Docx 6c584m

This document was ed by and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this report form. Report 2z6p3t

Overview 5o1f4z

& View Docx as PDF for free.

More details 6z3438

- Words: 21,579

- Pages: 57

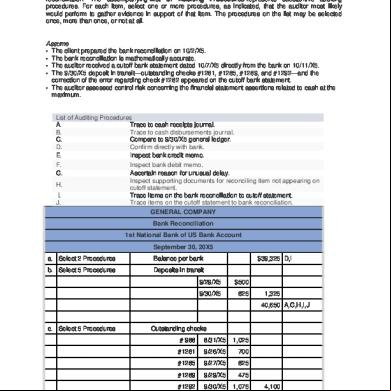

Chapter 10 1 Items 1 through 6 represent the items that an auditor ordinarily would find on a client-prepared bank reconciliation. The accompanying List of Auditing Procedures represents substantive auditing procedures. For each item, select one or more procedures, as indicated, that the auditor most likely would perform to gather evidence in of that item. The procedures on the list may be selected once, more than once, or not at all.

Assume • The client prepared the bank reconciliation on 10/2/X5. • The bank reconciliation is mathematically accurate. • The auditor received a cutoff bank statement dated 10/7/X5 directly from the bank on 10/11/X5. • The 9/30/X5 deposit in transit—outstanding checks #1281, #1285, #1289, and #1292—and the correction of the error regarding check #1282 appeared on the cutoff bank statement. • The auditor assessed control risk concerning the financial statement assertions related to cash at the maximum.

List of Auditing Procedures A. Trace to cash receipts journal. B. Trace to cash disbursements journal. C. Compare to 9/30/X5 general ledger. D. Confirm directly with bank. E. Inspect bank credit memo. F. G. H. I. J.

Inspect bank debit memo. Ascertain reason for unusual delay. Inspect ing documents for reconciling item not appearing on cutoff statement. Trace items on the bank reconciliation to cutoff statement. Trace items on the cutoff statement to bank reconciliation. GENERAL COMPANY Bank Reconciliation 1st National Bank of US Bank September 30, 20X5

a. Select 2 Procedures

Balance per bank

b. Select 5 Procedures

Deposits in transit

$39,325 D,I

9/29/X5

$500

9/30/X5

825

1,325 40,650 A,G,H,I,J

c. Select 5 Procedures

Outstanding checks # 988

8/31/X5

1,025

#1281

9/26/X5

700

#1285

9/27/X5

825

#1289

9/29/X5

475

#1292

9/30/X5

1,075

4,100

36,550 B,G,H,I,J

d. Select 1 Procedures e. Select 2 Procedures

f. Select 1 Procedure

Customer note collected by bank

(1,000) E

Error: Check #1282; written on 9/26/X5 for $560 was erroneously charged by bank as $650; bank was notified on 10/2/X5 Balance per books

90 E,I $35,640 C

Explanation: (a) D, I. The balance per bank may be traced to a standard form used to confirm balance information with financial institutions and to the cutoff statement (on which will appear the beginning balance).

(b) A, G, H, I, J. One of the deposits in transit does not appear on the cutoff bank statement (the 9/29/X5 deposit for $500). Accordingly, that deposit should be traced to the cash receipts journal (procedure A), the reason for the delay should be investigated (procedure G), and ing documents should be inspected (procedure H). Both deposits should be traced to and from the bank reconciliation and the cutoff statement (procedures I and J).

(c) B, G, H, I, J One of the checks does not appear on the cutoff statement (check #988 dated 8/31/X5 for $1,025). Accordingly, that check should be traced to the cash disbursements journal (procedure B), the reason for the delay should be investigated (procedure G), and ing documents should be inspected (procedure H). All checks should be traced to and from the bank reconciliation and cutoff statement (procedures I and J).

(d) E The credit memo from the bank for the note collected should be investigated.

(e) E, I The credit for the check that was charged by the bank for an incorrect amount should be investigated on both the bank credit memo and on the cutoff statement.

(f) C The only source of the balance per books is the cash general ledger as of 9/30/X5.

2. You are the senior auditor-in-charge of the July 31, 20X0, audit of Reliable Auto Parts, Inc. Your newly hired staff assistant reports to you that she is unable to complete the four-column proof of cash for the month of April 20X0, which you instructed her to do as part of the consideration of internal control over cash.

Your assistant shows you the working paper that she has prepared. Your review of your assistant’s work reveals that the dollar amounts of all the items in her working paper are correct. You learn that the ant for Reliable Auto Parts, Inc., makes no journal entries for bank service charges or note collections until the month following the bank’s recording of the item. In addition, Reliable’s ant makes no journal entries whatsoever for NSF checks that are redeposited and cleared. Your assistant’s working paper appears below.

Per bank statement Deposits in transit: At 3/31/X0 At 4/30/X0 Outstanding checks: At 3/31/X0 At 4/30/X0 Bank service charges: March 20X0 April 20X0 Note receivable collected by bank 4/30/X0 NSF check of customer L. G. Waite, charged back by bank 3/31/X0, redeposited and cleared 4/3/X0

RELIABLE AUTO PARTS, INC. Proof of Cash for April 20X0 July 31, 20X0 Balance 3/31/X0 Deposits $ 72,112.82 $ 61,855.41 2,130.89

(14,977.49)

14,977.49 (23,052.21)

23,052.21

22.30 (19.26)

19.26

(22.30)

18,300.00

$

(420.47)

420.47

58,823.45 59,708.99

85,523.43 45,951.60

Balance 4/30/X0 $ 65,433.02 (2,130.89) 4,947.55

4,947.55

Balances as computed Balances per book

Unlocated difference

Checks $ 68,535.21

18,300.00

60,463.53 76,612.97

(885.54) $ 39,571.83 $ (16,149.44) $

109,621.15 29,047.62

80,573.53

Prepare a corrected four-column proof of cash in good form for Reliable Auto Parts, Inc., for the month of April 20X0.

RELIABLE AUTO PARTS, INC Proof of Cash for April 20X0 July 31, 20X0 Balance 3/31/X0

Balance Deposits

Checks

4/30/X0

Per bank statement

$72,112.82 $61,855.41 $68,535.21 $65,433.02

Deposits in transit: At 3/31/X0

2,130.89

(2,130.89)

0

0

At 4/30/X0

0

4,947.55

0

4,947.55

Outstanding checks: At 3/31/X0

(14,977.49)

0 (14,977.49)

At 4/30/X0

0

0

22.30

0

23,052.21 (23,052.21)

Bank service charges: March 20X0 April 20X0 Note receivable collected by bank 4/30/X0

0 (18,300.00)

22.30

0

(19.26)

19.26

0 (18,300.00)

NSF check of customer L. G. Waite, charged back by bank 3/31/X0, redeposited and cleared 4/3/X0 Balances per book

420.47

(420.47)

0

0

$59,708.99 $45,951.60 $76,612.97 $29,047.62

3. During the audit of Sunset Building Supply, you are given the following year-end bank reconciliation prepared by the client:

SUNSET BUILDING SUPPLY Bank Reconciliation December 31 Balance per 12/31 bank statement Add: Deposits in transit

$49,204 4,514

Less: Checks outstanding

$53,718 20,958

Balance per ledger, 12/31

$32,760

According to the client’s ing records, checks totaling $31,791 were issued between January 1 and January 14 of the following year. You have obtained a cutoff bank statement dated January 14 containing paid checks amounting to $50,935. Of the checks outstanding at December 31, checks totaling $3,635 were not returned in the cutoff statement, and of those issued per the ing records in January, checks totaling $8,278 were not returned. Prepare a working paper comparing (1) the total of all checks returned by the bank or still outstanding with (2) the total per the client’s records of checks outstanding at December 31 plus checks issued from

January 1–14.

SUNSET BUILDING SUPPLY Comparison of Checks and Disbursements December 31 Checks returned or still outstanding: Returned in cutoff statement

$50,935

Outstanding checks on 1/14

11,913

$62,84 8

Disbursements per client records: Outstanding checks on 12/31

$20,958

Issued between 1/1 and 1/14

31,791

Excess of checks returned or outstanding over disbursements per client records

$52,74 9 $10,09 9

4. You are working on your firm’s fifth audit of SSC. The previous audits have all resulted in standard unqualified audit reports. Read the following write-up from your audit files concerning SSC and its industry, and then reply to the questions that follow. Company Information In 20X1, Gary Sherwood founded Sherwood Stone Company (SSC). In the middle of its second year of existence, the company completed development of a large extraction pit area and constructed an aggregate processing plant that is equipped to crush, screen, and wash aggregate products. By 20X4, the sand and gravel operation was profitable and growing market conditions justified modifications and expansion. Currently, SSC produces a wide range of sand and stone products from its pit near Bisbee, Arizona. The materials it develops are composed of sand and stone materials for commercial construction and highway projects. SSC sells to a wide variety of commercial and governmental customers, with only one of its numerous customers—Wingo Corporation—ing for more than 5 percent of total sales. In total, Wingo has represented approximately 30 percent of sales (and receivables) for the past few years. Wingo Corporation is by far Arizona’s largest street and road contractor and seems solid financially. Virtually all of SSC’s sales are on credit, although all but the smallest contracts require “progress” billings that result in payment being received by SSC on a pro rata basis with delivery of materials to the customer. Payments from customers are made directly to the company’s lockbox system with SSC’s local bank. All transactions occur in U.S. dollars, and SSC maintains both a general checking and a payroll . SSC has worked closely with Wingo Corporation in developing a superior road paying product (“QuietRide”). Not only is the car ride relatively quiet on QuietRide roads, but it is also relatively cool (thus lengthening the life of automobile tires) and less likely to lead to cars sliding in rainy conditions. Although Wingo Corporation holds the overall patent, SSC has patented a critical component that is used in the product (the component is “QSand”). The product now s for approximately 25 percent of the company’s sales (all to Wingo Corporation) and 33 percent of its profits.

The success of QSand has led SSC to start developing another product, QDeck. QDeck will be a final finishing coat over the pool deck—the concrete walking and lounging area that surrounds a swimming pool. QDeck is intended to address two problems: (1) individuals slipping and falling on pool decks while walking with wet feet, and (2) individuals burning their feet on the deck on particularly hot days. Gary indicates that the current compound seems to allow good traction and decks remain much cooler than with products of other companies. The problem being addressed at this point is that the current compound seems to crack easily and has a relatively short useful life. Indeed, in one test of the product on the deck at Gary’s home, Gary’s wife Madonna cut her foot on one of the cracks and required several stitches to close the wound. Gary laughed and said that at least she didn’t slip or burn her feet on that hot day when it happened. More seriously, he suggested that this deficiency is currently being worked on and must be solved before the product goes to market. The product is being independently developed and is intended for both residential and commercial markets. In 20X8, the company experienced a level of profitability just slightly above that of 20X7—but this was well below the net incomes of the preceding few years. Gary suggested to you that, surprisingly, intense price competition from several smaller competitors in the Bisbee area caused the somewhat low level of profitability. But, he added, he didn’t expect the problem to last for long because he doubted that those companies could continue to operate selling at those lower prices. Gary had hoped for a more profitable year in 20X8, as a significant amount of the company’s long-term debt is payable in 20X9. SSC is currently involved in discussions with the bank on refinancing. SSC added significant additional crushing and washing plant and equipment during 20X8 to increase production in the future by more than 100 percent while expanding capabilities to produce custom specification materials. No dividends have been paid during the past two years, although previously most of the earnings were distributed through dividends to SSC’s five shareholders—CEO and Chair of the Board of Directors Gary Sherwood, his wife Madonna Sherwood, CFO Jane Zhan, and two college friends of Gary’s who invested in the company, Cindy Stone and Kelly Higgins. These five individuals make up the company’s board of directors. The Bank of Arizona is the financial institution with which SSC maintains its two cash s (a general and payroll cash ) and from which it obtains a significant portion of its financing; the inventories are pledged on the Bank of Arizona loan. This year, in reaction to pressure from the bank, SSC est ablished an audit committee composed of Madonna Sherwood, Cindy Stone, and Kelly Higgins.

Industry Information The industry activities consist of the extraction and preparation of sand and rock products. These activities include the cleaning, separating, and sorting of quarried sand and the process of crushing rocks. The products are in the form of sand used in making concrete; sand used in laying bricks (which contains little soil); sand used for fill (which contains a large amount of soil); and quartz sand. It excludes the products of gravel quarrying (sandstone, gravel stone, and iron sand).

While sales within the industry are relatively unaffected by changes in technology or obsolescence, industry sales rely heavily upon both the residential and commercial construction markets as well as government spending. During the past five years, construction has performed well and that trend is expected to continue for at least the next several years. Sand and gravel production has increased at approximately 4 percent per year during this time period, as has construction within the central Arizona area. a. Which of the following represents a correct statement concerning the risk of misappropriation of cash for SSC?

This is not a major concern since sales are made on credit. Deposit of cash into a lockbox system decreases the risk of misappropriation. Misappropriation of cash is not a significant problem in a commercial company. The success of QSand increases the risk that cash will be misappropriated.

b. Which of the following correctly identifies a risk facing SSC that might adversely affect cash receipts during the coming years?

Establishment of the audit committee. Increase in the popularity of home swimming pools. Sales to many different customers. Sales to Wingo. c. Which of the following correctly identifies a risk facing SSC that might adversely affect sales during the coming years?

A general slowdown in the economy. Sales to many smaller customers other than Wingo Corporation. Increased attention to developing new products. A board of directors dominated by management. d. Which of the following correctly identifies a risk facing SSC that might affect its ability to continue as a going concern over the long run?

Competition from several competitors. Your A firm’s decision to issue standard unmodified audit reports not mentioning the goingconcern status during the past five years. Obsolescence of all products due to rapid changes in technology in the industry. The nature of inventory items—small in size, high in value. e. Of the following, the most significant risk factor relating to the risk of misstatement arising from fradulent financial reporting for SSC is that:

Company officers serve on the board of directors. The company must refinance a significant portion of its debt. The company operates in the Bisbee, Arizona, area. The company paid no dividend this year. f. In addition to the risk factor identified in the preceding question, another risk factor relating to misstatements arising from fraudulent financial reporting is:

Earnings this year are lower than management had hoped. s payable are limited to commercial suppliers. Sales are made to residential, commercial, and governmental purchasers. The industry faces great technological changes in almost all of its products.

Chapter 11 1 For each of the procedures described in the table below, identify the audit procedure performed and classification of the audit procedure using the following: Audit Procedures: (1) Analytical procedure (2) Confirmation (3) Inquiry (4) Inspection of records or documents (5) Inspection of tangible assets (6) Observation (7) Recalculation (8) Reperformance

Procedure

Classification of Audit Procedure (9) Substantive procedures (10) Test of controls

Audit Procedure

Classification of Audit Procedure

Requested responses directly from customers as to amounts due. Compared total bad debts this year with the totals for the previous two years. Questioned management about likely total uncollectible s. Watched the ing clerk record the daily deposit of cash receipts. Examined invoice to obtain evidence in of the ending recorded balance of a customer. Compared a sample of sales invoices to credit files to determine whether the customers were on the approved customer list. Examined a sample of sales invoices to see if they were initialized by the credit manager indicating credit approval.

(2)

(9)

(1)

(9)

(3)

(9)

(6)

(10)

(4)

(9)

(8)

(10)

(4)

(10)

2. An assistant on the Carter Company audit has been working in the revenue cycle and has compiled a list of possible errors and fraud that may result in the misstatement of Carter Company’s financial statements and a corresponding list of controls that, if properly designed and implemented, could assist in preventing or detecting the errors and fraud. For each possible error and fraud numbered a through o, select one internal control from the following answer list that, if properly designed and implemented, most likely could assist management in preventing or detecting the errors and fraud. Each response in the list of controls may be selected once, more than once, or not at all.

Controls A. Shipping clerks compare goods received from the warehouse with the details on the shipping documents. B. Approved sales orders are required for goods to be released from the warehouse. C. Monthly statements are mailed to all customers with outstanding balances. D. Shipping clerks compare goods received from the warehouse with approved sales orders. E. Customer orders are compared with the inventory master fi le to determine whether items ordered are in stock. F. Daily sales summaries are compared with control totals of invoices. G. Shipping documents are compared with sales invoices when goods are shipped. H. Sales invoices are compared with the master price file. I. Customer orders are compared with an approved customer list. J. Sales orders are prepared for each customer order. K. Control amounts posted to the s receivable ledger are compared with control totals of invoices. L. Sales invoices are compared with shipping documents and approved customer orders before invoices are mailed. M.Prenumbered credit memos are used for granting credit for goods returned. N. Goods returned for credit are approved by the supervisor of the sales department. O. Remittance advices are separated from the checks in the mailroom and forwarded to the ing department. P. Total amounts posted to the s receivable ledger from remittance advices are

compared with the validated bank deposit slip. Q. The cashier examines each check for proper endorsement. R. Validated deposit slips are compared with the cashier’s daily cash summaries. S. An employee, other than the bookkeeper, periodically prepares a bank reconciliation. T. Sales returns are approved by the same employee who issues receiving reports evidencing actual return of goods. Possible Errors and Fraud

Controls

a.

Invoices for goods sold are posted to incorrect customer s.

C

b.

Goods ordered by customers are shipped, but are not billed to anyone.

G

c.

Invoices are sent for shipped goods, but are not recorded in the sales journal.

F

d.

Invoices are sent for shipped goods and are recorded in the sales journal, but are not posted to any customer .

K

e.

Credit sales are made to individuals with unsatisfactory credit ratings.

I

f.

Goods are removed from inventory for unauthorized orders.

B

g.

Goods shipped to customers do not agree with goods ordered by customers.

D

h. i. j.

Invoices are sent to allies in a fraudulent scheme and sales are recorded for L fictitious transactions. Customers’ checks are received for less than the customers’ full balances, P but the customers’ full balances are credited. Customers’ checks are misappropriated before being forwarded to the cashier for C deposit.

k.

Customers’ checks are credited to incorrect customer s.

C

l.

Different customer s are each credited for the same cash receipt.

P

m. n. o.

Customers’ checks are properly credited to customer s and are properly deposited, but errors are made in recording receipts in the cash receipts journal. Customers’ checks are misappropriated after being forwarded to the cashier for deposit. Invalid transactions granting credit for sales returns are recorded. a. (C) Invoices posted to incorrect customer s will be detected by analyzing customer responses to monthly statements that include errors, particularly statements with errors not in favor of the customer. b. (G) The comparison of shipping documents with sales invoices will detect goods that have been shipped but not billed when no sales invoice is located for a particular shipping document. c. (F) To provide assurance that all invoiced goods that have been shipped are recorded as sales, daily sales summaries should be compared with invoices. For example, a sale that has not been recorded will result in a sales summary that does not include certain sales invoices. d. (K) A comparison of the amounts posted to the s receivable ledger with the control total for invoices will provide assurance that all invoices have been posted to a customer . e. (I) Comparing customer orders with an approved customer list will provide assurance that credit sales are made only to customers that have been granted credit. f. (B) Requiring an approved sales order before goods are released from the warehouse will provide assurance that goods are not removed for unauthorized orders. g. (D) A comparison by shipping clerks of goods received from the warehouse with the approved sales orders will provide assurance that goods shipped to customers agree with goods ordered by customers. h. (L) A comparison of sales invoices with shipping documents and approved sales orders will detect invoices that do not have the proper . Accordingly, it will help prevent the

S P N

recording of fictitious transactions. i. (P) Comparing amounts posted to the s receivable ledger with the validated bank deposit will detect improper postings to s receivable since any differences in amounts will be investigated. j. (C) Misappropriations of customers’ checks will be detected when customers indicate that they have made payments for items shown as payable on their monthly statement. Note that replies O and P will only detect this misappropriation in the unlikely event that the perpetrator does not dispose of the remittance advice. k. (C) Mispostings of payments made will be detected when customers indicate that they have made payments for items shown as payable on their monthly statement. l. (P) Crediting more than one for a cash receipt will be detected when the total of amounts posted to the s receivable ledger is compared with the validated bank deposit slip. m.(S) An independent reconciliation of the bank will reveal improper total recording of receipts in the cash receipts journal because unlocated differences between bank and book balances will occur and be investigated. n. (P) Comparing total amounts posted to the s receivable ledger with the validated bank deposit slip will detect a difference between total cash receipts and the amount credited to the s receivable ledger. o. (N) Requiring the approval of the supervisor of the sales department for goods received will provide assurance that invalid transactions granting credit for sales returns are not recorded. Note that using prenumbered credit memos (reply M) will only be effective if the sequence is ed for and if credit memos may be compared in some form to actual returns.

3. An auditor may use confirmations of s receivable. Reply as to whether the following statements are correct or incorrect with respect to the confirmation process when applied to s receivable.

Conditions a. b. c.

The confirmation requests should be mailed to respondents by the As. A combination of positive and negative request forms must be used if receivables are significant. Second requests are ordinarily sent for positive form confirmations requests when the first request is not returned.

Correct Incorrect Correct

d.

Confirmations address existence more than they address completeness.

Correct

e.

Confirmation of s receivable is a generally accepted auditing standard.

Incorrect

f.

The auditors ordinarily should confirm s receivable.

Correct

g. h. i. j.

4.

Auditors should always confirm the total balances of s rather than individual portions (e.g., if the balance is made up of three sales, all three should be confirmed). Auditors may ignore individually immaterial s when confirming s receivable. The best way to evaluate the results of the confirmation process is to compare the total misstatements identified to the ’s tolerable misstatements amounts. s receivable are ordinarily confirmed on a standard form developed by the American Institute of Certified Public ants and the Financial Executives Institute.

Incorrect Correct Incorrect Incorrect

A summary of the controls for the revenue and cash receipts cycle of Keystone Computers & Networks, Inc., is provided below: a. For the following three controls over sales, indicate one type of error or fraud that the control serves to prevent or detect. Select your solution as follows: (Each of the "Error or Fraud Controlled" may be used only once.)

1. 2. 3.

Error or Fraud Controlled Controls the recording of sales to ensure completeness. Controls errors in the delivery and billing of sales transactions. Controls the recording of fictitious sales and inaccurate sales to customer s.

Control

Error or Fraud Controlled

1.

Application controls are applied when customer orders are entered by the sales order clerk.

2

2.

The computer assigns numbers to sales invoices when they are prepared.

1

3.

Monthly statements are mailed to customers.

3

b.

For the following three controls over cash receipts, indicate one type of error or fraud that the control serves to prevent or detect. Select your solution as follows: (Each of the "Error or Fraud Controlled" may be used only once.)

Error or Fraud Controlled Controls the abstraction of cash and the incorrect recording of cash receipts and cash sales. Controls the embezzlement of cash receipts and errors in and incomplete postings to s receivables records. Controls errors in the recording of cash and controls the abstraction of cash.

1. 2. 3. Control 1.

Error or Fraud Controlled Cash receipts are prelisted by the receptionist. The ing manager reconciles control totals generated by the s receivable computer program. The computer summaries of cash collections and cash sales are reconciled to prelistings of cash receipts and cash deposits by the ing manager.

2. 3.

3 2 1

5. Listed below are types of errors and fraud that might occur in financial statements and audit procedures. Select the audit procedure with the error or fraud that the procedure is likely to detect.

Audit Procedure a. Confirming a sample of s receivable. b. Reviewing standard confirmations from financial institutions. c. Tracing a sample of shipping documents to recorded sales transactions. d. Comparing recorded sales several days before and after the balance sheet date with shipping documents. Error or Fraud

Audit Procedure

1.

Recording of sales made in the subsequent period.

d

2.

Failing to record all sales transactions.

c

3.

Recording fictitious s receivable.

a

4.

Failing to inform the auditors of pledged s receivable.

b

6. Smith Manufacturing Company's s receivable clerk has a friend who is also Smith's customer. The s receivable clerk, on occasion, has issued fictitious credit memorandums to his friend for goods supposedly returned. The most effective procedure for preventing this activity is to:

mail monthly statements. prenumber and for all credit memorandums. require receiving reports to all credit memorandums before they are approved. have the sales department independent of the s receivable department.

7. For effective internal control, the billing function should be performed by the:

shipping department. ing department. sales department. credit and collection department.

8. Which of the following is an effective control over s receivable?

Only persons who handle cash receipts should be responsible for the preparation of documents that reduce s receivable balances. Balances in the subsidiary s receivable ledger should be reconciled to the general ledger control once a year, preferably at year end. The billing function should be assigned to persons other than those responsible for maintaining s receivable subsidiary records. Responsibility for approval of the write-off of uncollectible s receivable should be assigned to the cashier.

9. You are involved with the audit of Jelco Company for year 1 and have been asked to consider the confirmation reply results indicated below. For each confirmation reply as to the proper action to be taken from the following possible actions: (Each of the "Action" items may be used once, more than once, or not at all.)

1. 2. 3. 4.

Exception; propose an adjustment. Send a second confirmation request to the customer. Examine shipping documents and/or subsequent cash receipts. whether the additional invoices noted on the confirmation reply pertain to the year under audit or the subsequent year.

5. Customer Reply (and any audit action already taken) a. b. c.

Not an exception, no further audit work is necessary.

Proper Action

“We mailed the check for this on December 31.”

3

“We returned those goods on December 2.” You have been able to determine that the 1 goods were received by the client on December 29, but not recorded until January 2. “We also owe for two more invoices for purchases we made around year-end; I’m not 4 sure of the exact date.”

d.

“We are very satisfied with Jelco and plan to purchase from them in the future. “

5

e.

“While that’s what we owe, we didn’t owe it on December 31 since we didn’t receive the goods until January 2 of year 2.”

3

f.

You received no reply to a negative confirmation request to Adams Co.

5

g.

You received no reply to a positive confirmation request to Blake Co. Subsequently you recalled that Blake Co. has a policy of not responding to confirmations—in writing 3 or orally.

10. An auditor’s working papers include the following narrative description of the cash receipts and billing portions of Southwest Medical Center’s internal control. Evaluate each condition following the narrative as being either (1) a strength, (2) a deficiency, (3) not a strength or a deficiency. Southwest is a health care provider that is owned by a partnership of five physicians. It employs 11 physicians, including the five owners, 20 nurses, five laboratory and X-ray technicians, and four clerical workers. The clerical workers perform such tasks as reception, correspondence, cash receipts, billing, s receivable, bank deposits, and appointment scheduling. These clerical workers are referred to as office manager, clerk #1, clerk #2, and clerk #3. Assume that the narrative is a complete description of the system. About two-thirds of Southwest’s patients receive medical services only after insurance coverage is verified by the office manager and communicated to the clerks. Most of the other patients pay for services by cash or check when services are rendered, although the office manager extends credit on a case-by-case basis to about 5 percent of the patients. When services are rendered, the attending physician prepares a prenumbered service slip for each patient and gives the slip to clerk #1 for pricing. Clerk #1 completes the slip and gives the completed slip to clerk #2 and a copy to the patient. Using the information on the completed slip, clerk #2 performs one of the following three procedures for each patient: • Clerk #2 files an insurance claim and records a receivable from the insurance company if the office manager has verified the patient’s coverage, or • Clerk #2 posts a receivable from the patient on clerk #2’s PC if the office manager has approved the patient’s credit, or • Clerk #2 receives cash or a check from the patient as the patient leaves the medical center, and clerk #2 records the cash receipt. At the end of each day, clerk #2 prepares a revenue summary.

Clerk #1 performs correspondence functions and opens the incoming mail. Clerk #1 gives checks from insurance companies and patients to clerk #2 for deposit. Clerk #2 posts the receipt of patients’ checks on clerk #2’s PC patient receivable records and insurance companies’ checks to the receivables from the applicable insurance companies. Clerk #1 gives mail requiring correspondence to clerk #3. Clerk #2 stamps all checks “for deposit only” and each day prepares a list of checks and cash to be deposited in the bank. (This list also includes the cash and checks personally given to clerk #2 by patients.) Clerk #2 keeps a copy of the deposit list and gives the original to clerk #3. Clerk #3 personally makes the daily bank deposit and maintains a file of the daily bank deposits. Clerk #3 also performs appointment scheduling for all of the doctors and various correspondence functions. Clerk #3 also maintains a list of patients whose insurance coverage the office manager has verified. When insurance claims or patient receivables are not settled within 60 days, clerk #2 notifies the office manager. The office manager personally inspects the details of each instance of nonpayment. The office manager converts insurance claims that have been rejected by insurance companies into patient receivables. Clerk #2 records these patient receivables on clerk #2’s PC and deletes these receivables from the applicable insurance companies. Clerk #2 deletes the patient receivables that appear to be uncollectible from clerk #2’s PC when authorized by the office manager. Clerk #2 prepares a list of patients with uncollectible balances and gives a copy of the list to clerk #3, who will not allow these patients to make appointments for future services. Once a month an outside ant posts clerk #2’s daily revenue summaries to the general ledger, prepares a monthly trial balance and monthly financial statements, s for prenumbered service slips, files payroll forms and tax returns, and reconciles the monthly bank statements to the general ledger. This ant reports directly to the physician who is the managing partner. All four clerical employees perform their tasks on PCs that are connected through a local area network. Each PC is accessible with a that is known only to the individual employee and the managing partner. Southwest uses a standard software package that was acquired from a software company and that cannot be modified by Southwest’s employees. None of the clerical employees are able to write checks on the company’s . For each of the following conditions, indicate whether they represent an internal control “strength” or “deficiency.” If the condition is not an internal strength or deficiency, respond that the condition is “neither.”

Conditions a. b. c. d.

Southwest is involved only in medical services and has not diversified its operations. Insurance coverage for patients is verified and communicated to the clerks by the office manager before medical services are rendered. The physician who renders the medical services documents the services on a prenumbered slip that is used for recording revenue and as a receipt for the patient. Cash collection is centralized in that clerk #2 receives the cash (checks) from patients and records the cash receipt.

Neither Strength Strength Deficiency

e.

Southwest extends credit rather than requiring cash or insurance in all cases.

Neither

f.

The office manager extends credit on a case-by-case basis rather than using a formal credit search and established credit limits.

Deficiency

g.

The office manager approves the extension of credit to patients and also approves the write-offs of uncollectible patient receivables.

Deficiency

h.

Clerk #2 receives cash and checks and prepares the daily bank deposit.

Deficiency

i. j. k. l.

Clerk #2 maintains the s receivable records and can add or delete information on the PC. Prenumbered service slips are ed for on a monthly basis by the outside ant who is independent of the revenue generating and revenue recording functions. The bank reconciliation is prepared monthly by the outside ant who is independentof the revenue generating and revenue recording functions. Computer s are only known to the individual employees and the managing partner, who has no duties in the revenue recording functions.

Deficiency Strength Strength Strength

m.

Computer software cannot be modified by Southwest’s employees.

Strength

n.

None of the employees who perform duties in the revenue generating and revenue recording are able to write checks.

Strength

Chapter 12 1. An auditor most likely would make inquiries of production and sales personnel concerning possible obsolete inventory to address:

Presentation. Rights. Existence. Valuation.

2. An auditor selects items from the client’s inventory listing and identifies the items in the warehouse. This procedure is most likely related to:

Completeness. Rights. Existence. Valuation.

3. An auditor concluded that no excessive costs for an idle plant were charged to inventory. This conclusion is most likely related to presentation and disclosure and:

Existence. Valuation. Completeness. Rights.

4.

During the inventory count an auditor selects items and determines that the proper description and quantity were recorded by the client. This procedure is most closely related to:

Existence. Rights. Completeness. Valuation.

5. An auditor most likely would analyze inventory turnover rates to obtain evidence about:

Rights. Presentation. Existence. Valuation.

6. During year 1 audit of Cellenting Co., the auditor performed various procedures relating to inventory. Match each of the descriptions provided below with the appropriate audit procedure. Audit procedures •Analytical procedure •External confirmation •Inquiry •Inspection of records or documents •Inspection of tangible assets •Observation •Recalculation •Reperformance Description of Audit Procedures Performed During the physical inventory count, the auditor asked the client to open various boxes of inventory items so she was able to assess the quality of the item. During a site visit to a construction site, the auditor determined that all employees b. were wearing proper safety equipment. The auditor asked the warehouse manager about whether certain inventory items c. were becoming obsolete. The auditor obtained a purchase order from the purchase order file and compared it d. to the authorized supplier list to determine that the related goods had been purchased from an approved supplier. a.

e. The auditor calculated the s receivable turnover for the year. f.

The auditor obtained a copy of the company’s ing manual and read the section on inventory to prepare for the physical inventory observation.

The auditing firm’s computer assisted audit specialist obtained an electronic g. inventory file from the company and checked the accuracy of the extensions and footings.

7.

Type of Audit Procedure Inspection of tangible assets Observation Inquiry Reperformance Analytical procedure Inspection of records or documents Recalculation

An auditor would be least likely to learn of slow-moving inventory through:

inquiry of sales personnel. inquiry of stores personnel. vouching of year-end purchases. review of perpetual inventory records.

8. An auditor has ed for a sequence of inventory tags and is now going to trace information on a representative number of tags to the physical inventory sheets. The purpose of this procedure is to obtain assurance that:

the final inventory is valued at cost. all inventory represented by an inventory tag is listed on the inventory sheets. all inventory represented by an inventory tag is bona fide. inventory sheets do not include untagged inventory items.

9. Described below are potential financial statement misstatements that are encountered by auditors. a. Inventory is understated because warehouse personnel overlooked several racks of parts in taking the physical inventory. b. Inventory is overstated because warehouse personnel included inventory items received subsequent to year-end while recording the purchase in the subsequent year to hide inventory shortages. c.Inventory is overstated because management instructed computer personnel to make changes in the file used to price inventories. Error or Misstatement Fraud a.

Error

b.

Fraud

c.

Fraud

Misstatement a.

Error or Fraud Error

b.

Fraud

c.

Fraud

Controls Development of adequate inventory taking procedures and adequate supervision of physical inventory. Use of prenumbered receiving reports and controls to insure adequate cutoff of purchases and payables. Effective audit committee and internal audit department to monitor management’s override of internal controls.

Substantive Procedure Observation of inventory.

Observation of inventory and collection of cut-off information that is traced to ing records.

Price tests of a sample of inventory items.

Chapter 13 1. To assure ability for fixed asset retirements, management should implement an internal control that includes: Continuous analysis of miscellaneous revenue to locate any cash proceeds from the sale of plant assets. Periodic inquiry of plant executives by internal auditors as to whether any plant assets have been retired. Utilization of serially numbered retirement work orders. Periodic observation of plant assets by the internal auditors. Serially numbered retirement work orders provide a systematic means of assuring that units of plant and equipment are not retired without authorization by management. Retirement work orders also provide the ing department with the information necessary to record the retirement of equipment in the ing records. The alternative procedures suggested are not satisfactory. Some retirements of plant asset do not involve cash receipts. The inquiries and observations by internal auditors would come after the fact of asset retirements

2. The auditors may conclude that depreciation charges are insufficient by noting:

Insured values greatly in excess of book values. Large amounts of fully depreciated assets. Continuous trade-ins of relatively new assets. Excessive recurring losses on assets retired. Excessive recurring losses on assets retired show that the depreciation expense recognized during the actual useful lives of the assets has been less than the real cost of using the assets.

3. Which of the following is an internal control weakness related to factory equipment? Checks issued in payment of purchases of equipment are not signed by the controller. All purchases of factory equipment are required to be made by the department in need of the equipment. Factory equipment replacements are generally made when estimated useful lives, as indicated in depreciation schedules, have expired. Proceeds from sales of fully depreciated equipment are credited to other income.

The purchase of factory equipment should be made by the purchasing department regardless of which unit of the company will use the equipment. The purchasing department has the expertise and the established procedures and documents to ensure that all purchases are made in accordance with company policy.

4. Which of the following s should be reviewed by the auditors to gain reasonable assurance that additions to property, plant, and equipment are not understated?

Depreciation. s Payable. Cash. Repairs and Maintenance. In recording expenditures on property, plant, and equipment, the logical choice usually is between a revenue expenditure and a capital expenditure. If the outlay is judged to be a revenue expenditure (rightly or wrongly), it will probably be recorded in the Repairs and Maintenance . If items that should be capitalized are erroneously charged to Repairs and Maintenance, the result will be an understatement of property, plant, and equipment. Consequently, the auditors can gain evidence that additions to property, plant, and equipment are not understated by reviewing the Repairs and Maintenance . The other alternatives suggested in the question are not plausible. An erroneous debit to cash would be disclosed quickly because of the disagreement between cash receipts and the cash being deposited daily in the bank. A debit to s Payable would lead to protests from creditors. A debit to Depreciation Expense would be a conspicuous error because of the timing of the entry and the lack of a related credit to Accumulated Depreciation.

5. The auditors are most likely to seek information from the plant manager with respect to the

Adequacy of the provision for uncollectible s. Appropriateness of physical inventory observation procedures. Existence of obsolete machinery. Deferral of procurement of certain necessary insurance coverage. The plant manager would be the most appropriate individual for inquiries about the existence of machinery that is no longer useable.

6. To strengthen internal control over the custody of heavy mobile equipment, the client would most likely institute a policy requiring a periodic:

Increase in insurance coverage. Inspection of equipment and reconciliation with ing records. Verification of liens, pledges, and collateralizations. ing for work orders. Inspection of equipment and the reconciliation of the equipment with ing records will strengthen internal control over custody of the equipment.

7. Error or

Audit Procedure

Fraud 1. 2. 3.

Land was exchanged for a long-term note receivable, but the exchange was not recorded. A machine was sold for cash, but the retirement was not recorded. The cost of repairing a machine was improperly capitalized.

Review current property tax bills. Analyze the Miscellaneous Revenue . Vouch additions to equipment s.

4.

A lien exists on certain equipment.

Review fire insurance policies.

5.

An expenditure for equipment was improperly expensed.

Review expenditures charged to a repairs and maintenance .

8. Which of the following is the best evidence of real estate ownership at the balance sheet date?

Original deed held in the client's safe. Title insurance policy. Paid real estate tax bills. Closing statement.

9. You are engaged in the audit of the financial statements of Holman Corporation for the year ended December 31, 20X6. The accompanying analyses of the Property, Plant, and Equipment and related accumulated depreciation s have been prepared by the chief ant of the client. You have traced the beginning balances to your prior year’s audit working papers.

Description Land Buildings Machinery and equipment

Description Buildings Machinery and equipment

HOLMAN CORPORATION Analysis of Property, Plant, and Equipment and Related Accumulated Depreciation s Year Ended December 31, 20X6 Final Assets 12/31/X5 Additions Retirements $ 422,500 $ 5,000 120,000 17,500 385,000 40,400 $ 26,000

62,900

$ 927,500

$

26,000

$964,400

Final 12/31/X5 $ 60,000 173,250

Accumulated Depreciation Additions* Retirements $ 5,150 39,220

Per Ledger 12/31/X6 $ 65,150 212,470

$ 233,250

$

44,370

$

Per Ledger 12/31/X6 $427,500 137,500 399,400

$ 277,620

*Depreciation expense for the year. All plant assets are depreciated on the straight-line basis (no residual value taken into consideration) based on the following estimated service lives: building, 25 years; and all other items, 10 years. The company’s policy is to take one half-year’s depreciation on all asset additions and disposals during the year. Your audit revealed the following information: 1. On April 1, the company entered into a 10-year lease contract for a die casting machine, with annual rentals of $5,000 payable in advance every April 1. The lease is cancelable by either party (60 days' written notice is required), and there is no option to renew the lease or buy the equipment at the end of the lease. The estimated service life of the machine is 10 years with no residual value. The company recorded the die casting machine in the Machinery and Equipment at $40,400, the present value at the date of the lease, and $2,020 applicable to the machine has been included in depreciation expense for the year. 2. The company completed the construction of a wing on the plant building on June 30. The service life of the building was not extended by this addition. The lowest construction bid received was $17,500, the amount recorded in the Buildings . Company personnel constructed the addition at a cost of $16,000 (materials, $7,500; labor, $5,500; and overhead, $3,000). 3. On August 18, $5,000 was paid for paving and fencing a portion of land owned by the company and used as a parking lot for employees. The expenditure was charged to the Land . 4. The amount shown in the machinery and equipment asset retirement column represents cash received on September 5 upon disposal of a machine purchased in July 20X2 for $48,000. The chief ant recorded depreciation expense of $3,500 on this machine in 20X6. 5. Harbor City donated land and a building appraised at $100,000 and $400,000, respectively, to Holman Corporation for a plant. On September 1, the company began operating the plant. Since no costs were involved, the chief ant made no entry for the above transaction. Required: Prepare the adjusting journal entries that you would propose at December 31, 20X6, to adjust the s for the above transactions. Disregard income tax implications. The s have not been closed

Transaction 1

General Journal

Debit

Prepaid rent

1,250

Accumulated depreciation-Machinery and equipment

2,020

Contract payable Rent expense

35,400 3,750

Machinery and equipment

40,400

Depreciation expense

2

Gain on construction of building Depreciation expense

2,020

1,500 317

Accumulated depreciation-Buildings

317

Buildings

3

Land improvements Depreciation expense Accumulated depreciation-Land improvements

Credit

1,500

5,000 250 250

Land

4

5,000

Accumulated depreciation-Machinery and equipment Loss on sale of machinery and equipment

20,300 2,800

Machinery and equipment

22,000

Depreciation expense

5

1,100

Land

100,000

Buildings

400,000

Depreciation expense

8,000

Paid-in capital from donated assets

500,000

Accumulated depreciation-Buildings

8,000

Explanation: 1. To correct April 1, 20X6, entry for lease of die casting machine under a 10-year, cancelable lease having no renewal or purchase option.

2. To correct June 30, 20X6, entry for addition to building, and to correct depreciation on addition as follows:

Should be 1/12 × 1/2 × $16,000 (12-yr life from 6/30/X6) Per client (computed on 25-yr life)

DIFFERENCE

$

667

350

$

317

3. To correct August 13, 20X6, entry for paving and fencing parking lot, and to provide depreciation thereon as follows: 1/10 × 1/2 × $5,000 = $250

4. To correct September 5, 20X6 entry for disposal of machine and depreciation thereon, and to provide for loss on disposal as follows:

Cost Accumulated depreciation Through 20X5 For 20X6

$48,000 $16,800 2,400 19,200

Undepreciated cost Proceeds of sale

28,800 26,000

Loss on sale

$ 2,800

5. To record at appraised value land and building donated by Harbor city, and to provide depreciation on building as follows: 1/25 × 1/2 × $400,000 = $8,000

Chapter 14 1. Nancy Howe, your staff assistant on the April 30, 20X2, audit of Wilcox Company, was transferred to another audit engagement before she could complete the audit of unrecorded s payable. Her working paper, which you have reviewed and are satisfied is complete, appears below. Wilcox Company Unrecorded s Payable April 30, 20X2 Vendor and Description

Invoice Date

M-1-1

Hill & Harper—unpaid legal fees at Apr. 30, X2 (see lawyer’s letter at M-4)

$

Amount 1,150y

Apr.1,X2

Drew Insurance Agency—unpaid on fire insurance for period Apr. 1, X2- Mar. 31, X5 (see insurance broker letter at J-1-1)

2,340y

Apr.30,X2

Mays and Sage, Stockbrokers—advice for 100 shares of Madison Ltd. common stock (settlement date May 7, X2)

2,200y

Lane Company—shipment received Apr. 30, X2 per receiver no. 3361 and included in Apr. 30, X2, physical inventory; invoice not yet received (amount is per purchase order)

5,938y

$ 11,628

y-Examined document described In my opinion, the $11,628 adjustment includes all material unrecorded s payable.

Date April 30

General Journal

Debit

Marketable securities

2,200

Cost of goods sold

5,938

N.A.H. May 29, X2 Credit

Unexpired insurance

2,275

Insurance expense Professional fees expense

65 1,150

s payable

11,628

Explanation: Unexpired Insurance (35/36 × $2,340) = $2,275 To record liability for following unpaid invoices: Hill & Harper Drew Insurance Agency Mays and Sage Lane Company Total

$

1,150 2,340

2,200 5,938

$

11,628

2. The following flowchart depicts the activities relating to the purchasing, receiving, and s payable departments of Model Company, Inc. Assume that you are a supervising assistant assigned to the Model Company audit. Joe Werell, a beginning assistant, analyzed the flowchart and has supplemented the flowchart by making certain inquiries of the controller. He has concluded that the internal control over purchasing, receiving, and s payable is strong and has provided the following list of what he refers to as internal control strengths. Review his list and for each internal control strength indicate whether you agree or disagree that each represents a strength. Internal Control Strengths Prepared by Joe Werell a. b. c. d.

The department head of the requisitioning department selects the appropriate supplier. Proper authorization of requisitions by department head is required before purchase orders are prepared. Purchasing department makes certain that a low-cost supplier is always chosen. Purchasing department assures that requisitions are within budget limits before purchase orders are prepared.

Disagree Agree Disagree Agree

e.

The adequacy of each vendor’s past record as a supplier is verified.

Agree

f.

Secure facilities limit access to the goods during the receiving activity.

Agree

g.

Receiving department compares its count of the quantity of goods received with Disagree that listed on its copy of the purchase order.

h.

A receiving report is required for all purchases, including purchases of services. Disagree The requisitioning department head independently verifies the quantity and quality of the goods received. Requisitions, purchase orders, and receiving reports are matched with vendor invoices as to quantity and price. s payable department personnel recompute the mathematical accuracy of each invoice. The voucher is independently reconciled to the control s monthly by the originators of the related vouchers. All ing documentation is marked “paid” by s payable immediately prior to making it available to the treasurer. All ing documentation is required for payment and is made available to the treasurer.

i. j. k. l. m. n. o.

The purchasing, receiving, and s payable functions are segregated.

Agree Agree Agree Disagree Disagree Agree Agree

a. Disagree. Someone independent of requisitioning should select the supplier. c. Disagree. Often, factors in addition to cost are considered (e.g., quality, dependability). g. Disagree. A comparison of quantities is not possible because the quantity is blacked out on the purchase order provided to receiving. h. Disagree. No receiving report is ordinarily necessary for purchases of services. l Disagree. The reconciliation should be performed by an independent party. m.Disagree. Documentation should be marked “paid” by the individual making the payment.

3. The auditors of SSC Company, a nonpublic company, are working on both audit objectives for the various s and documentation requirements. Parts (a) through (d) of this question relate to objectives. The auditors have established the objectives listed below as a part of the audit. Substantive Procedures 1. Obtain a trial balance of payables and reconcile with the s payable subsidiary ledger. 2. Vouch sales from throughout the year. 3. Vouch purchases recorded after year-end. 4. Vouch sales recorded shortly before year-end. 5. Vouch major warranty expenses paid during 20X8. 6. Inquire of management concerning the existence of related party transactions. 7. Test the computations made by the client to set up the accrual. 8. Test the reasonableness of general and istrative labor rates. 9. Confirm outstanding year-end balances of payables. 10. Confirm warranty expenses payable as of year-end.

For each objective, select a substantive procedure (from the list of substantive procedures) that will help achieve that objective. Each of the procedures may be used once, more than once, or not at all. Audit Objectives a.

Substantive Procedures Determine the existence of year-end recorded s payable and that the client has 9

obligations to pay these liabilities. b.

Establish the completeness of recorded s payable.

3

c.

Determine that the presentation and disclosure of s payable are appropriate.

6

d.

Determine that the valuation of warranty loss reserves is measured in accordance with 7 GAAP. a.Answer (9) is correct because confirming the outstanding year-end balances will result in replies from suppliers as to those balances. b.Answer (3) is correct because vouching purchases recorded after year-end may result in identification of purchases that should have been recorded prior to year end. c. Answer (6) is correct because inquiry of management is a basic procedure for identifying related party transactions which, if material, should be disclosed. d.Answer (7) is correct because confirming the outstanding year-end balances will result in replies from suppliers as to proper valuation of recorded receivables.

4. In applying audit procedures and evaluating the results of those procedures, auditors may encounter specific information that may raise a question concerning the existence of noncompliance with laws and related party transactions. Indicate whether each of the following is more likely related to noncompliance with a law (NL) or a related party transaction (RP).

a. b. c. d. e.

Purchases have been made from a vendor at a price well above the market price for the goods involved. A purchasing agent’s spouse has the same name as a major vendor of the company. Unexplained payments have been made to government officials. The company exchanged certain real estate property for similar real estate property. A purchasing agent of the company has received large cash payments from a major vendor of the company.

RP RP NL RP NL

5. Which of the following procedures is least likely to be completed before the balance sheet date?

Confirmation of receivables. Search for unrecorded liabilities. Observation of inventory. Review of internal ing control over cash disbursements. Because a significant portion of the search for unrecorded liabilities deals with transactions recorded after year-end, it is least likely to be completed before the balance sheet date.

6.

An audit of the balance in the s payable is ordinarily not designed to:

Detect s payable that are substantially past due. that s payable were properly authorized. Ascertain the reasonableness of recorded liabilities. Determine that all existing liabilities at the balance sheet date have been recorded. The auditors do not have as an objective the determination of whether s payable are past due.

7. Which of the following is the best audit procedure for determining the existence of unrecorded liabilities?

Examine confirmation requests returned by creditors whose s appear on a subsidiary trial balance of s payable. Examine unusual relationships between monthly s payable balances and recorded purchases. Examine a sample of invoices a few days prior to and subsequent to year-end to ascertain whether they have been properly recorded. Examine selected cash disbursements in the period subsequent to year-end.

8. Auditor confirmation of s payable balances at the balance sheet date may be unnecessary because:

This is a duplication of cutoff tests. s payable balances at the balance sheet date may not be paid before the audit is completed. Correspondence with the audit client’s attorney will reveal all legal action by vendors for nonpayment. There is likely to be other reliable external evidence available to the balances. Auditors will usually find in the client's possession externally created evidence such as vendors' invoices and statements that substantiate the s payable. No such external evidence is on hand to s receivable.

9. An audit of the balance in the s payable is ordinarily not designed to:

detect s payable due to public versus non-public companies. that s payable were properly authorized. ascertain the reasonableness of recorded liabilities. determine that all existing liabilities at the balance sheet date have been recorded.

Chapter 15 1. Which of the following is least likely to be an audit objective for debt?

Determine the existence of recorded debt. Establish the completeness of recorded debt. Determine that the client has rights to receive proceeds relating to the redemption of debt. Determine that the valuation of debt is in accordance with generally accepted ing principles.

The client will not receive proceeds related to redemption of its interest-bearing debt—it will pay off the debt.

2. The auditors would be most likely to find unrecorded long-term liabilities by analyzing:

Interest payments. Discounts on long-term liabilities. s on long-term liabilities. Recorded long-term liability s. Auditors will test the relationship between interest payments and recorded long term liabilities. When interest payments seem too high, it may be due to the existence of unrecorded liabilities. Also, the process of performing procedures to determine who interest is paid to may reveal unrecorded debt.

3. A likely reason that consideration of client compliance with debt provisions is important to an audit is that violation of such debt provisions may affect the total recorded:

Number of debt restrictions. Current liabilities. Long-term assets. Capital stock. When debt provisions are violated, long term debt often becomes immediately payable, and therefore, a current liability.

4. Select the following definitions (or partial definitions) to the appropriate term. Each term may be used once or not at all. Definition (or Partial Definition) An institution charged with responsibility for avoiding overissuance of a corporation’s stock An institution responsible for maintaining detailed records of shareholders and b. handling changes of ownership of stock ownership a.

c. Cash or other assets set aside for the retirement of a debt

Term Stock registrar Stock transfer agent Sinking fund

Shares of its own stock acquired by a corporation for the purpose of being reissued Treasury stock at a later date The formal agreement between bondholders and the issuer as to the of the e. Trust indenture debt d.

5. Debt Covenant Violations Read the case and answer the questions that follow. Oftentimes, especially in challenging economic times, companies may not comply fully with lender restrictions on debt and, consequently, fail to meet the requirements of the debt covenant. The debt agreement may have a trigger, making the debt due on demand, and, therefore, it is a current liability. Often, the client will be able to obtain a waiver of compliance for such a violation in order to satisfy this provision.

CONCEPT REVIEW: If a debt covenant is violated and a waiver is obtained, the auditor needs to ensure the covenant is appropriately dated (as of the balance sheet date), and that it extends to one year from the balance sheet date in order to avoid classifying the related debt as a current liability.

1. A waiver needs to be received from the ______.

bank/lender

2. Covenants are typically calculated as of _____.

year-end

3. Waivers must be dated the same date as the _______.

balance sheet

4. Waivers must extend for a period of ________.

one year

5. Covenant violations should still be disclosed in the ________. financial statements

6. Confirmation Procedures for Debt Read the case and answer the questions that follow. Debt transactions and s are often few in number but material in dollar amount. Also, lenders are eager to confirm balances, thereby assisting auditors in ing amounts owed. As such, confirmations provide an easy tool for obtaining excellent evidence on material balances. CONCEPT REVIEW: Confirmations, while not required for debt, are an efficient and effective way for auditors to obtain a high level of third party evidence on material amounts and balances.

1. Confirmations should be drafted on client ______.

letterhead

2. Confirmations should include a request that the bank confirm ____ borrowings. all 3. Auditors need to determine whether debt _____ have been met.

covenants

4. _______ transactions are examined for all large debt agreements.

Individual

5. A copy of debt agreements is typically housed in the ______ file.

permanent

Chapter 16 1. Which of the following is least likely to be considered a substantive procedure relating to payroll?

Investigate fluctuations in salaries, wages, and commissions. Test computations of compensation under profit sharing for bonus plans. Test commission earnings. Test whether employee time reports are approved by supervisors. Testing whether employee time reports are approved by supervisors is an example of a test of a control, not a substantive procedure.

2. Which of the following is the best way for the auditors to determine that every name on a company’s payroll is that of a bona fide employee presently on the job?

Examine human resources records for accuracy and completeness.

Examine employees’ names listed on payroll tax returns for agreement with payroll ing records. Make a surprise observation of the company’s regular distribution of paychecks on a test basis. Visit the working areas and that employees exist by examining their badge or identification numbers. The best procedure for the detection of a fictitious employee is a surprise observation of the distribution of paychecks. The fictitious employee’s paycheck will ordinarily not be picked up, and further audit procedures performed by the auditors may reveal that this is a fictitious employee.

3. As a result of analytical procedures, the independent auditors determine that the gross profit percentage has declined from 30 percent in the preceding year to 20 percent in the current year. The auditors should:

Express an opinion that is qualified due to the inability of the client company to continue as a going concern. Evaluate management’s performance in causing this decline. Require note disclosure. Consider the possibility of a misstatement in the financial statements. The purpose of analytical procedures is to locate potential misstatements in the financial statements. The auditors should investigate this significant fluctuation to determine whether it results from a financial statement misstatement.

4. For each of the following subsequent events, indicate whether the financial statements should be:

(A)

adjusted; the event should be disclosed in the financial (D) statements; or (ND) the event need not be disclosed. Subsequent Event Action taken 1.

2.

3.

4.

5.

6.

An employee strike is called. A lawsuit that was begun a year ago is settled. A new subsidiary is purchased. A major customer of the company is lost. A significant decline in the value of inventories occurs. A plant of the company is destroyed by fire.

ND

A

D

ND

D

D

5. The following situations represent excerpts from the responses to audit inquiries of external legal counsel of XYZ Co. during the annual audit of year 1 (“legal response”). For each excerpt, select the most

appropriate financial statement effect and audit response. Each excerpt is independent. Responses may be used once, more than once, or not at all from the table below: a. The client’s year end is December 31, year 1. b. The anticipated audit report date is February 15, year 2. c. All amounts are material to the financial statements. Financial Statement Effect 1. No impact on financial statement amounts or notes. 2. Disclosure in notes relating to nature of litigation, but no amount disclosed. 3. Disclosure in notes relating to nature of litigation, including loss amount. 4. Potential litigation settlement accrued in financial statements. 5. Potential litigation settlement not accrued in financial statements, amount

Audit Response 7. Legal response is appropriately dated. 8. Update legal response. 9. Update audit report date.

disclosed in notes. 6. amount due attorney is recorded in financial statement amounts. Situations

Financial Statement Effect

Audit Response

Letter dated February 14, year 2: “I advise you that at and since December 31, year 1, I have not been engaged to give substantive attention to, or represent, XYZ Co. in connection with any pending or threatened 1 litigation, claims, or assessments, nor am I aware of any loss contingencies. No amounts were due to this office for services provided at December 31, year 1.”

7

Letter dated January 21, year 2: “I advise you that at and since December 31, year 1, I have not been engaged to give substantive attention to, or represent, XYZ Co. in connection with any pending or threatened 6 litigation, claims, or assessments, nor am I aware of any loss contingencies. There were fees outstanding of $3,675 due to this office for services provided at December 31, year 1.”

8

Letter dated February 26, year 2: K. Bowt v. XYZ Co.: This matter commenced in December, year 1. The plaintiff alleges discrimination relating to his termination on November 17, year 1. The company intends to defend this 2 case vigorously. At this time, we are unable to evaluate the likelihood of an unfavorable outcome or estimate the amount or range of potential loss. Letter dated March 16, year 2:

9

J. Myers v. XYZ Co.: This matter commenced in March, year 2. The plaintiff alleges discrimination relating to his termination on November 17, year 1. The company intends to defend this 2 case vigorously. At this time, we are unable to evaluate the likelihood of an unfavorable outcome. The plaintiff is demanding $50,000.

9

Letter dated February 14, year 2: R. Brown v. XYZ Co.: This matter commenced in November, year 1. The plaintiff alleges discrimination relating to 3 his termination on March 17, year 1. It is reasonably possible that the case will be settled for approximately $35,000.

7

Letter dated February 14, year 2: L. Peep v. XYZ Co.: This matter commenced in November, year 1. The plaintiff alleges discrimination relating to 4 his termination on March 17, year 1. The case is tentatively settled for $35,000.

7

6. In connection with your audit of the financial statements of Hollis Mfg. Corporation for the year ended December 31, 20X3, your review of subsequent events disclosed the following items: a. January 7, 20X4: The mineral content of a shipment of ore en route to Hollis Mfg. Corporation on December 31, 20X3, was determined to be 72 percent. The shipment was recorded at year-end at an estimated content of 50 percent by a debit to Raw Materials Inventory and a credit to s Payable in the amount of $82,400. The final liability to the vendor is based on the actual mineral content of the shipment. b. January 15, 20X4: Following a series of personal disagreements between Ray Hollis, the president, and his brother-in-law, the treasurer, the latter resigned, effective immediately, under an agreement whereby the corporation would purchase his 10 percent stock ownership at book value as of December 31, 20X3. Payment is to be made in two equal amounts in cash on April 1 and October 1, 20X4. In December, the treasurer had obtained a divorce from his wife, who is Ray Hollis’s sister. c. January 16, 20X4: As a result of reduced sales, production was curtailed in mid-January and some workers were laid off. d. On January 18, 20X4, a major customer filed for bankruptcy. The customer’s financial condition had been degenerating over recent years. e. On January 28, 20X4, a famous analyst who followed the industry provided a negative report on his expectations concerning the short and intermediate term for the industry. Required: 1. For each of the subsequent events, indicate whether they should result in: Adjustment—an adjusting entry as of 20X3. Consider Disclosure—consideration of note disclosure as of 20X3. Items a. b. c.

Adjustment Consider Disclosure Consider Disclosure

d.

Adjustment

e.

Consider Disclosure 2.

Select the two events least likely to be reflected (resulting in adjustment or disclosure) in the financial statements

A b c d e

Chapter 17 Emphasis-of-Matter Paragraph Read the overview below and complete the activities that follow. When issuing financial statements and their related opinion, the auditor needs to assess the situation to determine the proper type of report to issue. Auditors express an unmodified opinion when they are able to obtain sufficient and appropriate audit evidence that the financial statements as a whole are free of material misstatement. Under certain circumstances, however, auditors may add an emphasis-of-matter paragraph that refers to a matter appropriately presented. CONCEPT REVIEW: The emphasis-of-matter paragraph follows the opinion paragraph and states that the auditor's opinion is not modified, but that the matter is to be emphasized.

1. Auditors may add an emphasis-of-matter paragraph that refers to a matter that is _________ presented or disclosed. A going concern is to be evaluated for a period not to exceed _________ beyond 2. the date of the financial statements. If substantial doubt about a going concern exists, an ______ paragraph is the most 3. common resolution. 1.

appropriately one year emphasis-ofmatter

4. An emphasis-of-matter paragraph always _______ the opinion paragraph.

follows

5. Changes in ing estimates ______ result in an explanatory paragraph.

do not

1. Auditors may want to emphasize a matter even though it is appropriately presented. 2. A going concern needs to be evaluated for a period not to exceed one year beyond the date of the financial statements. 3. Auditors may add an extra paragraph to emphasize the situation regarding the going concern doubt. 4. The emphasis-of-matter paragraph comes after the opinion paragraph. 5. Changes in estimates do not require an explanatory paragraph.

2. Going Concern Opinions Read the case and answer the questions that follow. Oftentimes, especially in challenging economic times, companies may not have positive financial results. The professional standards require that auditors evaluate whether there is substantial doubt about the company's ability to continue as a going concern for a reasonable period of time--a year from the balance sheet date. CONCEPT REVIEW: Tremendous judgment is involved in this phase of the audit. It should be noted that while auditors are not required to perform procedures to test the going concern assumption, they must evaluate the assumption in relation to the results of the audit procedures performed relative to the other components of the audit.

1. An emphasis-of-matter paragraph always follows the ______ paragraph. Auditors are _____ required to perform procedures specifically designed to test the going concern assumption. When items are identified that affect the going concern assumption, auditors must gather 3. ________. In addition to an emphasis-of-matter paragraph, auditors could issue a(n) _________ in a 4. going concern situation. A going concern evaluation should include evaluation of ________ from the balance sheet 5. date. 2.

opinion not evidence disclaimer one year