ATCRB00) The basis of the calculation will be as follows for the:Australia – Japan TCR: Platts Asia Pacific Day Rate (AARXT00) * (laden leg number of days + ballast leg

© 2019 S&P Global Platts, a division of S&P Global Inc. All rights reserved.

12

Similarly, the basis of the calculation will be as follows for the USGC – Japan TCR:

The number of round trip days will be 21 for the Australia – Japan route (nine days each way, three days for loading and discharge); 51 days (23 days each way, three days for loading and discharge, two days for Panama Canal transit) for the USGC – Japan route and 27 days for the USGC – NWE route. Platts will also publish back-calculated data history for these TCRs going back to September 3, 2018, when Platts first started assessing its Asia Pacific and Atlantic Ballast Rates. Please send , questions and comments to [email protected] and [email protected]. For written comments, please provide a clear indication if comments are not intended for publication by Platts for public viewing. Platts will consider all comments received and will make comments not marked as confidential available upon request. S&P Global Platts to launch yuan conversions of JKM LNG assessment S&P Global Platts will launch daily Chinese yuan per metric ton (yuan/mt) and yuan per MMBtu (yuan/MMBtu) conversions of the Platts JKM LNG assessment, effective December 16, 2019. The JKM assessment (AAOVQ00), which represents the average of the two half-month cycles, which comprise the first full month of delivery, will be converted into yuan/mt and yuan/MMBtu from $/MMBtu. The conversions will be calculated on a daily basis using a currency exchange rate (AAWFW00) published daily on working days in Singapore, with a factor of 52 for the MMBtu to metric ton conversion. The addition of yuan-converted JKM reflects the rapid growth of spot LNG volumes delivered to China and facilitates comparisons between LNG spot import and domestic market prices. Please send any comments or to [email protected] and copied to [email protected]. For written comments, please provide a clear indication if comments are not intended for publication by Platts for public viewing. Platts will consider all comments received and will make

LNG Daily

October 29, 2019

SUBSCRIBER NOTES (Continued) comments not marked as confidential available upon request. Platts to further define LNG FOB Gulf Coast Marker (GCM) assessment standard S&P Global Platts will further define the that form the basis of its spot LNG price assessment for US spot export cargoes, the FOB Gulf Coast Marker (GCM), with effect from November 1, 2019. These will form the basis of the GCM assessment process based on consultation with market participants active in the trading of US-origin LNG cargoes. Platts will continue to consider cargoes with differing the GCM standard, but may normalize where appropriate back to the GCM base specification as defined below.

sellers should not unreasonably withhold substitutions or hamper the established delivery process. Please send all , comments and questions to [email protected] and [email protected]. For written comments, please provide a clear indication if comments are not intended for publication by Platts for public viewing. Platts will consider all comments received and will make comments not marked as confidential available upon request. Platts proposes to launch Euro conversions for LNG prices S&P Global Platts Platts proposes to launch Euro-denominated assessments for its European LNG price assessments.

Platts may also consider for publication in its Atlantic assessment process, which concludes at 4:30 pm London time FOB USGC bids, offers and expressions of interest to trade, which may also be considered later in the GCM assessment process which concludes at 1:30 pm Houston time.

These would be published as currency conversions of the US dollardenominated assessments of Platts Northwest Europe (NWE) and Platts Mediterranean (Med) Markers. These values would be launched on January 16, 2020.

Full specifications for the GCM can be found here: https://www.spglobal.com/ platts/plattscontent/assets/files/en/ourmethodology/methodologyspecifications/lngmethodology.pdf

These prices would be published each business day and would be quoted in Eur/ MMBtu and Eur/MWh to three decimal places.

STANDARD : These will also apply to any bids, offers or expressions of interest to trade reported in the Platts Market on Close assessment process that underpins GCM. Unless otherwise stated by the counterparty at the time of providing data for publication, the bids and offers provided for publication in the MOC should reflect these following standards, which Platts understands to be broadly typical in the spot market for cargoes loaded in the US Gulf Coast. Platts may publish bids, offers and trades for LNG cargoes that carry different and conditions, but may normalize these when considered in final, published assessments. Market participants should clearly state in submitted bids or offers that differ from these standards.

Platts invites all questions and to [email protected] and [email protected].

DELIVERY WINDOW: The loading period reflected in bids, offers and trades should typically be three to five days long, with the seller to narrow to a one-day loading window 30 days before the first day of the traded delivery window. LOADING LOCATION: Bids, offers and trades should typically reflect loading in US Gulf Coast ports. Offers must be expressed with a specific base load port. The base load port chosen sets the conditions for any potential counterparty considering trading. Sellers will retain the option to substitute loading port in the US Gulf Coast up to a reasonable period before the first day of the traded loading window, subject to ship shore compatibility study (SSCS). Substitution of delivery locations to ports outside of the US Gulf Coast may be subject to normalization, and the option would need to be stated in the bid or offer. QUALITY: Market participants should clearly state GHV specifications in bids and offers submitted for publication. GCM will reflect cargoes with a GHV of 1,010-1,050 Btu/Scf. Platts may normalize for quality specifications with different ranges. QUANTITY: GCM will reflect a cargo quantity of 3.5 TBtu. This volume will be subject to +/-2% operational tolerance, at the seller’s option. Platts will continue to consider different cargo volumes, but may normalize where appropriate back to 3.5TBtu +/-2% operational tolerance. LNG VESSEL: Buyers will nominate an LNG ship 30 days prior to the first day of the traded delivery window, or at the time of trade confirmation for more prompt delivery windows. For cargoes for delivery at or less than 30 days from the date of assessment, buyers should state the LNG vessel explicitly in the bid. Buyers may substitute delivery vessel up to 15 days prior to the first day of the traded delivery window, subject to SSCS. Platts expects parties to be reasonable when exceptional circumstances require buyers to substitute vessels or sellers to substitute terminals beyond typical standards stated in Platts guidelines. Companies must promptly communicate to their counterparties when such a substitution is required. And buyers or

© 2019 S&P Global Platts, a division of S&P Global Inc. All rights reserved.

13

Platts is seeking on this proposal by November 8, 2019.

For written comments, please provide a clear indication if comments are not intended for publication by Platts for public viewing. Platts will consider all comments received and will make comments not marked as confidential available upon request Platts to launch seasonal and calendar year JKM derivative assessments S&P Global Platts will launch new seasonal and additional calendar year JKM LNG derivative assessments for two regional timestamps, effective December 16, 2019. One set of the assessments will reflect a timestamp of 4:30 pm Singapore time and the other a timestamp of 4:30 pm London time. The new seasonal assessments will reflect the two seasons beyond the active forward season, or forward-season +2 and forward-season +3, for summer or winter deliveries. Seasons will be defined as follows: Summer = April to September, and Winter = October to March. The two additional calendar year assessments will reflect the two calendar years beyond the active forward calendar year that Platts currently publishes. The seasonal and calendar year JKM LNG derivative assessments will be published each business day and reflect derivatives that settle on the physical JKM assessment. All prices will be published in dollars per million British thermal unit ($/MMBtu) to three decimal places. Platts will consider bids, offers and trade information for a minimum of five lots (one lot is equivalent to 10,000 MMBtu) for these assessments, matching the minimum lot size considered in its other JKM derivatives assessments. The seasonal assessment rolls over on the first working day of the new season for the Pricing Month derivative JKM. For example, on March 16, 2020, Platts will assess the Winter 20 and Summer 21 prices. On September 16, Platts will assess the Summer 21 and Winter 21 prices. The Calendar Year assessments rolls over on the first business day of the year. For example, the Cal 2020, 2021 and 2022 JKM derivative assessments roll into Cal 2021, 2022 and 2023 on January 2, 2019. Platts send all questions and to [email protected] and [email protected]. For written comments, please provide a clear indication if comments are not intended for publication by Platts for public

LNG Daily

October 29, 2019

SUBSCRIBER NOTES (Continued) viewing. Platts will consider all comments received and will make comments not marked as confidential available upon request. Centrica LNG Company Limited to Platts Atlantic LNG MOC Centrica LNG Company Limited has advised S&P Global Platts that it would like to participate in the Platts Market on Close assessment process for Atlantic LNG - Physical. Platts has reviewed Centrica LNG Company Limited and will consider information from Centrica LNG Company Limited in the EMEA - LNG - Physical

© 2019 S&P Global Platts, a division of S&P Global Inc. All rights reserved.

14

MOC subject at all times in adherence with Platts editorial standards. Platts will publish all relevant information from Centrica LNG Company Limited accordingly. Platts welcomes all relevant regarding MOC participation. Platts considers bids, offers and transactions by all credible and credit-worthy parties in its assessment processes. For comments and , please Platts editors at [email protected] and [email protected].

Key Drivers / Market Highlights MOC: 3 entities posted 2 bids and 3 offers ■■Sakhalin issues sell tender for Dec 11 loading ■■CFE issues buy tender for Nov 16-17 delivery ■■GAIL issues buy tender for Nov 17-25 delivery ■■Ichthys sell tender heard awarded at high $5 FOB for Nov 18-23 loading ■■BOTAS issues buy tender for a strip of cargoes from 2020-2023 ■■Deals heard into Europe at TTF-$0.60/MMBtu for Nov ■■European trader outlook bearish for December

Shipping Market Highlights ■■Shinshu

Maru diverted to load JERA FOB cargo early November Aurora heard fixed by Shell ■■PetroChina heard seeking vessel for multi-month charter ■■Arctic

News headlines ■■European

LNG regas back above 300 million cu m during Monday’s gas day...................................................................................................... 5

■■BP

sees global LNG supply glut persisting until 2022........................... 7 LNG touts modular approach, second-mover advantage................................................................................................. 7

■■Commonwealth

stories........................................................................................ 10-11

Contents ■■Market

Commentary................................................................................ 2 ■■Price Comparisons................................................................................... 3 ■■Recent Tenders and Strips...................................................................... 4 ■■News.......................................................................................................... 5 ■■Shipping Prices......................................................................................... 6

Shipping rates, Oct 29 Asia Pacific Atlantic

$/day AARXT00 120,000 AASYC00 130,000

Ballast rate AAXTN00 150% AAXTM00 150%

Daily Cumulative averages and monthly averages Oct 29 ($/MMBtu) JKM DES West India DES Mediterranean DES Northwest Europe FOB EAM FOB GCM JKM Yen conversion

www.platts.com

Cumulative monthly average (Dec) Previous month average (Nov)

6.157 -0.111

AAOVQ00

AAOVS00 6.688 AAOVS03 5.826

Platts daily LNG markers ($/MMBtu)

■■Asia

■■More

JKM TM

➧

JKM falls further amid limited demand, emerging supplies

Cumulative Previous monthly average month average AAOVS00 6.688 Dec AAOVS03 5.826 Nov AALIC00 5.992 Dec AAWIC03 5.411 Nov AADCU00 5.336 Dec AASWC03 5.233 Nov AASDF00 5.311 Dec AASDE03 5.116 Nov LEAMT00 4.920 Nov LEAMS31 4.120 Oct LGGCN00 4.236 Nov LGGCM31 4.074 Oct AAOVT00 726.622 Dec AAOVT03 627.482 Nov

www.twitter.com/PlattsGas

Oct 29 Change DES Japan/Korea Marker (JKM) JKM (Dec) AAOVQ00 6.157 -0.111 H2 Nov AAPSU00 6.000 -0.150 H1 Dec AAPSV00 6.064 -0.136 H2 Dec AAPSW00 6.250 -0.086 H1 Jan AAPXA00 6.500 -0.075 JKM (Dec) Japanese Yen conversion AAOVR00 670.313 -10.454 DES Japan/Korea (JKM) derivatives Dec LJKMO00 6.275 -0.075 Jan LJKMO01 6.475 -0.100 Feb LJKMO02 6.475 -0.100 Mar LJKMO03 6.225 -0.100 Q1 2020 LJKQR01 6.392 -0.100 Q2 2020 LJKQR02 5.550 -0.050 2020 LJKYR01 6.050 -0.150 DES Japan/Korea (JKM) derivatives London close Dec JKLMO00 6.275 0.000 Jan JKLMO01 6.450 -0.025 Feb JKLMO02 6.475 0.000 Mar JKLMO03 6.200 -0.025 Q1 2020 JKLQR01 6.375 -0.017 Q2 2020 JKLQR02 5.600 0.050 2020 JKLYR01 6.025 -0.075 DES Mediterranean Marker (MED) MED (Dec) AASXY00 5.059 -0.066 H2 Nov AASXZ00 4.202 -0.181 H1 Dec AASYA00 5.059 -0.066 H2 Dec AASYB00 5.059 -0.066 DES Northwest Europe Marker (NWE) NWE (Dec) AASXU00 5.059 -0.066 H2 Nov AASXV00 4.202 -0.181 H1 Dec AASXW00 5.059 -0.066 H2 Dec AASXX00 5.059 -0.066 Middle East Marker (MEM) MEM (Dec) LMEMA00 5.463 -0.100 H2 Nov LMEMB00 5.350 -0.125 H1 Dec LMEMC00 5.375 -0.125 H2 Dec LMEMD00 5.550 -0.075 H1 Jan LMEME00 5.800 -0.075 DES West India DES West India (Dec) AARXS00 5.463 -0.100 H1 Nov LMEAA00 5.050 -0.125 H2 Nov LMEAB00 5.350 -0.125 H1 Dec LMEAC00 5.375 -0.125 H2 Dec LMEAD00 5.550 -0.075 H1 Jan LMEAE00 5.800 -0.075 FOB Gulf Coast Marker (GCM) GCM (Nov) LGCSM01 3.357 -0.101 H1 Nov LUGCA01 3.114 -0.136 H2 Nov LUGCB02 3.599 -0.066 H1 Dec LUGCC03 3.599 -0.066

▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼

— —

▼ ▼ ▼ ▲ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼ ▼

LNG netback prices ($/MMBtu) Oct 29 AARXR00 5.060 FOB Australia FOB Middle East AARXQ00 4.900 DES Brazil Netforward LEBMH01 5.179 FOB Singapore AARXU00 5.187

Change 0.040 -0.100 -0.066 -0.101

▲ ▼ ▼ ▼

LNG Daily

October 29, 2019

Market Commentary

Platts LNG Asia JKM Rationale The S&P Global Platts JKM for December cargoes was assessed 11.1 cents/ MMBtu lower on the day at $6.157/MMBtu Tuesday on a competitive offer during the Platts Market on Close assessment process.

JKM falls further amid limited demand, emerging supplies London—Spot Asia LNG prices fell further amid healthy supplies and subdued demand from end-s in the region. The S&P Global Platts JKM for December cargoes was assessed 11.1 cents/MMBtu lower from Friday at $6.157/MMBtu Tuesday on a competitive offer during the Platts Market on Close assessment process. Bearish sentiment continued within the market as December supplies emerged in the market, while Asian end-s already maintained comfortable inventory levels despite approaching peakdemand season. “As far as I know, no Japanese end-s are approaching us or other sellers for winter stockpiling,” a Japanese trader said. While market participants awaited demand from other Asian countries, additional demand from Chinese and South Korean ends was not prevalent on Tuesday. In the bilateral market, a Japanese trading house was heard to have sold a December 22-26 cargo to a portfolio player at the low $6.00/MMBtu recently. On tender results, Ichthys LNG’s sell-tender for November 18-23 loading was heard awarded at the high $5.00/MMBtu on a FOB basis, according to market participants. The tender closed on Friday. Further details of the tender remained limited at the time of publication. On newly issued tenders, Russia’s Sakhalin Energy was heard to have issued a sell tender for December 11 loading. The tender closes on Thursday. Indian end- GAIL issued a buy tender for November 17-25 delivery to west coast India. The tender closes on October 29 with same-day validity. Elsewhere, Mexico’s CFE issued a buy tender for November 16-17

Platts assessed H1 and H2 December at $6.064/MMBtu and $6.250/MMBtu, respectively, with a half-monthly contango structure of 18.6 cents/MMBtu. Value on December 12 was assessed at $6.09/MMBtu, below BP’s offer at $6.10/ MMBtu for December 11-13 delivery, with a GHV of 1030-1130 Btu/cu ft and volume of 3.4 Tbtu. The same entity bid at $5.80/MMBtu for December 13-17 delivery, with a GHV of 1065-1150 Btu/cu ft and volume of 3.3 Tbtu. The bid was normalized down by 5 cents/MMBtu for higher GHV limiting supply sources against the JKM specification. DGI’s bid for December 20-24 was excluded from Tuesday’s assessment process. This rationale applies to symbol(s)

Platts LNG US FOB Gulf Coast Daily Rationale The FOB Gulf Coast Marker (GCM) for November was assessed at $3.357/ MMBtu. In the absence of transactional data, DES JKM (H1) and NWE (H2) yield the best netback for an exporter of US LNG based on prevailing market values. This rationale applies to symbol(s)

Platts LNG European Assessment Rationale The Northwest Europe Marker (NWE) for December was assessed at $5.059/ MMBtu, at a $0.20/MMBtu discount to the equivalent TTF forward contract. The Mediterranean Marker (MED) for December was assessed at $5.059/MMBtu, at a $0.20/MMBtu discount to the equivalent TTF forward contract. This rationale applies to symbol(s)

delivery to Manzanillo on a DES basis. The tender also closes on Thursday. Further ahead in the market, Turkey’s BOTAS issued a buy tender for a strip of cargoes from 2020 to 2023. This tender closes on November 9, and is valid until November 30. During the Platts MOC process on Tuesday, DGI, BP and Vitol posted two bids and three offers for December delivery. Meanwhile in Europe, market participants remain bearish in their (continued on page 5)

Reported Atlantic bids, offers and trades ($/MMBtu) Date Seller Loading

Buyer Basis Loading Window Offer/Bid Notes Best Bids/Offers Oct 29 Gate, Netherlands DES H2 Dec TTF-0.40 bid Oct 29 Gate, Netherlands DES H2 Dec TTF-0.45 bid

Reported North Asian bids, offers and trades ($/MMBtu) Date

Buyer Destination Seller Source Basis Delivery period Bid/Offer Notes Best Bids/Offers Oct 29 BPSG JKTC DES Dec 13-Dec 17 5.80 bid MOC VITOLSG JKTC DES Dec 16-Dec 20 5.80 bid MOC Oct 29 Oct 29 JKC DGI DES Dec 22-Dec 26 6.30 offer MOC JKTC DGI DES Dec 22-Dec 26 6.35 offer MOC Oct 29 Oct 29 JKTC BPSG DES Dec 11-Dec 13 6.10 offer MOC Last 5 trades NE Asia Oct 25 Yudean Dapeng LNG Vitol DES Dec 2-6 6.05 Oct 24 JKTC Sakhalin LNG Russia DES Nov 26 loading mid-$6s Oct 17 VITOLSG JKTC GUNVOR DES Dec 13-17 7.10 MOC Oct 15 North Asia Oman DES Dec 3 Around 6.50 Oct 15 Shell JKTC Brunei LNG DES Dec 2-4 Around 6.50

© 2019 S&P Global Platts, a division of S&P Global Inc. All rights reserved.

2

LNG Daily

October 29, 2019

Asia/Middle East ($/MMBtu), Oct 29

Europe ($/MMBtu), Oct 29

DES Japan/Korea Marker (JKM) JKM (Dec) JKM (H2 Nov) JKM (H1 Dec) JKM (H2 Dec) JKM (H1 Jan) Asian Dated Brent (16:30 Singapore) JKM vs Henry Hub futures JKM vs NBP futures JKM vs TTF JKM vs Asian Dated Brent (16:30 Singapore) JKM vs MED (16:30 London) JKM vs NWE (16:30 London)

AAOVQ00 6.157 AAPSU00 6.000 AAPSV00 6.064 AAPSW00 6.250 AAPXA00 6.500 ADBAA00 10.42 AAPRZ00 3.554 AAPSA00 0.607 LNTFJ00 0.898 AAPSB00 -4.261 ALNGB00 1.098 ALNGA00 1.098

FOB East Atlantic Marker (EAM) EAM (Nov) EAM (H1 Nov) EAM (H2 Nov) EAM (H1 Dec) Dated Brent (16:30 London) EAM vs Henry Hub futures EAM vs NBP futures EAM vs Dated Brent (16:30 London) EAM vs MED EAM vs JKM EAM vs ARA fuel oil

LEAMM01 4.700 LEAMH01 4.70 LEAMH02 4.70 LEAMH03 5.10 ADBAB00 10.53 LEHHM01 2.085 LENPM01 0.061 LEADB00 -5.834 LESWE00 -0.359 LEJKM01 -1.457 LEARA00 -4.970

DES Japan/Korea (JKM) derivatives Dec Jan Feb Mar Q1 2020 Q2 2020 2020

LJKMO00 6.275 LJKMO01 6.475 LJKMO02 6.475 LJKMO03 6.225 LJKQR01 6.392 LJKQR02 5.550 LJKYR01 6.050

FOB Middle East FOB Middle East

AARXQ00 4.900

DES Mediterranean Marker (MED) MED (Dec) MED (H2 Nov) MED (H1 Dec) MED (H2 Dec) Dated Brent (16:30 London) MED vs Henry Hub futures MED vs TTF MED vs NBP futures MED vs Dated Brent (16:30 London) MED vs NWE MED vs JKM

AASXY00 5.059 AASXZ00 4.202 AASYA00 5.059 AASYB00 5.059 ADBAB00 10.53 AASYF00 2.378 LNTFS00 -0.200 AASYH00 -0.401 AASYJ00 -5.475 ALNSA00 0.000 AASYM00 -1.098

DES West India DES West India (Dec)

AARXS00 5.463

FOB Australia (netback) JKM (Dec) (-) Freight FOB Australia

AAOVQ00 6.157 AAUSA00 1.10 AARXR00 5.06

Key gas price benchmarks Japan JCC LNG (Jul) Japan JCC LNG (Aug)

LAKPN00 9.54 Final LAKPM00 10.12 Estimated

Platts Dutch TTF Nov Dec

GTFWM10 4.502 GTFWM20 5.259

DES Northwest Europe Marker (NWE) NWE (Dec) NWE (H2 Nov) NWE (H1 Dec) NWE (H2 Dec) Dated Brent (16:30 London) NWE vs Henry Hub futures NWE vs TTF NWE vs NBP futures NWE vs Dated Brent (16:30 London) NWE vs MED NWE vs JKM NWE as a % of NBP

AASXU00 5.059 AASXV00 4.202 AASXW00 5.059 AASXX00 5.059 ADBAB00 10.53 AASYE00 2.378 LNTFN00 -0.200 AASYG00 -0.401 AASYI00 -5.475 AASYK00 0.000 AASYL00 -1.098 AASYD00 92.65

Competing fuel prices JCC crude oil (Jul) ($/b) JCC crude oil (Aug) ($/b) HSFO 3.5% sulfur 180 CST FOB Singapore NEAT Coal Index Minas crude oil Naphtha CFR Japan

AAKOP00 67.32 Final AAKOM00 67.38 Estimated LUAXZ00 6.91 JKTCB00 3.077 LCABO00 10.032 LNPHJ00 11.210

Competing fuel prices Northwest Europe fuel oil CIF ARA 15-60 day thermal coal

LAEGR00 9.67 CSAAB00 2.30

Notes: Japan JCC value shows latest available CIF price published by the Ministry of Finance, converted to US dollars per MMBtu. All other values reflect Platts most recent one-month forward assessments for each product in each region, converted to US dollars per MMBtu. JKM Marker, SWE LNG and NWE LNG average the assessments of the two half-months comprising the first full month of forward delivery. Asian LNG assessments assessed at Singapore market close 0830 GMT, European LNG assessment assessed at London market close 1630 UK time. NYMEX Henry Hub futures and ICE NBP futures values taken at Singapore market close and London market close. ICE NBP futures converted from Pence/Therm to $/MMBtu. Asian Dated Brent crude oil assessed at Asian market close 0830 GMT and converted from $/barrel to $/MMBtu. Detailed assessment methodology is found on www.platts.com.

South America ($/MMBtu), Oct 29 DES Brazil Netforward DES Brazil (Nov) DES Brazil vs NWE Fuel Oil Derivative DES Brazil vs DES MED LNG DES Brazil vs Dated Brent DES Brazil vs Henry Hub (16:30 London) DES Brazil vs JKM (16:30 London) DES Brazil vs NBP (16:30 London)

LEBMH01 5.179 LAARM01 -4.491 LASWM01 0.120 LADBM01 -5.355 LAHHM01 2.564 LAJKM01 -0.978 LABPM01 0.540

FOB Gulf Coast Marker (GCM) GCM (Nov) GCM (H1 Nov) GCM (H2 Nov) GCM (H1 Dec) Americas Dated Brent (13:30 Houston) Dated Brent (16:30 London) WTI (13:30 Houston) GCM vs JKM GCM vs EAM GCM vs Henry Hub futures GCM vs TTF GCM vs NBP futures GCM vs Americas Dated Brent (13:30 Houston) GCM vs Dated Brent (16:30 London) GCM vs WTI (13:30 Houston) GCM vs USGC HSFO

LGCSM01 3.357 LUGCA01 3.114 LUGCB02 3.599 LUGCC03 3.599 ADBAC00 10.488 ADBAB00 10.53 ADBAD00 9.576 LGMJM01 -2.800 LGMEA00 -1.343 LGMHM01 0.760 LNTFG00 -1.145 LGMNM01 -1.282 AGCMA00 -7.131 LGMDB00 -7.177 LGMWT00 -6.219 LGMFO00 -2.223

Competing fuel prices US Gulf Coast high sulfur fuel oil New York Harbor 1%S fuel oil

LUAXJ00 5.47 LUAXD00 10.07

Futures ($/MMBtu), Oct 29

Marine Fuel LNG Bunker, Oct 29 $/MMBtu $/mt Singapore LNBSG00 11.625 LNBSM00 449.225 Eur/MWh $/mt Rotterdam LNBRT00 19.325 LNBRM00 243.106 MMBtu to $/mt factor: 38.643; MWh to $/mt factor: 11.322.

© 2019 S&P Global Platts, a division of S&P Global Inc. All rights reserved.

North America ($/MMBtu), Oct 29

3