Sgx Apac Ex Japan Dividend Leaders Reit Index Factsheet w4e4f

This document was ed by and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this report form. Report 2z6p3t

Overview 5o1f4z

& View Sgx Apac Ex Japan Dividend Leaders Reit Index Factsheet as PDF for free.

More details 6z3438

- Words: 918

- Pages: 4

Aug 2016

SGX APAC ex Japan Dividend Leaders REIT Index

SGX Index Edge

SGX APAC ex Japan Dividend Leaders REIT Index

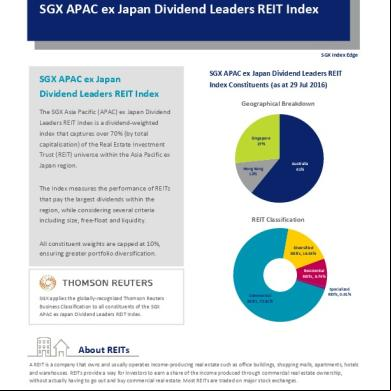

SGX APAC ex Japan Dividend Leaders REIT Index Constituents (as at 29 Jul 2016) Geographical Breakdown

The SGX Asia Pacific (APAC) ex Japan Dividend Leaders REIT Index is a dividend-weighted index that captures over 70% (by total capitalisation) of the Real Estate Investment

Singapore 27%

Trust (REIT) universe within the Asia Pacific ex Japan region.

Hong Kong 12%

Australia 61%

The Index measures the performance of REITs that pay the largest dividends within the region, while considering several criteria including size, free-float and liquidity.

REIT Classification

All constituent weights are capped at 10%, ensuring greater portfolio diversification.

Diversified REITs, 16.54%

Residential REITs, 9.74%

SGX applies the globally-recognized Thomson Reuters Business Classification to all constituents of the SGX APAC ex Japan Dividend Leaders REIT Index.

Commercial REITs, 72.81%

Specialized REITs, 0.91%

About REITs A REIT is a company that owns and usually operates income-producing real estate such as office buildings, shopping malls, apartments, hotels and warehouses. REITs provide a way for investors to earn a share of the income produced through commercial real estate ownership, without actually having to go out and buy commercial real estate. Most REITs are traded on major stock exchanges. Most REITs pay out all of their taxable income as dividends to shareholders and owe no corporate tax. In turn, shareholders pay the income taxes on those dividends. A REIT Index provides investors with exposure to a portfolio of income-producing real estate assets.

SGX APAC ex Japan Dividend Leaders REIT Index 1,800 1,600 1,400 1,200 1,000 800 600 400 200 0

* Index rebased to 1000 as of 1 April 2011.

SGX APAC ex Japan Dividend Leaders REIT Index PR SGX APAC ex Japan Dividend Leaders REIT Index TR SGX APAC ex Japan Dividend Leaders REIT Index NTR

Index Information Number of Constituents

30

Currency

USD

Index Start Date

19 August 2016

Base Value

1000

Weighting

Total Dividends Weighted

Review Dates

Semi-annually in March and September

Bloomberg Ticker

SGAPDL (Price Return) SGAPDLT (Total Return) SGAPDLN (Net Total Return)

Thomson Reuters RIC

.SGAPDL (Price Return) .SGAPDLT (Total Return) .SGAPDLN (Net Total Return)

Performance (as at 29 Jul 2016) 1 Year

3 Years*

5 Years*

SGX APAC ex Japan Dividend Leaders REIT Index (PR)

13.74%

3.35%

2.54%

SGX APAC ex Japan Dividend Leaders REIT Index (TR)

19.97%

11.01%

9.78%

SGX APAC ex Japan Dividend Leaders REIT Index (NTR)

19.48%

10.28%

9.13%

*Returns are reported on an annualised basis.

Fundamentals (as at 29 Jul 2016) SGX APAC ex Japan Dividend Leaders REIT Index

Dividend Yield (%)

P/E

Net MCap (USD M)

4.53%

10.91

139,302

Risk Analysis Standard Deviation

1 Year

3 Years*

5 Years*

SGX APAC ex Japan Dividend Leaders REIT Index (PR)

17.50%

14.49%

17.68%

SGX APAC ex Japan Dividend Leaders REIT Index (TR)

17.87%

14.31%

17.74%

SGX APAC ex Japan Dividend Leaders REIT Index (NTR)

17.82%

14.30%

17.74%

*Standard deviations are calculated using monthly returns and reported on an annualised basis.

Top 10 Constituents Company Name

Stock Code

Country

TRBC Industry

Index Weight

LINK REIT

823

Hong Kong

Commercial REIT

11.32%

SCENTRE GROUP

SCG

Australia

Commercial REIT

10.62%

WESTFIELD CORP

WFD

Australia

Commercial REIT

8.29%

STOCKLAND

SGP

Australia

Residential REIT

8.73%

VICINITY CENTRES

VCX

Australia

Commercial REIT

7.59%

GPT GROUP

GPT

Australia

Diversified REIT

6.15%

GOODMAN GROUP

GMG

Australia

Commercial REIT

5.44%

MIRVAC GROUP

MGR

Australia

Diversified REIT

5.48%

ASCENDAS REAL ESTATE INV TRT

A17U

Singapore

Commercial REIT

4.43%

CAPITALAND MALL TRUST

C38U

Singapore

Commercial REIT

3.47%

Data updated as of 29 July 2016

Us If you have any questions, please our Index Services Team at [email protected] sgx.com/indexedge

This document is not intended for distribution to, or for use by or to be acted on by any person or entity located in any jurisdiction where such distribution, use or action would be contrary to applicable laws or regulations or would subject SGX to any registration or licensing requirement. This document is not an offer or solicitation to buy or sell, nor financial advice or recommendation for any investment product. This document has been published for general circulation only. It does not address the specific investment objectives, financial situation or particular needs of any person. Advice should be sought from a financial adviser regarding the suitability of any investment product before investing or adopting any investment strategies. Further information on this investment product may be obtained from [www.sgx.com]. Investment products are subject to significant investment risks, including the possible loss of the principal amount invested. Past performance of investment products is not indicative of their future performance. Examples provided are for illustrative purposes only. While SGX and its s have taken reasonable care to ensure the accuracy and completeness of the information provided, they will not be liable for any loss or damage of any kind (whether direct, indirect or consequential losses or other economic loss of any kind) suffered due to any omission, error, inaccuracy, incompleteness, or otherwise, any reliance on such information. Neither SGX nor any of its s shall be liable for the content of information provided by third parties. SGX and its s may deal in investment products in the usual course of their business, and may be on the opposite side of any trades. Investment in this product is restricted to accredited investors. SGX is an exempt financial adviser under the Financial Advisers Act (Cap. 110) of Singapore. The information in this document is subject to change without notice.

SGX APAC ex Japan Dividend Leaders REIT Index

SGX Index Edge

SGX APAC ex Japan Dividend Leaders REIT Index

SGX APAC ex Japan Dividend Leaders REIT Index Constituents (as at 29 Jul 2016) Geographical Breakdown

The SGX Asia Pacific (APAC) ex Japan Dividend Leaders REIT Index is a dividend-weighted index that captures over 70% (by total capitalisation) of the Real Estate Investment

Singapore 27%

Trust (REIT) universe within the Asia Pacific ex Japan region.

Hong Kong 12%

Australia 61%

The Index measures the performance of REITs that pay the largest dividends within the region, while considering several criteria including size, free-float and liquidity.

REIT Classification

All constituent weights are capped at 10%, ensuring greater portfolio diversification.

Diversified REITs, 16.54%

Residential REITs, 9.74%

SGX applies the globally-recognized Thomson Reuters Business Classification to all constituents of the SGX APAC ex Japan Dividend Leaders REIT Index.

Commercial REITs, 72.81%

Specialized REITs, 0.91%

About REITs A REIT is a company that owns and usually operates income-producing real estate such as office buildings, shopping malls, apartments, hotels and warehouses. REITs provide a way for investors to earn a share of the income produced through commercial real estate ownership, without actually having to go out and buy commercial real estate. Most REITs are traded on major stock exchanges. Most REITs pay out all of their taxable income as dividends to shareholders and owe no corporate tax. In turn, shareholders pay the income taxes on those dividends. A REIT Index provides investors with exposure to a portfolio of income-producing real estate assets.

SGX APAC ex Japan Dividend Leaders REIT Index 1,800 1,600 1,400 1,200 1,000 800 600 400 200 0

* Index rebased to 1000 as of 1 April 2011.

SGX APAC ex Japan Dividend Leaders REIT Index PR SGX APAC ex Japan Dividend Leaders REIT Index TR SGX APAC ex Japan Dividend Leaders REIT Index NTR

Index Information Number of Constituents

30

Currency

USD

Index Start Date

19 August 2016

Base Value

1000

Weighting

Total Dividends Weighted

Review Dates

Semi-annually in March and September

Bloomberg Ticker

SGAPDL (Price Return) SGAPDLT (Total Return) SGAPDLN (Net Total Return)

Thomson Reuters RIC

.SGAPDL (Price Return) .SGAPDLT (Total Return) .SGAPDLN (Net Total Return)

Performance (as at 29 Jul 2016) 1 Year

3 Years*

5 Years*

SGX APAC ex Japan Dividend Leaders REIT Index (PR)

13.74%

3.35%

2.54%

SGX APAC ex Japan Dividend Leaders REIT Index (TR)

19.97%

11.01%

9.78%

SGX APAC ex Japan Dividend Leaders REIT Index (NTR)

19.48%

10.28%

9.13%

*Returns are reported on an annualised basis.

Fundamentals (as at 29 Jul 2016) SGX APAC ex Japan Dividend Leaders REIT Index

Dividend Yield (%)

P/E

Net MCap (USD M)

4.53%

10.91

139,302

Risk Analysis Standard Deviation

1 Year

3 Years*

5 Years*

SGX APAC ex Japan Dividend Leaders REIT Index (PR)

17.50%

14.49%

17.68%

SGX APAC ex Japan Dividend Leaders REIT Index (TR)

17.87%

14.31%

17.74%

SGX APAC ex Japan Dividend Leaders REIT Index (NTR)

17.82%

14.30%

17.74%

*Standard deviations are calculated using monthly returns and reported on an annualised basis.

Top 10 Constituents Company Name

Stock Code

Country

TRBC Industry

Index Weight

LINK REIT

823

Hong Kong

Commercial REIT

11.32%

SCENTRE GROUP

SCG

Australia

Commercial REIT

10.62%

WESTFIELD CORP

WFD

Australia

Commercial REIT

8.29%

STOCKLAND

SGP

Australia

Residential REIT

8.73%

VICINITY CENTRES

VCX

Australia

Commercial REIT

7.59%

GPT GROUP

GPT

Australia

Diversified REIT

6.15%

GOODMAN GROUP

GMG

Australia

Commercial REIT

5.44%

MIRVAC GROUP

MGR

Australia

Diversified REIT

5.48%

ASCENDAS REAL ESTATE INV TRT

A17U

Singapore

Commercial REIT

4.43%

CAPITALAND MALL TRUST

C38U

Singapore

Commercial REIT

3.47%

Data updated as of 29 July 2016

Us If you have any questions, please our Index Services Team at [email protected] sgx.com/indexedge

This document is not intended for distribution to, or for use by or to be acted on by any person or entity located in any jurisdiction where such distribution, use or action would be contrary to applicable laws or regulations or would subject SGX to any registration or licensing requirement. This document is not an offer or solicitation to buy or sell, nor financial advice or recommendation for any investment product. This document has been published for general circulation only. It does not address the specific investment objectives, financial situation or particular needs of any person. Advice should be sought from a financial adviser regarding the suitability of any investment product before investing or adopting any investment strategies. Further information on this investment product may be obtained from [www.sgx.com]. Investment products are subject to significant investment risks, including the possible loss of the principal amount invested. Past performance of investment products is not indicative of their future performance. Examples provided are for illustrative purposes only. While SGX and its s have taken reasonable care to ensure the accuracy and completeness of the information provided, they will not be liable for any loss or damage of any kind (whether direct, indirect or consequential losses or other economic loss of any kind) suffered due to any omission, error, inaccuracy, incompleteness, or otherwise, any reliance on such information. Neither SGX nor any of its s shall be liable for the content of information provided by third parties. SGX and its s may deal in investment products in the usual course of their business, and may be on the opposite side of any trades. Investment in this product is restricted to accredited investors. SGX is an exempt financial adviser under the Financial Advisers Act (Cap. 110) of Singapore. The information in this document is subject to change without notice.