Business Model - Consumer Finance 322u67

This document was ed by and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this report form. Report 2z6p3t

Overview 5o1f4z

& View Business Model - Consumer Finance as PDF for free.

More details 6z3438

- Words: 2,343

- Pages: 9

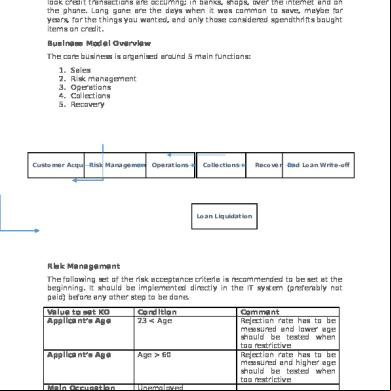

Introduction Consumer finance is an important part of the emerging middle class in Nigeria and a major driving force behind the culture of consumerism. Everywhere you look credit transactions are occurring; in banks, shops, over the internet and on the phone. Long gone are the days when it was common to save, maybe for years, for the things you wanted, and only those considered spendthrifts bought items on credit. Business Model Overview The core business is organised around 5 main functions: 1. 2. 3. 4. 5.

Sales Risk management Operations Collections Recovery

Customer Acquisition Risk Management Operations

Collections

Recovery Bad Loan Write-of

Loan Liquidation

Risk Management The following set of the risk acceptance criteria is recommended to be set at the beginning. It should be implemented directly in the IT system (preferably not paid) before any other step to be done. Value to set KO Applicant’s Age

Condition 23 < Age

Applicant’s Age

Age > 60

Main Occupation Bank Phone Pension/Tax ID

Unemployed No No phone No Pension (employed) /

Comment Rejection rate has to be measured and lower age should be tested when too restrictive Rejection rate has to be measured and higher age should be tested when too restrictive

1 | Page

Value to set KO

Condition Tax ID (self-employed) DPD > 1

DPD on any loan client already loan product DTI

has

downpayment Internal Blacklist Dud Cheque Credit bureau Blacklist Credit bureau DPD

no more than 1 loan pDTI > 50% downpayment <30% Yes >2 Yes CB DPD > 30

Comment Good for start; need to be reviewed after starting phase good for start, delete in the future need to be monitored on daily basis, tested and set properly valid for POS loans only paid access; should be the last check paid access; should be the last check

Operations This third phase of credit management – Operations – begins once a credit agreement has been created. It continues until the customer has repaid their debt according to the of the agreement or they become delinquent, requiring collections action to be taken (the fourth phase of credit management). The goals of customer management are twofold. First, to ensure that relationships with customers function as intended and an acceptable level of customer service is provided. Second, to maximize the return generated from customers over the lifetime of the relationship. These goals are achieved by undertaking: Operational management: This is about providing and managing the infrastructure required to maintain customer relationships. For example, dealing with customer enquires, updating records when transactions occur and issuing statements of . Relationship management: This is about understanding and meeting customer requirements for products and services over the long term. For example, regularly reviewing the credit limit and APR for a credit card customer, and identifying which mortgage customers are suitable targets for cross selling credit cards, personal loans and insurance. Collections Historically, the cost of writing-off bad loans is one of the largest cost associated with operating any lending business. In other words, the management of the bad loan write-off process is a critical tool for controling and promoting portfolio profitablity. Given the centrality of bad loan write-off to the overall profitability goal of a business, close attention needs to be paid to this side of the business. Early collections Early collections strategies are defined for each risk segment (high risk/low risk) and DPD bucket (1-30, 31-60, and 61-90). Each bucket starts by segmenting customers into either low or high risk segment strategy. Risk segment generally drives start of calling and intensity of communication. 2 | Page

Bucket 1-30 The calling strategy: For high risk customers in 1-30 bucket starts at 3DPD and call spin rate is 7 days. Call strategy for low risk segment starts at 15DPD and call spin rate is 10 days. Spin rate 7 days means that you make one call attempt every 7 days unless customer is already in promise. SMS: That is an important channel in the beginning of collection process where there are lots of low risk customers who would pay soon anyway. SMS is accelerating payments from those low risk customers without need to call them therefore it’s a great tool how to focus calling capacities where really needed – on tougher cases. Suggested SMS spin rate for 1-30 bucket high risk is 7 days, for low risk is 5 days. This means you send customer SMS every 5/7 days unless he’s in promise. Very important is to put emphasis on the escalation of the process. It means: Start with the SMS with soft reminder in the beginning of the bucket for both high and low risk customer and gradually escalate through harder reminders into Field visits. This field visits should to start for high risk clients in 15DPD with spin rate 15 days and for low risk clients in 25DPD with spin rate 30 days. Bucket 31-60 The bucket starts with risk segmentation. It might happen that some clients who belonged to low risk in 1-30 bucket change to high risk in 31-60 bucket. The strategies differ in call intensity. The spin rate for the high risk clients is 7 starting at 31 DPD, for the low risk clients the spin rate is 10 starting at 35 DPD. Main warnings delivered in second bucket in advance are “Call to employer” and warning before “Late collection unit assignment” in case of high risk clients. However it is important to remind in previous bucket that we don’t call to employers if we reached them on an alternative phone number in the previous calls to client. Bucket 61-90 The bucket starts with risk segmentation. It might happen some clients who belonged to low risk in 31-60 bucket change to high risk in 61-90 bucket. The strategies differ in call scheduling. The spin rate for the high risk clients is 9 starting at 66 DPD, for the low risk clients the spin rate is 12 starting at 70 DPD. There are much stricter scripts used for both high and low risk clients. The escalation of the warnings ends by the information about LC assignment. The new method used in this bucket is the institution of wage garnishment over the first 20 DPD (61-80 DPD) in this bucket. Note: In case of high risk clients in the 61-90 bucket we suggest to transfer them directly into late collection, where they could be personally assigned. Low risk 3 | Page

segment customers would be kept in calling strategy. High risk customers would be informed about the fact they were accelerated into late collections. Except standard rules there might be special events which can accelerate clients into Late (field) stage at any time (DPD). The special conditions are for example:

Consecutive 5 call attempts without RPC All phone numbers are wrong (non-existing or belonging to somebody else) Client refused to pay his obligation 3rd promise broken (within current collection cycle, i.e. since DPD1)

Queue engine Queue engine manages the entire collection process. It generates various daily lists of delinquent clients for which specific action is supposed to be taken in particular day. Typical queues are:

Standard call lists to clients Special call lists for promises, broken promises SMS Field visits Wage garnishment queues Field queues Servicing queues for skip-trace and others

Queue engine enables you to manage sophisticated collections process where different strategies (call scripts, SMS, letters, field visits) are applied for different s and where interdependencies between actions exist. For example if client breaks promise he will be assigned to promise queue only and he won’t be on standard call list. Call list queues are assigned to different collectors (or team of collectors) and processed with different priorities. Each queue can be managed and monitored (within In-out report) separately so you can see whether your capacity is sufficient to execute defined strategies. The input data which are needed to make decision to which queue case belongs are:

Delinquency status (DPD) Overdue amount Risk segment (low risk, high risk) Number of consecutive call attempts without RPC Promised period (date) Promised amount Promise kept Days since last Number of promise broken within current cycle

Basically there are two types of queues and strategies: Dependent on DPD (standard call queues, SMS, field visits) Independent on DPD, driven by special events (SMS confirming promise was taken, call list for promise broken, skip tracing, weekend queue...) 4 | Page

Queue prioritization Example Recommended priority list for Early Collections (highest priority on the top):

Call Call Call Call Call Call Call

to to to to to to to

client client client client client client client

1-30 High risk 31-60 High risk Promise broken 61-90 High risk 61-90 Low risk 31-60 Low risk 1-30 Low risk

5 | Page

Dunning Strategy Past Due Day s

Collections Strategy Strategy 11

Strategy 22

Strategy 33

Strategy 44

5

SMS1

7

Letter 1

SMS1

SMS1

SMS1

10

Letter 2/SMS2

Letter 1

Letter 1

Letter 1

15

Letter 3

SMS2

SMS2

SMS2

20

Letter 4

Letter 2

Letter 2

Letter 2

30

Letter 5

Letter 3

Letter 3

Letter 3

45

Letter 6

Letter 4

Letter 4

60

Letter 7

Letter 4

Letter 5

65

Letter 5

70

Letter 5

Letter 6

Letter 6

75

Letter 6

Letter 7

80

Letter 7

1 All first payment defaulters and High Risk Customers 2 Medium Risk Customers with High Outstanding Loan Balances 3 Low Risk Customers with High Outstanding Loan Balances 4 Customers with Low Outstanding Loan Balances (Less than 100k) 6 | Page

90

Letter 7

7 | Page

Debt Recovery When collections action has failed to persuade a customer to pay the arrears on their , or the relationship with a customer has broken down, then the will be transferred to debt recovery Transfer to debt recovery usually occurs when an is between 60 and 120 days past its due date (2–4 months in arrears), but each lender has its own policy about when s should be transferred. Once in debt recovery the goal is to recover as much of the outstanding debt as possible in order to minimize the losses due to bad debt write-off. If a good rapport with the customer can be maintained then that is all well and good, but it is not a priority. The main tools used in debt recovery departments are similar to those used in collections – as are many of the outcomes that result. Letters, phone calls, SMS and e-mails are used to try and persuade customers to pay what they owe. Thus, the credit dunning process define above can equally be adopted for the debt recovery stage. The key difference between collections and debt recovery is typically in the tone and content of the communication with customers. There is a move away from conciliatory messages that are not intended to offend more than absolutely necessary, towards stronger language and threats of legal action. Depending on the structure implemented, debt collections may include visit individuals’ homes – a business decision has to be taken with respect to this approach as it is costly and time consuming. The other main difference between collections and debt recovery is that in debt recovery decisions are made about what to do with the debt (rather than just how to collect the arrears). This could be to: Continue trying to collect the debt using the in-house debt recovery team. Refer the debt to an external debt collector. The debt collector will collect the debt on behalf of the lender, and in return will receive a commission on what they recover. Sell the debt to a third party for a proportion of the debt’s value. The difference between the value of the debt and the amount it is sold for is then written-off. Move to repossess property if the debt is secured. In some situations the permission of the courts may be required before repossession can occur. For example, in the UK repossession1 of someone’s home can only occur after a court order has been obtained and a final chance to pay the debt has been given to the customer. Take legal action via the courts in an attempt to force the customer to pay. There are usually several different types of legal action that can be taken to recover debt, including various forms of bankruptcy. Accept a partial payment to settle the debt in full and write-off the difference. Partial payment of the debt may be accepted if it is believed that the customer has only limited assets and that the likelihood of further recoveries is low. Write-off the entire debt, taking no further action. This is a common strategy where debts are small, or if there is little chance of the debt being recovered.

8 | Page

Debt recovery is a labour intensive area of credit management. Even with the most technologically advanced debt management systems there is a requirement for people to customers, negotiate repayments, and manage the legal process should it prove necessary. Given the scarcity of resources, there will be a need to prioritize delinquent s, so that the greatest resources are applied to those cases where the most money is likely to be recovered with the minimum of effort. The most common way to do this is to rank debts in priority order, using various rules based on past experience.

9 | Page

Sales Risk management Operations Collections Recovery

Customer Acquisition Risk Management Operations

Collections

Recovery Bad Loan Write-of

Loan Liquidation

Risk Management The following set of the risk acceptance criteria is recommended to be set at the beginning. It should be implemented directly in the IT system (preferably not paid) before any other step to be done. Value to set KO Applicant’s Age

Condition 23 < Age

Applicant’s Age

Age > 60

Main Occupation Bank Phone Pension/Tax ID

Unemployed No No phone No Pension (employed) /

Comment Rejection rate has to be measured and lower age should be tested when too restrictive Rejection rate has to be measured and higher age should be tested when too restrictive

1 | Page

Value to set KO

Condition Tax ID (self-employed) DPD > 1

DPD on any loan client already loan product DTI

has

downpayment Internal Blacklist Dud Cheque Credit bureau Blacklist Credit bureau DPD

no more than 1 loan pDTI > 50% downpayment <30% Yes >2 Yes CB DPD > 30

Comment Good for start; need to be reviewed after starting phase good for start, delete in the future need to be monitored on daily basis, tested and set properly valid for POS loans only paid access; should be the last check paid access; should be the last check

Operations This third phase of credit management – Operations – begins once a credit agreement has been created. It continues until the customer has repaid their debt according to the of the agreement or they become delinquent, requiring collections action to be taken (the fourth phase of credit management). The goals of customer management are twofold. First, to ensure that relationships with customers function as intended and an acceptable level of customer service is provided. Second, to maximize the return generated from customers over the lifetime of the relationship. These goals are achieved by undertaking: Operational management: This is about providing and managing the infrastructure required to maintain customer relationships. For example, dealing with customer enquires, updating records when transactions occur and issuing statements of . Relationship management: This is about understanding and meeting customer requirements for products and services over the long term. For example, regularly reviewing the credit limit and APR for a credit card customer, and identifying which mortgage customers are suitable targets for cross selling credit cards, personal loans and insurance. Collections Historically, the cost of writing-off bad loans is one of the largest cost associated with operating any lending business. In other words, the management of the bad loan write-off process is a critical tool for controling and promoting portfolio profitablity. Given the centrality of bad loan write-off to the overall profitability goal of a business, close attention needs to be paid to this side of the business. Early collections Early collections strategies are defined for each risk segment (high risk/low risk) and DPD bucket (1-30, 31-60, and 61-90). Each bucket starts by segmenting customers into either low or high risk segment strategy. Risk segment generally drives start of calling and intensity of communication. 2 | Page

Bucket 1-30 The calling strategy: For high risk customers in 1-30 bucket starts at 3DPD and call spin rate is 7 days. Call strategy for low risk segment starts at 15DPD and call spin rate is 10 days. Spin rate 7 days means that you make one call attempt every 7 days unless customer is already in promise. SMS: That is an important channel in the beginning of collection process where there are lots of low risk customers who would pay soon anyway. SMS is accelerating payments from those low risk customers without need to call them therefore it’s a great tool how to focus calling capacities where really needed – on tougher cases. Suggested SMS spin rate for 1-30 bucket high risk is 7 days, for low risk is 5 days. This means you send customer SMS every 5/7 days unless he’s in promise. Very important is to put emphasis on the escalation of the process. It means: Start with the SMS with soft reminder in the beginning of the bucket for both high and low risk customer and gradually escalate through harder reminders into Field visits. This field visits should to start for high risk clients in 15DPD with spin rate 15 days and for low risk clients in 25DPD with spin rate 30 days. Bucket 31-60 The bucket starts with risk segmentation. It might happen that some clients who belonged to low risk in 1-30 bucket change to high risk in 31-60 bucket. The strategies differ in call intensity. The spin rate for the high risk clients is 7 starting at 31 DPD, for the low risk clients the spin rate is 10 starting at 35 DPD. Main warnings delivered in second bucket in advance are “Call to employer” and warning before “Late collection unit assignment” in case of high risk clients. However it is important to remind in previous bucket that we don’t call to employers if we reached them on an alternative phone number in the previous calls to client. Bucket 61-90 The bucket starts with risk segmentation. It might happen some clients who belonged to low risk in 31-60 bucket change to high risk in 61-90 bucket. The strategies differ in call scheduling. The spin rate for the high risk clients is 9 starting at 66 DPD, for the low risk clients the spin rate is 12 starting at 70 DPD. There are much stricter scripts used for both high and low risk clients. The escalation of the warnings ends by the information about LC assignment. The new method used in this bucket is the institution of wage garnishment over the first 20 DPD (61-80 DPD) in this bucket. Note: In case of high risk clients in the 61-90 bucket we suggest to transfer them directly into late collection, where they could be personally assigned. Low risk 3 | Page

segment customers would be kept in calling strategy. High risk customers would be informed about the fact they were accelerated into late collections. Except standard rules there might be special events which can accelerate clients into Late (field) stage at any time (DPD). The special conditions are for example:

Consecutive 5 call attempts without RPC All phone numbers are wrong (non-existing or belonging to somebody else) Client refused to pay his obligation 3rd promise broken (within current collection cycle, i.e. since DPD1)

Queue engine Queue engine manages the entire collection process. It generates various daily lists of delinquent clients for which specific action is supposed to be taken in particular day. Typical queues are:

Standard call lists to clients Special call lists for promises, broken promises SMS Field visits Wage garnishment queues Field queues Servicing queues for skip-trace and others

Queue engine enables you to manage sophisticated collections process where different strategies (call scripts, SMS, letters, field visits) are applied for different s and where interdependencies between actions exist. For example if client breaks promise he will be assigned to promise queue only and he won’t be on standard call list. Call list queues are assigned to different collectors (or team of collectors) and processed with different priorities. Each queue can be managed and monitored (within In-out report) separately so you can see whether your capacity is sufficient to execute defined strategies. The input data which are needed to make decision to which queue case belongs are:

Delinquency status (DPD) Overdue amount Risk segment (low risk, high risk) Number of consecutive call attempts without RPC Promised period (date) Promised amount Promise kept Days since last Number of promise broken within current cycle

Basically there are two types of queues and strategies: Dependent on DPD (standard call queues, SMS, field visits) Independent on DPD, driven by special events (SMS confirming promise was taken, call list for promise broken, skip tracing, weekend queue...) 4 | Page

Queue prioritization Example Recommended priority list for Early Collections (highest priority on the top):

Call Call Call Call Call Call Call

to to to to to to to

client client client client client client client

1-30 High risk 31-60 High risk Promise broken 61-90 High risk 61-90 Low risk 31-60 Low risk 1-30 Low risk

5 | Page

Dunning Strategy Past Due Day s

Collections Strategy Strategy 11

Strategy 22

Strategy 33

Strategy 44

5

SMS1

7

Letter 1

SMS1

SMS1

SMS1

10

Letter 2/SMS2

Letter 1

Letter 1

Letter 1

15

Letter 3

SMS2

SMS2

SMS2

20

Letter 4

Letter 2

Letter 2

Letter 2

30

Letter 5

Letter 3

Letter 3

Letter 3

45

Letter 6

Letter 4

Letter 4

60

Letter 7

Letter 4

Letter 5

65

Letter 5

70

Letter 5

Letter 6

Letter 6

75

Letter 6

Letter 7

80

Letter 7

1 All first payment defaulters and High Risk Customers 2 Medium Risk Customers with High Outstanding Loan Balances 3 Low Risk Customers with High Outstanding Loan Balances 4 Customers with Low Outstanding Loan Balances (Less than 100k) 6 | Page

90

Letter 7

7 | Page

Debt Recovery When collections action has failed to persuade a customer to pay the arrears on their , or the relationship with a customer has broken down, then the will be transferred to debt recovery Transfer to debt recovery usually occurs when an is between 60 and 120 days past its due date (2–4 months in arrears), but each lender has its own policy about when s should be transferred. Once in debt recovery the goal is to recover as much of the outstanding debt as possible in order to minimize the losses due to bad debt write-off. If a good rapport with the customer can be maintained then that is all well and good, but it is not a priority. The main tools used in debt recovery departments are similar to those used in collections – as are many of the outcomes that result. Letters, phone calls, SMS and e-mails are used to try and persuade customers to pay what they owe. Thus, the credit dunning process define above can equally be adopted for the debt recovery stage. The key difference between collections and debt recovery is typically in the tone and content of the communication with customers. There is a move away from conciliatory messages that are not intended to offend more than absolutely necessary, towards stronger language and threats of legal action. Depending on the structure implemented, debt collections may include visit individuals’ homes – a business decision has to be taken with respect to this approach as it is costly and time consuming. The other main difference between collections and debt recovery is that in debt recovery decisions are made about what to do with the debt (rather than just how to collect the arrears). This could be to: Continue trying to collect the debt using the in-house debt recovery team. Refer the debt to an external debt collector. The debt collector will collect the debt on behalf of the lender, and in return will receive a commission on what they recover. Sell the debt to a third party for a proportion of the debt’s value. The difference between the value of the debt and the amount it is sold for is then written-off. Move to repossess property if the debt is secured. In some situations the permission of the courts may be required before repossession can occur. For example, in the UK repossession1 of someone’s home can only occur after a court order has been obtained and a final chance to pay the debt has been given to the customer. Take legal action via the courts in an attempt to force the customer to pay. There are usually several different types of legal action that can be taken to recover debt, including various forms of bankruptcy. Accept a partial payment to settle the debt in full and write-off the difference. Partial payment of the debt may be accepted if it is believed that the customer has only limited assets and that the likelihood of further recoveries is low. Write-off the entire debt, taking no further action. This is a common strategy where debts are small, or if there is little chance of the debt being recovered.

8 | Page

Debt recovery is a labour intensive area of credit management. Even with the most technologically advanced debt management systems there is a requirement for people to customers, negotiate repayments, and manage the legal process should it prove necessary. Given the scarcity of resources, there will be a need to prioritize delinquent s, so that the greatest resources are applied to those cases where the most money is likely to be recovered with the minimum of effort. The most common way to do this is to rank debts in priority order, using various rules based on past experience.

9 | Page