This document was ed by and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this report form. Report 2z6p3t

Overview 5o1f4z

& View Chapter 18, Modern Advanced ing-review Q & Exr as PDF for free.

More details 6z3438

- Words: 6,142

- Pages: 23

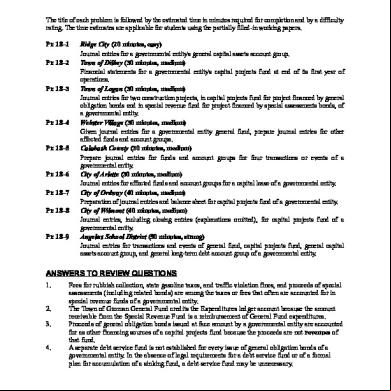

CHAPTER 18 GOVERNMENTAL ENTITIES: OTHER GOVERNMENTAL FUNDS AND GROUPS The title of each problem is followed by the estimated time in minutes required for completion and by a difficulty rating. The time estimates are applicable for students using the partially filled-in working papers. Pr. 18–1 Pr. 18–2

Pr. 18–3

Pr. 18–4

Pr. 18–5

Pr. 18–6 Pr. 18–7 Pr. 18–8

Pr. 18–9

Ridge City (20 minutes, easy) Journal entries for a governmental entity's general capital assets group. Town of Dilbey (30 minutes, medium) Financial statements for a governmental entity's capital projects fund at end of its first year of operations. Town of Logan (30 minutes, medium) Journal entries for two construction projects, in capital projects fund for project financed by general obligation bonds and in special revenue fund for project financed by special assessments bonds, of a governmental entity. Webster Village (30 minutes, medium) Given journal entries for a governmental entity general fund, prepare journal entries for other affected funds and groups. Calabash County (30 minutes, medium) Prepare journal entries for funds and groups for four transactions or events of a governmental entity. City of Arlette (30 minutes, medium) Journal entries for affected funds and groups for a capital lease of a governmental entity. City of Ordway (40 minutes, medium) Preparation of journal entries and balance sheet for capital projects fund of a governmental entity. City of Wilmont (40 minutes, medium) Journal entries, including closing entries (explanations omitted), for capital projects fund of a governmental entity. Angelus School District (50 minutes, strong) Journal entries for transactions and events of general fund, capital projects fund, general capital assets group, and general long-term debt group of a governmental entity.

ANSWERS TO REVIEW QUESTIONS 1. 2. 3. 4.

Fees for rubbish collection, state gasoline taxes, and traffic violation fines, and proceeds of special assessments (including related bonds) are among the taxes or fees that often are ed for in special revenue funds of a governmental entity. The Town of Groman General Fund credits the Expenditures ledger because the amount receivable from the Special Revenue Fund is a reimbursement of General Fund expenditures. Proceeds of general obligation bonds issued at face amount by a governmental entity are ed for as other financing sources of a capital projects fund because the proceeds are not revenues of that fund. A separate debt service fund is not established for every issue of general obligation bonds of a governmental entity. In the absence of legal requirements for a debt service fund or of a formal plan for accumulation of a sinking fund, a debt service fund may be unnecessary.

The McGraw-Hill Companies, Inc., 2006 232

Modern Advanced ing, 10/e

5. 6. 7. 8. 9. 10.

11.

The probable explanation of the illustrated journal entry is to record payment of cash to a bank trust department acting as fiscal agent for the payment of bond principal and interest. The recognition of depreciation of plant assets is appropriate for all assets of a governmental entity's general capital assets group except for certain infrastructure and inexhaustible (land and certain works of art) assets. The Investment in General Capital Assets from Gifts ledger is credited for the current fair value of plant assets donated to a governmental entity for its general use, as opposed to use by a proprietary fund or a trust fund. A balance sheet is not issued for a governmental entity's general capital assets group because an group is not a fund. The journal entry in the Village of Marvell General Long-Term Debt Group is incorrect; Amount Available in Debt Service Fund should be debited, and Amount to Be Provided should be credited. For a capital lease for fire engines, a governmental entity's general fund records the appropriations and expenditures for the lease payments; the general long-term debt group records the liability under the capital lease; and the general capital assets group records the leased assets under the capital lease and the related depreciation. A liability for special assessment bonds is recorded in a governmental entity's general long-term debt group if the governmental entity is obligated in some manner for the payment of the bonds if the assessed property owners default.

SOLUTIONS TO EXERCISES Ex. 18–1 1. a 2. b 3. b 4. c 5. a 6. a 7. b 8. b Ex. 18–2

9. d 10. b 11. d 12. d 13. c 14. c 15. d 16. b

Journal entries for County of Larchmont Special Revenue Fund, July, 2005: 480,000 Taxes ReceivableCurrent Allowance for Uncollectible Current Taxes ($480,000 x 0.015) Revenues To accrue property taxes billed and to provide for estimated uncollectible portion. Cash

142,700

Taxes ReceivableCurrent To record collection of property taxes during July, 2005 Ex. 18–3

Ex. 18–4

Computation of present value of City of Garbo 6% serial bonds, July 1, 2005: July 1, 2003 payment [($200,000 + $60,000) x 0.925926*)] July 1, 2004 payment [($200,000 + $48,000) x 0.857339*)] July 1, 2005 payment [($200,000 + $36,000) x 0.793832*)] July 1, 2006 payment [($200,000 + $24,000) x 0.735030*)] July 1, 2007 payment [($200,000 + $12,000) x 0.680583*)] Present value of 6% serial bonds *From present value tables.

7,200 472,800

142,700

$240,741 212,620 187,344 164,647 144,284 $949,636

Journal entry for County of Pinecrest Capital Projects Fund, July 1, 2005:

The McGraw-Hill Companies, Inc., 2006 233

Modern Advanced ing, 10/e

Cash

1,200,000 Other Financing Sources 1,200,000 To record receipt of proceeds of 30-year, 5% general obligation bonds issued at face amount. Journal entry for County of Pinecrest General Long-Term Group, July 1, 2005: Amount to Be Provided 1,200,000 Term Bonds Payable 1,200,000 To record liability for 30-year, 5% general obligation bonds issued to finance construction of public health center. Ex. 18–5

Ex. 18–6

Journal entry for Town of Wallen Debt Service Fund, Apr. 30, 2006: Matured Bonds Payable Matured Interest Payable ($50,000 x 0.08 x ½) Cash with Fiscal Agent To record fiscal agent's payment of bond principal and interest. Journal entry in Bucolic Township General Fund, Mar. 18, 2006: Other Financing Uses—Transfers Out Cash

50,000 2,000 52,000

140,000 140,000

Journal entry in Bucolic Township Debt Service Fund, Mar. 18, 2006: Cash

140,000 Other Financing Sources—Transfers In

140,000

Journal entry in Bucolic Township General Long-Term Debt Group, Mar. 18, 2006:

Ex. 18–7

Amount Available in Debt Service Fund Amount to Be Provided Journal entries for Nemo County, Sept. 1, 2005: GF Expenditures Cash

GCAAG

Ex. 18–8

140,000 140,000 80,000 80,000

Fund Balance Reserved for Encumbrances Encumbrances

79,600

Machinery and Equipment Investment in General Capital Assets from General Fund Revenues

80,000

Journal entries in Wildwood Village General Fund, Mar. 24, 2006: Cash Other Financing Sources

79,600

80,000 40,000 40,000

Expenditures Cash

450,000

Fund Balance Reserved for Encumbrances Encumbrances

446,000

Solutions Manual, Chapter 18

450,000 446,000

The McGraw-Hill Companies, Inc., 2006 234

Journal entries in Wildwood Village General Capital Assets Group, Mar. 24, 2006: Investment in General Capital Assets from General Fund Revenues 20,000 Accumulated Depreciation of Machinery and Equipment 180,000 Machinery and Equipment 200,000

Ex. 18–9

Machinery and Equipment 450,000 Investment in General Capital Assets from General Fund Revenues 450,000 Journal entry for Town of Backwoods General Capital Assets Group, June 30, 2006: Construction in Progress 950,000 Investment in General Capital Assets from Capital Projects Funds 950,000 To record construction work in progress on town hall.

Ex. 18–10 Journal entry for Hays City General Capital Assets Group: Land

850,000

Investment in General Capital Assets from Gifts To record gift of 10 acres of undeveloped land for future school site.

850,000

Ex. 18–11 Journal entry for Town of Noblisse General Fund, Apr. 30, 2006: Cash

30,000

Other Financing Sources 30,000 To record proceeds of disposal of computer. Journal entry for Town of Noblisse General Capital Assets Group, Apr. 30, 2006: Investment in General Capital Assets from General Fund Revenues 40,000 Accumulated Depreciation of Machinery and Equipment ($100,000 – $40,000) 60,000 Machinery 100,000 To record disposal of computer. Ex. 18–12 Journal entry for City of Rogell General Fund, July l, 2005: Expenditures 20,000 Cash 20,000 To record first lease payment on five-year capital lease for firefighting equipment. Journal entries for City of Rogell General Long-Term Debt Group, July l, 2005: Amount to Be Provided ($20,000 x 4.312127*) Liability under Capital Lease (net) To record liability under five-year capital lease for firefighting equipment.

86,243

Liability under Capital Lease (net) Amount to Be Provided To record General Fund payment of first lease payment on fiveyear capital lease for firefighting equipment.

20,000

86,243

20,000

*Present value of annuity due of one for five periods at 8%. Journal entry for City of Rogell General Capital Assets Group, July l, 2005: Leased Machinery and EquipmentCapital Lease The McGraw-Hill Companies, Inc., 2006 235

86,243

Modern Advanced ing, 10/e

Investment in General Capital Assets from General Fund Revenues To record acquisition of firefighting equipment under five-year capital lease.

86,243

Ex. 18–13 Journal entry for Town of Warren Capital Projects Fund, July l, 2005: Cash ($254,000 x 0.909091*) + ($236,000 x 0.826446*) + ($218,000 x 0.751315*) Other Financing Uses: Discount on Bonds Issued Other Financing Sources: Bonds Issued To record issuance of $600,000 face amount of three-year, 9% special assessment bonds to yield 10%.

589,737 10,263 600,000

*From present value tables. Journal entry for Town of Warren General Long-Term Debt Group, July l, 2005: Amount to Be Provided 600,000 Special Assessment Bonds Payable 600,000 To record issuance of 9% special assessment bonds for street improvement project; the town is obligated to honor deficiencies on payment of the bonds. Ex. 18–14

1. d, f 2. a, b, c 3. f 4. e

5. a, b 6. a, b 7. a, b

CASES Case 18–1 The ing for the installment contract proposed by the City of Darby controller results in an understatement of the city's plant assets and long-term debt. The installment contract may be considered a borrowing of cash repayable in installments and use of the cash to acquire the parking-lot equipment. The cost of the equipment should be recorded in the City of Darby voluntarily maintained General Capital Assets Group with a debit to Equipment and a credit to Investment in General Capital Assets from General Fund Revenues. The unpaid balance (including interest, if applicable) of the installment contract should be recorded in the City of Darby voluntarily maintained General Long Term Debt Group with a debit to Amount to Be Provided and a credit to Installment Contracts Payable. The monthly payments on the contract should be debited to the General Fund's Expenditures ledger , as the controller proposes, with accompanying reductions in the memorandum s of the General Long-Term Debt Group. Case 18–2 The proceeds of the special assessment for streetlighting and maintenance services to selected residents of the Town of Minimus should be ed for in a special revenue fund, with reimbursements from that fund to the General Fund, together with expenditures for the streetlighting and maintenance services, ed for in the City of DelVille General Fund. Similarly, a special revenue fund should be established to for the proceeds of the special assessment to finance construction of the new town hall. Expenditures for construction, together with amounts received from the special revenue fund, should be ed for in a capital projects fund. At the end of each fiscal year during the construction period, costs of the town hall construction should be recorded in the voluntarily maintained City of DelVille General Capital Assets Group. Case 18–3 TO: James Milton, Controller, Wilburton FROM: _____________________________, A DATE: _____________________________ Solutions Manual, Chapter 18

The McGraw-Hill Companies, Inc., 2006 236

SUBJECT: Possible Closure of Selected Special Revenue Funds After reviewing Sections 1300.105 of Governmental ing and Financial Reporting Standards, Governmental ing Standards Board (Norwalk: 2003), I have concluded that any Wilburton special revenue funds not mandated by state constitutional provisions or statutes or by Wilburton charter, ordinances, or governing body orders might possibly be closed. As pointed out in Section 1300.105: “Resources restricted to expenditure for purposes normally financed from the general fund may be ed for through the general fund provided that applicable legal requirements can be appropriately satisfied . . .” Accordingly, I recommend that you undertake a review of Wilburton's 25 special revenue funds to ascertain which ones are legally mandated. All others may be candidates for closure, with their revenues and expenditures ed for in the Wilburton General Fund. As indicated in the excerpt from Section 1300.105, any current special revenue fund whose expenditures generally are made by a governmental entity's general fund may be closed. Please call me if you need further consultation in this matter. Case 18–4 Students who answer “No” to Professor Newton's question might rely on the rationale of the following excerpt from Section 1600.120 of Governmental ing and Financial Reporting Standards, GASB (Norwalk: 2003): The major exception to the general rule of expenditure accrual…relates to unmatured principal and interest on general long-term debt, which includes special assessment debt for which the government is obligated in some manner. …Financial resources usually are appropriated in other funds for transfer to a debt service fund in the period in which maturing debt principal and interest must be paid. Such amounts thus are not current liabilities of the debt service fund as their settlement will not require expenditure of existing fund assets. Further, to accrue the debt service fund expenditure and liability in one period but record the transfer of financial resources for debt service purposes in a later period would be confusing and would result in overstatement of debt service fund expenditures and liabilities and understatement of the fund balance. Thus, disclosure of subsequent year debt service requirements is appropriate, but they usually are appropriately ed for as expenditures in the year of payment. However, students who answer “Yes” to Professor Newton's question might point out that interest expenditures over the period general obligation term bonds are outstanding may exceed the total principal of the bonds. For example, total interest expenditures of $1,200,000 must be made on an issue of $1,000,000 face amount of 20-year general obligation term bonds ($1,000,000 x 0.06 x 20 = $1,200,000). Thus, inclusion of the obligation for unmatured interest on general obligation term and serial bonds outstanding might well be appropriate for the ing records of the general long-term debt group instead of being relegated to a note to financial statements of the appropriate debt service fund.

The McGraw-Hill Companies, Inc., 2006 237

Modern Advanced ing, 10/e

Case 18–5 The engagement manager of the A firm that audited the City of Martinburg financial statements should explain to the Martinburg City Council that the Clinic Capital Projects Fund has insufficient resources to pay for the fund's present and potential liabilities. The negative balance of the Unreserved and Undesignated Fund Balance ledger measures the approximate shortfall. The City Council will have to authorizeperhaps through a supplemental appropriationa subsidy from the City of Martinburg General Fund to enable the construction of the clinic to be completed.

Solutions Manual, Chapter 18

The McGraw-Hill Companies, Inc., 2006 238

20 Minutes, Medium Ridge City

Pr. 18–1 Ridge City General Capital Assets Group Journal Entries

20 05 Oct 31 Machinery and Equipment Investment in General Capital Assets from General Fund Revenues To record acquisition of equipment by General Fund. Dec.

10 Land Buildings Investment in General Capital Assets from Gifts To record, at current fair value, private citizen’s gift of land and a building.

20 06 June 30 Construction in Progress Investment in General Capital Assets from Capital Projects Funds To record construction work in progress. 30 Investment in General Capital Assets from General Fund Revenues Investment in General Capital Assets from Capital Projects Funds Investment in General Capital Assets from Gifts Accumulated Depreciation of Buildings Accumulated Depreciation of Machinery and Equipment To recognize depreciation of buildings and machinery and equipment. 30 Investment in General Capital Assets from Capital Projects Funds Accumulated Depreciation of Infrastructure To recognize depreciation of infrastructure.

The McGraw-Hill Companies, Inc., 2006 239

2 0 0 0 0 2 0 0 0 0

1 0 0 0 0 0 5 0 0 0 0 0 6 0 0 0 0 0

9 7 0 0 0 0 9 7 0 0 0 0

6 0 0 0 0 1 4 0 0 0 0 9 0 0 0 0 2 5 0 0 0 0 4 0 0 0 0

8 5 0 0 0 0 8 5 0 0 0 0

Modern Advanced ing, 10/e

30 Minutes, Medium Town of Dilbey

Pr. 18–2 Town of Dilbey Capital Projects Fund Statement of Revenues, Expenditures, and Changes in Fund Balance For Year Ended June 30, 2006

Revenues: Miscellaneous Expenditures: Construction contracts Engineering and other Total expenditures Excess (deficiency) of revenues over expenditures Other financing sources (uses): Face amount of general obligation bonds Discount on general obligation bonds

$

3 0 0 0 0

$

5 7 5 2 0 0 1 8 0 8 0 0

$ 7 5 6 0 0 0 $( 7 2 6 0 0 0 ) $1 0 0 0 0 0 0 ( 9 8 9 6 4 )

Excess of revenues and other sources over expenditures and other uses (fund balance, end of year)

$

1 7 5 0 3 6

Town of Dilbey Capital Projects Fund Balance Sheet June 30, 2006 Assets Cash

$ 2 7 6 0 3 6 Liabilities & Fund Balance

Liabilities: Vouchers payable Fund balance: Reserved for encumbrances Unreserved and undesignated Total liabilities & fund balance

Solutions Manual, Chapter 18

$ 1 0 1 0 0 0 $ 2 2 7 6 0 0 ( 5 2 5 6 4 )

1 7 5 0 3 6 $ 2 7 6 0 3 6

The McGraw-Hill Companies, Inc., 2006 240

30 Minutes, Medium Town of Logan a.

Pr. 18–3 Town of Logan Town Hall Capital Projects Fund Journal Entries For Year Ended June 30, 2006

Cash

6 0 0 0 0 0

Other Financing Sources To record issuance, at face amount, of 20-year, 7% general obligation term bonds due July 1, 2025, interest payable Jan. 1 and July 1.

6 0 0 0 0 0

Encumbrances Fund Balance Reserved for Encumbrances To record encumbrances for the year.

5 3 0 2 0 0

Expenditures Vouchers Payable To record expenditures for the year.

3 8 0 6 0 0

Fund Balance Reserved for Encumbrances Encumbrances To reverse encumbrances applicable to vouchered expenditures.

3 8 2 1 0 0

Vouchers Payable Cash To record payment of vouchers during the year.

3 2 2 7 0 0

b.

5 3 0 2 0 0

3 8 0 6 0 0

3 8 2 1 0 0

3 2 2 7 0 0

Town of Logan Special Revenue Fund Journal Entries For Year Ended June 30, 2006 Special Assessments Receivable—Current ($400,000 ÷ 5) Special Assessments Receivable—Deferred Revenue Deferred Revenues To record special assessment levied on property owners benefited by curbing project. Cash

8 0 0 0 0 3 2 0 0 0 0 8 0 0 0 0 3 2 0 0 0 0

8 0 0 0 0

Special Assessment Receivable—Current To record receipt of current special assessment payments. Other Financing Uses Cash To record transfer of cash for financing of curbing project to Capital Projects Fund established for that purpose.

8 0 0 0 0

8 0 0 0 0 8 0 0 0 0

(Continued on page 498.)

The McGraw-Hill Companies, Inc., 2006 241

Modern Advanced ing, 10/e

Town of Logan (concluded)

Pr. 18–3 Town of Logan Special Revenue Fund Journal Entries (concluded) For Year Ended June 30, 2006

Interest Receivable ($320,000 x 0.08) Revenue To accrue interest on deferred special assessments on June 30, 2006. Expenditures [$80,000 + ($320,000 x 0.075)] Matured Bonds Payable Matured Interest Payable To record expenditures for principal and interest on special assessment bonds due July 1, 2006. Special Assessment Receivable—Current Deferred Revenues Special Assessments Receivable—Deferred S Revenues To transfer special assessment installment receivable on July 1, 2006, and related revenue to the current category from the deferred category.

Solutions Manual, Chapter 18

2 5 6 0 0 2 5 6 0 0

1 0 4 0 0 0 8 0 0 0 0 2 4 0 0 0

8 0 0 0 0 8 0 0 0 0 8 0 0 0 0 8 0 0 0 0

The McGraw-Hill Companies, Inc., 2006 242

30 Minutes, Medium Webster Villiage

Pr. 18–4 Webster Village Capital Projects Fund Journal Entry

20 05 July 3 Receivable from General Fund Other Financing Sources—Transfers In To record receivable from General Fund for transfer to make up cash deficiency.

1 5 0 0 0 1 5 0 0 0

Webster Village Debt Service Fund Journal Entry 20 05 Aug 31 Cash

2 1 0 0 0 0

Other Financing Sources—Transfers In To record receipt of cash from General Fund for payment of term bond principal ($200,000) and interest ($10,000) maturing on August 31, 2005.

2 1 0 0 0 0

Webster Village General Long-Term Debt Group Journal Entry 20 05 Aug 31 Amount Available in Debt Service Fund Amount to Be Provided To record amount received by Debt Service Fund from General Fund for retirement of principal of general obligation term bonds.

2 0 0 0 0 0 2 0 0 0 0 0

Webster Village General Capital Assets Group Journal Entries 20 05 Nov 30 Machinery and Equipment Investment in General Capital Assets from General Fund Revenues To record acquisition of computer by General Fund. 20 06 June 30 Investment in General Capital Assets from General Fund Revenues ($60,000 x 1/5 x 7/12) Accumulated Depreciation of Machinery and Equipment To recognize depreciation of computer for seven months ended June 30, 2006.

The McGraw-Hill Companies, Inc., 2006 243

6 0 0 0 0 6 0 0 0 0

7 0 0 0 7 0 0 0

Modern Advanced ing, 10/e

Webster Village (concluded)

Pr. 18–4 Webster Village Special Revenue Fund Journal Entry

20 06 Jan 2 Cash Other Financing Sources—Transfers In To record transfer from General Fund for share of street-paving project cost in Westside section.

Solutions Manual, Chapter 18

2 0 0 0 0 2 0 0 0 0

The McGraw-Hill Companies, Inc., 2006 244

30 Minutes, Medium Calabash County

Pr. 18–5 Calabash County Gasoline Tax Special Revenue Fund Journal Entry

20 05 July 1 Estimated Revenues Appropriations Budgetary Fund Balance To record annual budget adopted for Fiscal Year 2006.

6 4 0 0 0 0 6 0 0 0 0 0 4 0 0 0 0

Calabash County Capital Projects Fund Journal Entry 20 05 July 5 Encumbrances Fund Balance Reserved for Encumbrances To record execution of contract for construction of new public library.

5 0 0 0 0 0 0 5 0 0 0 0 0 0

Calabash County Special Assessment Special Revenue Fund Journal Entry 20 05 Aug 1 Special Assessments Receivable—Current ($400,000 ÷ 5) Special Assessments Receivable—Deferred Revenue Deferred Revenues To record special assessment on property owners of North Subdivision for construction of sidewalks; special assessments receivable and related revenue applicable to year ending June 30, 2006, are current, and the balance is deferred.

8 0 0 0 0 3 2 0 0 0 0 8 0 0 0 0 3 2 0 0 0 0

Calabash County General Fund Journal Entries 20 05 Sept 1 Expenditures Cash (or Vouchers Payable) To record acquisition of equipment. 1 Fund Balance Reserved for Encumbrances Encumbrances To reverse encumbrances applicable to expenditure for equipment

2 0 0 0 0 2 0 0 0 0

1 9 6 0 0 1 9 6 0 0

(Continued on page 502.)

The McGraw-Hill Companies, Inc., 2006 245

Modern Advanced ing, 10/e

Calabash County (concluded)

Pr. 18–5

Calabash County General Capital Assets Group Journal Entry 20 05 Sept 1 Machinery and Equipment Investment in General Capital Assets from General Fund Revenues To record acquisition of equipment by General Fund.

Solutions Manual, Chapter 18

2 0 0 0 0 2 0 0 0 0

The McGraw-Hill Companies, Inc., 2006 246

30 Minutes, Medium City of Arlette

Pr. 18–6 City of Arlette General Fund Journal Entries

20 05 July 1 Expenditures Cash To record first lease payment on three-year capital lease for computer. 20 06 July 1 Expenditures ($510 interest + $2,490 principal) Cash To record second lease payment on three-year capital lease for computer. 20 07 July 1 Expenditures ($268 interest + $2,714 principal) Cash To record third lease payment on three-year capital lease for computer. 20 08 June 30 Expenditures ($41 interest + $459 principal) Cash To record payment of bargain-purchase option under capital lease for computer.

3 0 0 0 3 0 0 0

3 0 0 0 3 0 0 0

3 0 0 0 3 0 0 0

5 0 0 5 0 0

City of Arlette General Long-Term Debt Group Journal Entries 20 05 July 1 Amount to Be Provided [($3,000 x 2.759111) + ($500 x 0.772183)] Liability under Capital Lease (net) To record liability under three-year capital lease for computer. 1 Liability under Capital Lease (net) Amount to Be Provided To record General Fund payment of first lease payment on three-year capital lease for computer. 20 06 July 1 Liability under Capital Lease (net) Amount to Be Provided To record General Fund payment of second lease payment on three-year capital lease for computer.

8 6 6 3 8 6 6 3

3 0 0 0 3 0 0 0

2 4 9 0 2 4 9 0

(Continued on page 504.)

The McGraw-Hill Companies, Inc., 2006 247

Modern Advanced ing, 10/e

City of Arlette (concluded)

Pr. 18–6 City of Arlette General Long-Term Debt Group Journal Entries (concluded)

20 07 July 1

Liabilities under Capital Lease (net) Amount to Be Provided To record General Fund payment of third lease payment on three-year capital lease for computer.

20 08 June 30 Liability under Capital Lease (net) Amount to Be Provided To record General Fund payment of bargain-purchase option under three-year capital lease for computer.

2 7 1 4 2 7 1 4

4 5 9 4 5 9

City of Arlette General Capital Assets Group Journal Entries 20 05 July 1

Leased Equipment—Capital Lease Investment in General Capital Assets from General Fund Revenues To record acquisition of computer under three-year capital lease.

20 06 June 30 Investment in General Capital Assets from General Fund Revenues ($8,663 ÷ 4) Accumulated Depreciation of Equipment To recognized depreciation of leased computer for the year ended June 30, 2006.

8 6 6 3 8 6 6 3

2 1 6 6 2 1 6 6

(The same depreciation journal entries would be prepared on June 30, 2007, June 30, 2008, and June 20, 2009.)

40 Minutes, Medium

Solutions Manual, Chapter 18

The McGraw-Hill Companies, Inc., 2006 248

City of Ordway a.

Pr. 18–7 City of Ordway Library Capital Projects Fund Journal Entries For Year Ended June 30, 2007

20 06 July 1 Cash

5 1 0 0 0 0 0

Other Financing Sources: Bonds Issued Other Financing Sources: on Bonds Issued To record issuance of 30-year, 9%, $5,000,000 face amount general obligation term bonds due July 1, 2036 interest payable June 30 and December 31.

5 0 0 0 0 0 0 1 0 0 0 0 0

3 Investments Cash To record acquisition of $4,900,000 face amount of short-term notes.

4 9 0 0 0 0 0

5 Encumbrances Fund Balance Reserved for Encumbrances To record construction-type contract with Premier Construction Company.

4 9 8 0 0 0 0

20 07 Jan 15 Cash

4 9 0 0 0 0 0

4 9 8 0 0 0 0

3 0 4 0 0 0 0

Investments Payable to Library Debt Service Fund To record receipt of cash for matured short-term notes. 15 Payable to Library Debt Service Fund Cash To record transfer of cash to Library Debt Service Fund.

June

3 0 0 0 0 0 0 4 0 0 0 0

4 0 0 0 0 4 0 0 0 0

20 Expenditures Vouchers Payable To record billing from Premier Construction Company.

3 0 0 0 0 0 0

20

Fund Balance Reserved for Encumbrances Encumbrances To reverse encumbrance applicable to vouchered expenditure.

3 0 0 0 0 0 0

20 Vouchers Payable Cash To record payment to Premier Construction Company.

2 7 0 0 0 0 0

30 Interest Receivable ($140,000 – $40,000) Payable to Library Debt Service Fund To accrue interest on short-term notes. 30 Unreserved and Undesignated Fund Balance ($4,980,000 – $3,000,000) Encumbrances To close Encumbrances ledger .

3 0 0 0 0 0 0

3 0 0 0 0 0 0

2 7 0 0 0 0 0

1 0 0 0 0 0 1 0 0 0 0 0

1 9 8 0 0 0 0 1 9 8 0 0 0 0 (Continued on page 506.)

City of Ordway (concluded)

The McGraw-Hill Companies, Inc., 2006 249

Pr. 18–7

Modern Advanced ing, 10/e

City of Ordway Library Capital Project Fund Journal Entries (concluded) For Year Ended June 30, 2007 20 07 June 30 Other Financing Sources: Bonds Issued Other Financing Sources: on Bonds Issued Expenditures Unreserved and Undesignated Fund Balance To close Other Financing Sources and Expenditures ledger s.

b.

5 0 0 0 0 0 0 1 0 0 0 0 0 3 0 0 0 0 0 0 2 1 0 0 0 0 0

City of Ordway Library Capital Projects Fund Balance Sheet June 30, 2007 Assets Cash Interest receivable Investments Total assets Liabilities & Fund Balance Liabilities: Vouchers payable Payable to Library Debt Service Fund Fund balance: Reserved for encumbrances Unreserved and undesignated Total liabilities & fund balance

Solutions Manual, Chapter 18

$ 5 0 0 0 0 0 1 0 0 0 0 0 1 9 0 0 0 0 0 $2 5 0 0 0 0 0

$ 3 0 0 0 0 0 1 0 0 0 0 0 $1 9 8 0 0 0 0 1 2 0 0 0 0

$ 4 0 0 0 0 0

2 1 0 0 0 0 0 $2 5 0 0 0 0 0

The McGraw-Hill Companies, Inc., 2006 250

40 Minutes, Medium City of Wilmont

Pr. 18–8 City of Wilmont Civic Center Capital Projects Fund Journal Entries For Year Ended June 30, 2006

(1) Receivable from State Government Revenue Cash

5 0 0 0 0 0 0 5 0 0 0 0 0 0 5 0 0 0 0 0

Payable to General Fund (2) Expenditures Cash (3) Cash [($10,000,000 x 0.171929) + ($400,000 x 18.401584)] Other Financing Uses: Discount on Bonds Issued Other Financing Sources: Bonds Issued

5 0 0 0 0 0 3 2 0 0 0 0 3 2 0 0 0 0

9 0 7 9 9 2 4 9 2 0 0 7 6 10 0 0 0 0 0 0

(4) Encumbrances Fund Balance Reserved for Encumbrances

12 0 0 0 0 0 0

(5) Encumbrances Fund Balance Reserved for Encumbrances

5 5 0 0 0

(6) Cash

12 0 0 0 0 0 0

5 5 0 0 0 2 5 0 0 0 0 0

Receivable from State Government (7) Expenditures Vouchers Payable

2 5 0 0 0 0 0 5 1 0 0 0 5 1 0 0 0

Fund Balance Reserved for Encumbrances Encumbrances

5 5 0 0 0

Vouchers Payable Cash

5 1 0 0 0

(8) Expenditures Vouchers Payable Fund Balance Reserved for Encumbrances Encumbrances (9) Payable to General Fund Cash Unreserved and Undesignated Fund Balance ($12,000,000 – $2,000,000) Encumbrances Revenue Other Financing Sources: Bonds Issued Expenditures ($320,000 + $51,000 + $2,000,000) Unreserved and Undesignated Fund Balance Other Financing Uses: Discount on Bonds Issued

The McGraw-Hill Companies, Inc., 2006 251

5 5 0 0 0

5 1 0 0 0 2 0 0 0 0 0 0 2 0 0 0 0 0 0 2 0 0 0 0 0 0 2 0 0 0 0 0 0 5 0 0 0 0 0 5 0 0 0 0 0

10 0 0 0 0 0 0 10 0 0 0 0 0 0 5 0 0 0 0 0 0 10 0 0 0 0 0 0 2 3 7 1 0 0 0 11 7 0 8 9 2 4 9 2 0 0 7 6

Modern Advanced ing, 10/e

50 Minutes, Strong Angelus School District a.

Pr. 18–9 Angelus School District General Fund Journal Entries

20 05 Jan 1 Estimated Revenues ($112,000 + $4,000) Budgetary Fund Balance ($128,000 – $72,880) Appropriations ($120,000 + $1,120 + $50,000) To record annual budget adopted for 2005. 1 Taxes Receivable—Current Revenues To accrue property taxes billed. Feb

Apr

May

28 Cash Expenditures Taxes Receivable—Current ($49,500 ÷ 0.99) To record collections of property taxes received from county treasurer, net of 1% fee. 1 Cash (or Receivable from Capital Projects Fund) Revenues ($1,000,000 x 0.01) Expenditures ($1,000,000 x 0.075 x 3/12) To record receipt of bond and accrued interest from Capital Projects Fund. 1 Cash

1 1 6 0 0 0 5 5 1 2 0 1 7 1 1 2 0

1 1 2 0 0 0 1 1 2 0 0 0

4 9 5 0 0 5 0 0 5 0 0 0 0

2 8 7 5 0 1 0 0 0 0 1 8 7 5 0

3 0 0 0

Revenues To record receipt of interest on short-term investments ($100,000 x 0.06 x ½ = $3,000). July

Aug

Nov

3 0 0 0

1 Expenditures Cash To record payment of interest on general obligation bonds ($1,000,000 x 0.075 x ½ = $37,500).

3 7 5 0 0

31 Cash Expenditures Taxes Receivable—Current ($59,400 ÷ 0.99) To record collections of property taxes received from county treasurer, net of 1% fee.

5 9 4 0 0 6 0 0

1 Cash

3 7 5 0 0

6 0 0 0 0

3 0 0 0

Revenues To record receipt of interest on temporary investments ($100,000 x 0.06 x ½ = $3,000). Dec

31 Expenditures Cash To record operating expenditures paid during year.

Solutions Manual, Chapter 18

3 0 0 0

1 1 5 0 0 0 1 1 5 0 0 0

The McGraw-Hill Companies, Inc., 2006 252

Angelus School District (continued) b.

Pr. 18–9

Angelus School District Capital Projects Fund Journal Entries 20 05 Apr 1 Cash

1 0 2 8 7 5 0

Other Financing Sources: Bonds Issued Other Financing Sources: on Bonds Issued ($1,000,000 x 0.01) Accrued Interest ($1,000,000 x 0.075 x 3/12) To record receipt of proceeds of general obligation term bonds issued at 101. 1 on Bonds Issued Accrued Interest Cash (or Payable to General Fund) To record payment of bond and accrued interest to General Fund.

Nov

1 0 0 0 0 0 0 1 0 0 0 0 1 8 7 5 0

1 0 0 0 0 1 8 7 5 0 2 8 7 5 0

2 Expenditures Cash To record acquisition of site for new school.

1 4 7 0 0 0

3 Encumbrances Fund Balance Reserved for Encumbrances To record estimated cost of construction of new school under contract signed.

8 5 0 0 0 0

1 Expenditures Cash To record payment of progress billing under construction contract.

2 0 0 0 0 0

1 Fund Balance Reserved for Encumbrances Encumbrances To reverse encumbrances applicable to payment to contractor.

2 0 0 0 0 0

The McGraw-Hill Companies, Inc., 2006 253

1 4 7 0 0 0

8 5 0 0 0 0

2 0 0 0 0 0

2 0 0 0 0 0

Modern Advanced ing, 10/e

Angelus School District (concluded) c.

Pr. 18–9

Angelus School District General Capital Assets Group Journal Entry 20 05 Apr 2 Land

1 4 7 0 0 0 Investment in General Capital Assets from

Capital Projects Fund To record cost of land for site of new school.

d.

1 4 7 0 0 0

Angelus School District General Long-Term Debt Group Journal Entry 20 05 Apr 1 Amount to Be Provided Term Bonds Payable To record issuance of general obligation term bonds for new school.

1 0 0 0 0 0 0 1 0 0 0 0 0 0

Note to Instructor: Because closing entries are not required, there is no Dec. 31, 2005, journal entry in the General Capital Assets Group for the accumulated construction costs for the new school in the Capital Projects Fund on that date, and no Dec. 31, 2005, journal entry in the General Long-Term Debt Group for cash available in the General Fund for payment of general obligation bonds.

Solutions Manual, Chapter 18

The McGraw-Hill Companies, Inc., 2006 254

Pr. 18–3

Pr. 18–4

Pr. 18–5

Pr. 18–6 Pr. 18–7 Pr. 18–8

Pr. 18–9

Ridge City (20 minutes, easy) Journal entries for a governmental entity's general capital assets group. Town of Dilbey (30 minutes, medium) Financial statements for a governmental entity's capital projects fund at end of its first year of operations. Town of Logan (30 minutes, medium) Journal entries for two construction projects, in capital projects fund for project financed by general obligation bonds and in special revenue fund for project financed by special assessments bonds, of a governmental entity. Webster Village (30 minutes, medium) Given journal entries for a governmental entity general fund, prepare journal entries for other affected funds and groups. Calabash County (30 minutes, medium) Prepare journal entries for funds and groups for four transactions or events of a governmental entity. City of Arlette (30 minutes, medium) Journal entries for affected funds and groups for a capital lease of a governmental entity. City of Ordway (40 minutes, medium) Preparation of journal entries and balance sheet for capital projects fund of a governmental entity. City of Wilmont (40 minutes, medium) Journal entries, including closing entries (explanations omitted), for capital projects fund of a governmental entity. Angelus School District (50 minutes, strong) Journal entries for transactions and events of general fund, capital projects fund, general capital assets group, and general long-term debt group of a governmental entity.

ANSWERS TO REVIEW QUESTIONS 1. 2. 3. 4.

Fees for rubbish collection, state gasoline taxes, and traffic violation fines, and proceeds of special assessments (including related bonds) are among the taxes or fees that often are ed for in special revenue funds of a governmental entity. The Town of Groman General Fund credits the Expenditures ledger because the amount receivable from the Special Revenue Fund is a reimbursement of General Fund expenditures. Proceeds of general obligation bonds issued at face amount by a governmental entity are ed for as other financing sources of a capital projects fund because the proceeds are not revenues of that fund. A separate debt service fund is not established for every issue of general obligation bonds of a governmental entity. In the absence of legal requirements for a debt service fund or of a formal plan for accumulation of a sinking fund, a debt service fund may be unnecessary.

The McGraw-Hill Companies, Inc., 2006 232

Modern Advanced ing, 10/e

5. 6. 7. 8. 9. 10.

11.

The probable explanation of the illustrated journal entry is to record payment of cash to a bank trust department acting as fiscal agent for the payment of bond principal and interest. The recognition of depreciation of plant assets is appropriate for all assets of a governmental entity's general capital assets group except for certain infrastructure and inexhaustible (land and certain works of art) assets. The Investment in General Capital Assets from Gifts ledger is credited for the current fair value of plant assets donated to a governmental entity for its general use, as opposed to use by a proprietary fund or a trust fund. A balance sheet is not issued for a governmental entity's general capital assets group because an group is not a fund. The journal entry in the Village of Marvell General Long-Term Debt Group is incorrect; Amount Available in Debt Service Fund should be debited, and Amount to Be Provided should be credited. For a capital lease for fire engines, a governmental entity's general fund records the appropriations and expenditures for the lease payments; the general long-term debt group records the liability under the capital lease; and the general capital assets group records the leased assets under the capital lease and the related depreciation. A liability for special assessment bonds is recorded in a governmental entity's general long-term debt group if the governmental entity is obligated in some manner for the payment of the bonds if the assessed property owners default.

SOLUTIONS TO EXERCISES Ex. 18–1 1. a 2. b 3. b 4. c 5. a 6. a 7. b 8. b Ex. 18–2

9. d 10. b 11. d 12. d 13. c 14. c 15. d 16. b

Journal entries for County of Larchmont Special Revenue Fund, July, 2005: 480,000 Taxes ReceivableCurrent Allowance for Uncollectible Current Taxes ($480,000 x 0.015) Revenues To accrue property taxes billed and to provide for estimated uncollectible portion. Cash

142,700

Taxes ReceivableCurrent To record collection of property taxes during July, 2005 Ex. 18–3

Ex. 18–4

Computation of present value of City of Garbo 6% serial bonds, July 1, 2005: July 1, 2003 payment [($200,000 + $60,000) x 0.925926*)] July 1, 2004 payment [($200,000 + $48,000) x 0.857339*)] July 1, 2005 payment [($200,000 + $36,000) x 0.793832*)] July 1, 2006 payment [($200,000 + $24,000) x 0.735030*)] July 1, 2007 payment [($200,000 + $12,000) x 0.680583*)] Present value of 6% serial bonds *From present value tables.

7,200 472,800

142,700

$240,741 212,620 187,344 164,647 144,284 $949,636

Journal entry for County of Pinecrest Capital Projects Fund, July 1, 2005:

The McGraw-Hill Companies, Inc., 2006 233

Modern Advanced ing, 10/e

Cash

1,200,000 Other Financing Sources 1,200,000 To record receipt of proceeds of 30-year, 5% general obligation bonds issued at face amount. Journal entry for County of Pinecrest General Long-Term Group, July 1, 2005: Amount to Be Provided 1,200,000 Term Bonds Payable 1,200,000 To record liability for 30-year, 5% general obligation bonds issued to finance construction of public health center. Ex. 18–5

Ex. 18–6

Journal entry for Town of Wallen Debt Service Fund, Apr. 30, 2006: Matured Bonds Payable Matured Interest Payable ($50,000 x 0.08 x ½) Cash with Fiscal Agent To record fiscal agent's payment of bond principal and interest. Journal entry in Bucolic Township General Fund, Mar. 18, 2006: Other Financing Uses—Transfers Out Cash

50,000 2,000 52,000

140,000 140,000

Journal entry in Bucolic Township Debt Service Fund, Mar. 18, 2006: Cash

140,000 Other Financing Sources—Transfers In

140,000

Journal entry in Bucolic Township General Long-Term Debt Group, Mar. 18, 2006:

Ex. 18–7

Amount Available in Debt Service Fund Amount to Be Provided Journal entries for Nemo County, Sept. 1, 2005: GF Expenditures Cash

GCAAG

Ex. 18–8

140,000 140,000 80,000 80,000

Fund Balance Reserved for Encumbrances Encumbrances

79,600

Machinery and Equipment Investment in General Capital Assets from General Fund Revenues

80,000

Journal entries in Wildwood Village General Fund, Mar. 24, 2006: Cash Other Financing Sources

79,600

80,000 40,000 40,000

Expenditures Cash

450,000

Fund Balance Reserved for Encumbrances Encumbrances

446,000

Solutions Manual, Chapter 18

450,000 446,000

The McGraw-Hill Companies, Inc., 2006 234

Journal entries in Wildwood Village General Capital Assets Group, Mar. 24, 2006: Investment in General Capital Assets from General Fund Revenues 20,000 Accumulated Depreciation of Machinery and Equipment 180,000 Machinery and Equipment 200,000

Ex. 18–9

Machinery and Equipment 450,000 Investment in General Capital Assets from General Fund Revenues 450,000 Journal entry for Town of Backwoods General Capital Assets Group, June 30, 2006: Construction in Progress 950,000 Investment in General Capital Assets from Capital Projects Funds 950,000 To record construction work in progress on town hall.

Ex. 18–10 Journal entry for Hays City General Capital Assets Group: Land

850,000

Investment in General Capital Assets from Gifts To record gift of 10 acres of undeveloped land for future school site.

850,000

Ex. 18–11 Journal entry for Town of Noblisse General Fund, Apr. 30, 2006: Cash

30,000

Other Financing Sources 30,000 To record proceeds of disposal of computer. Journal entry for Town of Noblisse General Capital Assets Group, Apr. 30, 2006: Investment in General Capital Assets from General Fund Revenues 40,000 Accumulated Depreciation of Machinery and Equipment ($100,000 – $40,000) 60,000 Machinery 100,000 To record disposal of computer. Ex. 18–12 Journal entry for City of Rogell General Fund, July l, 2005: Expenditures 20,000 Cash 20,000 To record first lease payment on five-year capital lease for firefighting equipment. Journal entries for City of Rogell General Long-Term Debt Group, July l, 2005: Amount to Be Provided ($20,000 x 4.312127*) Liability under Capital Lease (net) To record liability under five-year capital lease for firefighting equipment.

86,243

Liability under Capital Lease (net) Amount to Be Provided To record General Fund payment of first lease payment on fiveyear capital lease for firefighting equipment.

20,000

86,243

20,000

*Present value of annuity due of one for five periods at 8%. Journal entry for City of Rogell General Capital Assets Group, July l, 2005: Leased Machinery and EquipmentCapital Lease The McGraw-Hill Companies, Inc., 2006 235

86,243

Modern Advanced ing, 10/e

Investment in General Capital Assets from General Fund Revenues To record acquisition of firefighting equipment under five-year capital lease.

86,243

Ex. 18–13 Journal entry for Town of Warren Capital Projects Fund, July l, 2005: Cash ($254,000 x 0.909091*) + ($236,000 x 0.826446*) + ($218,000 x 0.751315*) Other Financing Uses: Discount on Bonds Issued Other Financing Sources: Bonds Issued To record issuance of $600,000 face amount of three-year, 9% special assessment bonds to yield 10%.

589,737 10,263 600,000

*From present value tables. Journal entry for Town of Warren General Long-Term Debt Group, July l, 2005: Amount to Be Provided 600,000 Special Assessment Bonds Payable 600,000 To record issuance of 9% special assessment bonds for street improvement project; the town is obligated to honor deficiencies on payment of the bonds. Ex. 18–14

1. d, f 2. a, b, c 3. f 4. e

5. a, b 6. a, b 7. a, b

CASES Case 18–1 The ing for the installment contract proposed by the City of Darby controller results in an understatement of the city's plant assets and long-term debt. The installment contract may be considered a borrowing of cash repayable in installments and use of the cash to acquire the parking-lot equipment. The cost of the equipment should be recorded in the City of Darby voluntarily maintained General Capital Assets Group with a debit to Equipment and a credit to Investment in General Capital Assets from General Fund Revenues. The unpaid balance (including interest, if applicable) of the installment contract should be recorded in the City of Darby voluntarily maintained General Long Term Debt Group with a debit to Amount to Be Provided and a credit to Installment Contracts Payable. The monthly payments on the contract should be debited to the General Fund's Expenditures ledger , as the controller proposes, with accompanying reductions in the memorandum s of the General Long-Term Debt Group. Case 18–2 The proceeds of the special assessment for streetlighting and maintenance services to selected residents of the Town of Minimus should be ed for in a special revenue fund, with reimbursements from that fund to the General Fund, together with expenditures for the streetlighting and maintenance services, ed for in the City of DelVille General Fund. Similarly, a special revenue fund should be established to for the proceeds of the special assessment to finance construction of the new town hall. Expenditures for construction, together with amounts received from the special revenue fund, should be ed for in a capital projects fund. At the end of each fiscal year during the construction period, costs of the town hall construction should be recorded in the voluntarily maintained City of DelVille General Capital Assets Group. Case 18–3 TO: James Milton, Controller, Wilburton FROM: _____________________________, A DATE: _____________________________ Solutions Manual, Chapter 18

The McGraw-Hill Companies, Inc., 2006 236

SUBJECT: Possible Closure of Selected Special Revenue Funds After reviewing Sections 1300.105 of Governmental ing and Financial Reporting Standards, Governmental ing Standards Board (Norwalk: 2003), I have concluded that any Wilburton special revenue funds not mandated by state constitutional provisions or statutes or by Wilburton charter, ordinances, or governing body orders might possibly be closed. As pointed out in Section 1300.105: “Resources restricted to expenditure for purposes normally financed from the general fund may be ed for through the general fund provided that applicable legal requirements can be appropriately satisfied . . .” Accordingly, I recommend that you undertake a review of Wilburton's 25 special revenue funds to ascertain which ones are legally mandated. All others may be candidates for closure, with their revenues and expenditures ed for in the Wilburton General Fund. As indicated in the excerpt from Section 1300.105, any current special revenue fund whose expenditures generally are made by a governmental entity's general fund may be closed. Please call me if you need further consultation in this matter. Case 18–4 Students who answer “No” to Professor Newton's question might rely on the rationale of the following excerpt from Section 1600.120 of Governmental ing and Financial Reporting Standards, GASB (Norwalk: 2003): The major exception to the general rule of expenditure accrual…relates to unmatured principal and interest on general long-term debt, which includes special assessment debt for which the government is obligated in some manner. …Financial resources usually are appropriated in other funds for transfer to a debt service fund in the period in which maturing debt principal and interest must be paid. Such amounts thus are not current liabilities of the debt service fund as their settlement will not require expenditure of existing fund assets. Further, to accrue the debt service fund expenditure and liability in one period but record the transfer of financial resources for debt service purposes in a later period would be confusing and would result in overstatement of debt service fund expenditures and liabilities and understatement of the fund balance. Thus, disclosure of subsequent year debt service requirements is appropriate, but they usually are appropriately ed for as expenditures in the year of payment. However, students who answer “Yes” to Professor Newton's question might point out that interest expenditures over the period general obligation term bonds are outstanding may exceed the total principal of the bonds. For example, total interest expenditures of $1,200,000 must be made on an issue of $1,000,000 face amount of 20-year general obligation term bonds ($1,000,000 x 0.06 x 20 = $1,200,000). Thus, inclusion of the obligation for unmatured interest on general obligation term and serial bonds outstanding might well be appropriate for the ing records of the general long-term debt group instead of being relegated to a note to financial statements of the appropriate debt service fund.

The McGraw-Hill Companies, Inc., 2006 237

Modern Advanced ing, 10/e

Case 18–5 The engagement manager of the A firm that audited the City of Martinburg financial statements should explain to the Martinburg City Council that the Clinic Capital Projects Fund has insufficient resources to pay for the fund's present and potential liabilities. The negative balance of the Unreserved and Undesignated Fund Balance ledger measures the approximate shortfall. The City Council will have to authorizeperhaps through a supplemental appropriationa subsidy from the City of Martinburg General Fund to enable the construction of the clinic to be completed.

Solutions Manual, Chapter 18

The McGraw-Hill Companies, Inc., 2006 238

20 Minutes, Medium Ridge City

Pr. 18–1 Ridge City General Capital Assets Group Journal Entries

20 05 Oct 31 Machinery and Equipment Investment in General Capital Assets from General Fund Revenues To record acquisition of equipment by General Fund. Dec.

10 Land Buildings Investment in General Capital Assets from Gifts To record, at current fair value, private citizen’s gift of land and a building.

20 06 June 30 Construction in Progress Investment in General Capital Assets from Capital Projects Funds To record construction work in progress. 30 Investment in General Capital Assets from General Fund Revenues Investment in General Capital Assets from Capital Projects Funds Investment in General Capital Assets from Gifts Accumulated Depreciation of Buildings Accumulated Depreciation of Machinery and Equipment To recognize depreciation of buildings and machinery and equipment. 30 Investment in General Capital Assets from Capital Projects Funds Accumulated Depreciation of Infrastructure To recognize depreciation of infrastructure.

The McGraw-Hill Companies, Inc., 2006 239

2 0 0 0 0 2 0 0 0 0

1 0 0 0 0 0 5 0 0 0 0 0 6 0 0 0 0 0

9 7 0 0 0 0 9 7 0 0 0 0

6 0 0 0 0 1 4 0 0 0 0 9 0 0 0 0 2 5 0 0 0 0 4 0 0 0 0

8 5 0 0 0 0 8 5 0 0 0 0

Modern Advanced ing, 10/e

30 Minutes, Medium Town of Dilbey

Pr. 18–2 Town of Dilbey Capital Projects Fund Statement of Revenues, Expenditures, and Changes in Fund Balance For Year Ended June 30, 2006

Revenues: Miscellaneous Expenditures: Construction contracts Engineering and other Total expenditures Excess (deficiency) of revenues over expenditures Other financing sources (uses): Face amount of general obligation bonds Discount on general obligation bonds

$

3 0 0 0 0

$

5 7 5 2 0 0 1 8 0 8 0 0

$ 7 5 6 0 0 0 $( 7 2 6 0 0 0 ) $1 0 0 0 0 0 0 ( 9 8 9 6 4 )

Excess of revenues and other sources over expenditures and other uses (fund balance, end of year)

$

1 7 5 0 3 6

Town of Dilbey Capital Projects Fund Balance Sheet June 30, 2006 Assets Cash

$ 2 7 6 0 3 6 Liabilities & Fund Balance

Liabilities: Vouchers payable Fund balance: Reserved for encumbrances Unreserved and undesignated Total liabilities & fund balance

Solutions Manual, Chapter 18

$ 1 0 1 0 0 0 $ 2 2 7 6 0 0 ( 5 2 5 6 4 )

1 7 5 0 3 6 $ 2 7 6 0 3 6

The McGraw-Hill Companies, Inc., 2006 240

30 Minutes, Medium Town of Logan a.

Pr. 18–3 Town of Logan Town Hall Capital Projects Fund Journal Entries For Year Ended June 30, 2006

Cash

6 0 0 0 0 0

Other Financing Sources To record issuance, at face amount, of 20-year, 7% general obligation term bonds due July 1, 2025, interest payable Jan. 1 and July 1.

6 0 0 0 0 0

Encumbrances Fund Balance Reserved for Encumbrances To record encumbrances for the year.

5 3 0 2 0 0

Expenditures Vouchers Payable To record expenditures for the year.

3 8 0 6 0 0

Fund Balance Reserved for Encumbrances Encumbrances To reverse encumbrances applicable to vouchered expenditures.

3 8 2 1 0 0

Vouchers Payable Cash To record payment of vouchers during the year.

3 2 2 7 0 0

b.

5 3 0 2 0 0

3 8 0 6 0 0

3 8 2 1 0 0

3 2 2 7 0 0

Town of Logan Special Revenue Fund Journal Entries For Year Ended June 30, 2006 Special Assessments Receivable—Current ($400,000 ÷ 5) Special Assessments Receivable—Deferred Revenue Deferred Revenues To record special assessment levied on property owners benefited by curbing project. Cash

8 0 0 0 0 3 2 0 0 0 0 8 0 0 0 0 3 2 0 0 0 0

8 0 0 0 0

Special Assessment Receivable—Current To record receipt of current special assessment payments. Other Financing Uses Cash To record transfer of cash for financing of curbing project to Capital Projects Fund established for that purpose.

8 0 0 0 0

8 0 0 0 0 8 0 0 0 0

(Continued on page 498.)

The McGraw-Hill Companies, Inc., 2006 241

Modern Advanced ing, 10/e

Town of Logan (concluded)

Pr. 18–3 Town of Logan Special Revenue Fund Journal Entries (concluded) For Year Ended June 30, 2006

Interest Receivable ($320,000 x 0.08) Revenue To accrue interest on deferred special assessments on June 30, 2006. Expenditures [$80,000 + ($320,000 x 0.075)] Matured Bonds Payable Matured Interest Payable To record expenditures for principal and interest on special assessment bonds due July 1, 2006. Special Assessment Receivable—Current Deferred Revenues Special Assessments Receivable—Deferred S Revenues To transfer special assessment installment receivable on July 1, 2006, and related revenue to the current category from the deferred category.

Solutions Manual, Chapter 18

2 5 6 0 0 2 5 6 0 0

1 0 4 0 0 0 8 0 0 0 0 2 4 0 0 0

8 0 0 0 0 8 0 0 0 0 8 0 0 0 0 8 0 0 0 0

The McGraw-Hill Companies, Inc., 2006 242

30 Minutes, Medium Webster Villiage

Pr. 18–4 Webster Village Capital Projects Fund Journal Entry

20 05 July 3 Receivable from General Fund Other Financing Sources—Transfers In To record receivable from General Fund for transfer to make up cash deficiency.

1 5 0 0 0 1 5 0 0 0

Webster Village Debt Service Fund Journal Entry 20 05 Aug 31 Cash

2 1 0 0 0 0

Other Financing Sources—Transfers In To record receipt of cash from General Fund for payment of term bond principal ($200,000) and interest ($10,000) maturing on August 31, 2005.

2 1 0 0 0 0

Webster Village General Long-Term Debt Group Journal Entry 20 05 Aug 31 Amount Available in Debt Service Fund Amount to Be Provided To record amount received by Debt Service Fund from General Fund for retirement of principal of general obligation term bonds.

2 0 0 0 0 0 2 0 0 0 0 0

Webster Village General Capital Assets Group Journal Entries 20 05 Nov 30 Machinery and Equipment Investment in General Capital Assets from General Fund Revenues To record acquisition of computer by General Fund. 20 06 June 30 Investment in General Capital Assets from General Fund Revenues ($60,000 x 1/5 x 7/12) Accumulated Depreciation of Machinery and Equipment To recognize depreciation of computer for seven months ended June 30, 2006.

The McGraw-Hill Companies, Inc., 2006 243

6 0 0 0 0 6 0 0 0 0

7 0 0 0 7 0 0 0

Modern Advanced ing, 10/e

Webster Village (concluded)

Pr. 18–4 Webster Village Special Revenue Fund Journal Entry

20 06 Jan 2 Cash Other Financing Sources—Transfers In To record transfer from General Fund for share of street-paving project cost in Westside section.

Solutions Manual, Chapter 18

2 0 0 0 0 2 0 0 0 0

The McGraw-Hill Companies, Inc., 2006 244

30 Minutes, Medium Calabash County

Pr. 18–5 Calabash County Gasoline Tax Special Revenue Fund Journal Entry

20 05 July 1 Estimated Revenues Appropriations Budgetary Fund Balance To record annual budget adopted for Fiscal Year 2006.

6 4 0 0 0 0 6 0 0 0 0 0 4 0 0 0 0

Calabash County Capital Projects Fund Journal Entry 20 05 July 5 Encumbrances Fund Balance Reserved for Encumbrances To record execution of contract for construction of new public library.

5 0 0 0 0 0 0 5 0 0 0 0 0 0

Calabash County Special Assessment Special Revenue Fund Journal Entry 20 05 Aug 1 Special Assessments Receivable—Current ($400,000 ÷ 5) Special Assessments Receivable—Deferred Revenue Deferred Revenues To record special assessment on property owners of North Subdivision for construction of sidewalks; special assessments receivable and related revenue applicable to year ending June 30, 2006, are current, and the balance is deferred.

8 0 0 0 0 3 2 0 0 0 0 8 0 0 0 0 3 2 0 0 0 0

Calabash County General Fund Journal Entries 20 05 Sept 1 Expenditures Cash (or Vouchers Payable) To record acquisition of equipment. 1 Fund Balance Reserved for Encumbrances Encumbrances To reverse encumbrances applicable to expenditure for equipment

2 0 0 0 0 2 0 0 0 0

1 9 6 0 0 1 9 6 0 0

(Continued on page 502.)

The McGraw-Hill Companies, Inc., 2006 245

Modern Advanced ing, 10/e

Calabash County (concluded)

Pr. 18–5

Calabash County General Capital Assets Group Journal Entry 20 05 Sept 1 Machinery and Equipment Investment in General Capital Assets from General Fund Revenues To record acquisition of equipment by General Fund.

Solutions Manual, Chapter 18

2 0 0 0 0 2 0 0 0 0

The McGraw-Hill Companies, Inc., 2006 246

30 Minutes, Medium City of Arlette

Pr. 18–6 City of Arlette General Fund Journal Entries

20 05 July 1 Expenditures Cash To record first lease payment on three-year capital lease for computer. 20 06 July 1 Expenditures ($510 interest + $2,490 principal) Cash To record second lease payment on three-year capital lease for computer. 20 07 July 1 Expenditures ($268 interest + $2,714 principal) Cash To record third lease payment on three-year capital lease for computer. 20 08 June 30 Expenditures ($41 interest + $459 principal) Cash To record payment of bargain-purchase option under capital lease for computer.

3 0 0 0 3 0 0 0

3 0 0 0 3 0 0 0

3 0 0 0 3 0 0 0

5 0 0 5 0 0

City of Arlette General Long-Term Debt Group Journal Entries 20 05 July 1 Amount to Be Provided [($3,000 x 2.759111) + ($500 x 0.772183)] Liability under Capital Lease (net) To record liability under three-year capital lease for computer. 1 Liability under Capital Lease (net) Amount to Be Provided To record General Fund payment of first lease payment on three-year capital lease for computer. 20 06 July 1 Liability under Capital Lease (net) Amount to Be Provided To record General Fund payment of second lease payment on three-year capital lease for computer.

8 6 6 3 8 6 6 3

3 0 0 0 3 0 0 0

2 4 9 0 2 4 9 0

(Continued on page 504.)

The McGraw-Hill Companies, Inc., 2006 247

Modern Advanced ing, 10/e

City of Arlette (concluded)

Pr. 18–6 City of Arlette General Long-Term Debt Group Journal Entries (concluded)

20 07 July 1

Liabilities under Capital Lease (net) Amount to Be Provided To record General Fund payment of third lease payment on three-year capital lease for computer.

20 08 June 30 Liability under Capital Lease (net) Amount to Be Provided To record General Fund payment of bargain-purchase option under three-year capital lease for computer.

2 7 1 4 2 7 1 4

4 5 9 4 5 9

City of Arlette General Capital Assets Group Journal Entries 20 05 July 1

Leased Equipment—Capital Lease Investment in General Capital Assets from General Fund Revenues To record acquisition of computer under three-year capital lease.

20 06 June 30 Investment in General Capital Assets from General Fund Revenues ($8,663 ÷ 4) Accumulated Depreciation of Equipment To recognized depreciation of leased computer for the year ended June 30, 2006.

8 6 6 3 8 6 6 3

2 1 6 6 2 1 6 6

(The same depreciation journal entries would be prepared on June 30, 2007, June 30, 2008, and June 20, 2009.)

40 Minutes, Medium

Solutions Manual, Chapter 18

The McGraw-Hill Companies, Inc., 2006 248

City of Ordway a.

Pr. 18–7 City of Ordway Library Capital Projects Fund Journal Entries For Year Ended June 30, 2007

20 06 July 1 Cash

5 1 0 0 0 0 0

Other Financing Sources: Bonds Issued Other Financing Sources: on Bonds Issued To record issuance of 30-year, 9%, $5,000,000 face amount general obligation term bonds due July 1, 2036 interest payable June 30 and December 31.

5 0 0 0 0 0 0 1 0 0 0 0 0

3 Investments Cash To record acquisition of $4,900,000 face amount of short-term notes.

4 9 0 0 0 0 0

5 Encumbrances Fund Balance Reserved for Encumbrances To record construction-type contract with Premier Construction Company.

4 9 8 0 0 0 0

20 07 Jan 15 Cash

4 9 0 0 0 0 0

4 9 8 0 0 0 0

3 0 4 0 0 0 0

Investments Payable to Library Debt Service Fund To record receipt of cash for matured short-term notes. 15 Payable to Library Debt Service Fund Cash To record transfer of cash to Library Debt Service Fund.

June

3 0 0 0 0 0 0 4 0 0 0 0

4 0 0 0 0 4 0 0 0 0

20 Expenditures Vouchers Payable To record billing from Premier Construction Company.

3 0 0 0 0 0 0

20

Fund Balance Reserved for Encumbrances Encumbrances To reverse encumbrance applicable to vouchered expenditure.

3 0 0 0 0 0 0

20 Vouchers Payable Cash To record payment to Premier Construction Company.

2 7 0 0 0 0 0

30 Interest Receivable ($140,000 – $40,000) Payable to Library Debt Service Fund To accrue interest on short-term notes. 30 Unreserved and Undesignated Fund Balance ($4,980,000 – $3,000,000) Encumbrances To close Encumbrances ledger .

3 0 0 0 0 0 0

3 0 0 0 0 0 0

2 7 0 0 0 0 0

1 0 0 0 0 0 1 0 0 0 0 0

1 9 8 0 0 0 0 1 9 8 0 0 0 0 (Continued on page 506.)

City of Ordway (concluded)

The McGraw-Hill Companies, Inc., 2006 249

Pr. 18–7

Modern Advanced ing, 10/e

City of Ordway Library Capital Project Fund Journal Entries (concluded) For Year Ended June 30, 2007 20 07 June 30 Other Financing Sources: Bonds Issued Other Financing Sources: on Bonds Issued Expenditures Unreserved and Undesignated Fund Balance To close Other Financing Sources and Expenditures ledger s.

b.

5 0 0 0 0 0 0 1 0 0 0 0 0 3 0 0 0 0 0 0 2 1 0 0 0 0 0

City of Ordway Library Capital Projects Fund Balance Sheet June 30, 2007 Assets Cash Interest receivable Investments Total assets Liabilities & Fund Balance Liabilities: Vouchers payable Payable to Library Debt Service Fund Fund balance: Reserved for encumbrances Unreserved and undesignated Total liabilities & fund balance

Solutions Manual, Chapter 18

$ 5 0 0 0 0 0 1 0 0 0 0 0 1 9 0 0 0 0 0 $2 5 0 0 0 0 0

$ 3 0 0 0 0 0 1 0 0 0 0 0 $1 9 8 0 0 0 0 1 2 0 0 0 0

$ 4 0 0 0 0 0

2 1 0 0 0 0 0 $2 5 0 0 0 0 0

The McGraw-Hill Companies, Inc., 2006 250

40 Minutes, Medium City of Wilmont

Pr. 18–8 City of Wilmont Civic Center Capital Projects Fund Journal Entries For Year Ended June 30, 2006

(1) Receivable from State Government Revenue Cash

5 0 0 0 0 0 0 5 0 0 0 0 0 0 5 0 0 0 0 0

Payable to General Fund (2) Expenditures Cash (3) Cash [($10,000,000 x 0.171929) + ($400,000 x 18.401584)] Other Financing Uses: Discount on Bonds Issued Other Financing Sources: Bonds Issued

5 0 0 0 0 0 3 2 0 0 0 0 3 2 0 0 0 0

9 0 7 9 9 2 4 9 2 0 0 7 6 10 0 0 0 0 0 0

(4) Encumbrances Fund Balance Reserved for Encumbrances

12 0 0 0 0 0 0

(5) Encumbrances Fund Balance Reserved for Encumbrances

5 5 0 0 0

(6) Cash

12 0 0 0 0 0 0

5 5 0 0 0 2 5 0 0 0 0 0

Receivable from State Government (7) Expenditures Vouchers Payable

2 5 0 0 0 0 0 5 1 0 0 0 5 1 0 0 0

Fund Balance Reserved for Encumbrances Encumbrances

5 5 0 0 0

Vouchers Payable Cash

5 1 0 0 0

(8) Expenditures Vouchers Payable Fund Balance Reserved for Encumbrances Encumbrances (9) Payable to General Fund Cash Unreserved and Undesignated Fund Balance ($12,000,000 – $2,000,000) Encumbrances Revenue Other Financing Sources: Bonds Issued Expenditures ($320,000 + $51,000 + $2,000,000) Unreserved and Undesignated Fund Balance Other Financing Uses: Discount on Bonds Issued

The McGraw-Hill Companies, Inc., 2006 251

5 5 0 0 0

5 1 0 0 0 2 0 0 0 0 0 0 2 0 0 0 0 0 0 2 0 0 0 0 0 0 2 0 0 0 0 0 0 5 0 0 0 0 0 5 0 0 0 0 0

10 0 0 0 0 0 0 10 0 0 0 0 0 0 5 0 0 0 0 0 0 10 0 0 0 0 0 0 2 3 7 1 0 0 0 11 7 0 8 9 2 4 9 2 0 0 7 6

Modern Advanced ing, 10/e

50 Minutes, Strong Angelus School District a.

Pr. 18–9 Angelus School District General Fund Journal Entries

20 05 Jan 1 Estimated Revenues ($112,000 + $4,000) Budgetary Fund Balance ($128,000 – $72,880) Appropriations ($120,000 + $1,120 + $50,000) To record annual budget adopted for 2005. 1 Taxes Receivable—Current Revenues To accrue property taxes billed. Feb

Apr

May

28 Cash Expenditures Taxes Receivable—Current ($49,500 ÷ 0.99) To record collections of property taxes received from county treasurer, net of 1% fee. 1 Cash (or Receivable from Capital Projects Fund) Revenues ($1,000,000 x 0.01) Expenditures ($1,000,000 x 0.075 x 3/12) To record receipt of bond and accrued interest from Capital Projects Fund. 1 Cash

1 1 6 0 0 0 5 5 1 2 0 1 7 1 1 2 0

1 1 2 0 0 0 1 1 2 0 0 0

4 9 5 0 0 5 0 0 5 0 0 0 0

2 8 7 5 0 1 0 0 0 0 1 8 7 5 0

3 0 0 0

Revenues To record receipt of interest on short-term investments ($100,000 x 0.06 x ½ = $3,000). July

Aug

Nov

3 0 0 0

1 Expenditures Cash To record payment of interest on general obligation bonds ($1,000,000 x 0.075 x ½ = $37,500).

3 7 5 0 0

31 Cash Expenditures Taxes Receivable—Current ($59,400 ÷ 0.99) To record collections of property taxes received from county treasurer, net of 1% fee.

5 9 4 0 0 6 0 0

1 Cash

3 7 5 0 0

6 0 0 0 0

3 0 0 0

Revenues To record receipt of interest on temporary investments ($100,000 x 0.06 x ½ = $3,000). Dec

31 Expenditures Cash To record operating expenditures paid during year.

Solutions Manual, Chapter 18

3 0 0 0

1 1 5 0 0 0 1 1 5 0 0 0

The McGraw-Hill Companies, Inc., 2006 252

Angelus School District (continued) b.

Pr. 18–9

Angelus School District Capital Projects Fund Journal Entries 20 05 Apr 1 Cash

1 0 2 8 7 5 0

Other Financing Sources: Bonds Issued Other Financing Sources: on Bonds Issued ($1,000,000 x 0.01) Accrued Interest ($1,000,000 x 0.075 x 3/12) To record receipt of proceeds of general obligation term bonds issued at 101. 1 on Bonds Issued Accrued Interest Cash (or Payable to General Fund) To record payment of bond and accrued interest to General Fund.

Nov

1 0 0 0 0 0 0 1 0 0 0 0 1 8 7 5 0

1 0 0 0 0 1 8 7 5 0 2 8 7 5 0

2 Expenditures Cash To record acquisition of site for new school.

1 4 7 0 0 0

3 Encumbrances Fund Balance Reserved for Encumbrances To record estimated cost of construction of new school under contract signed.

8 5 0 0 0 0

1 Expenditures Cash To record payment of progress billing under construction contract.

2 0 0 0 0 0

1 Fund Balance Reserved for Encumbrances Encumbrances To reverse encumbrances applicable to payment to contractor.

2 0 0 0 0 0

The McGraw-Hill Companies, Inc., 2006 253

1 4 7 0 0 0

8 5 0 0 0 0

2 0 0 0 0 0

2 0 0 0 0 0

Modern Advanced ing, 10/e

Angelus School District (concluded) c.

Pr. 18–9

Angelus School District General Capital Assets Group Journal Entry 20 05 Apr 2 Land

1 4 7 0 0 0 Investment in General Capital Assets from

Capital Projects Fund To record cost of land for site of new school.

d.

1 4 7 0 0 0

Angelus School District General Long-Term Debt Group Journal Entry 20 05 Apr 1 Amount to Be Provided Term Bonds Payable To record issuance of general obligation term bonds for new school.

1 0 0 0 0 0 0 1 0 0 0 0 0 0

Note to Instructor: Because closing entries are not required, there is no Dec. 31, 2005, journal entry in the General Capital Assets Group for the accumulated construction costs for the new school in the Capital Projects Fund on that date, and no Dec. 31, 2005, journal entry in the General Long-Term Debt Group for cash available in the General Fund for payment of general obligation bonds.

Solutions Manual, Chapter 18

The McGraw-Hill Companies, Inc., 2006 254