Analysis Of Financial Statements 2h4j1p

This document was ed by and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this report form. Report 2z6p3t

Overview 5o1f4z

& View Analysis Of Financial Statements as PDF for free.

More details 6z3438

- Words: 1,921

- Pages: 46

Analysis of Financial Statements

The basic question

What do we finance ?

Cost ? or Asset ?

We finance Cost

Asset is a Security Cover guaranteed by legal rights or charges

The corollary

Two principles of financing

Cash flow backed financing

Lender gets a legal charge on the cash flow

Asset backed financing

Lender gets a legal charge on the assets created

Asset backed financing The concept of security

Primary security

Assets created out of bank finance

Collateral security

Any other asset charged to the bank against the loan

The basic question

Whom do we finance ?

How do we judge him ?

Borrower The 3 ‘C’s Capital, Capacity & Character

The judgment requires and makes use of Prudence, Due diligence & Analysis

Credit Appraisal The process of decision making in Credit by undertaking Informed Analysis using Prudence, Due diligence & Conservatism

Informed Analysis

Attribute based

Financial statements based

Please count every ‘F’ in the following text FINISHED FILES ARE THE RESULT OF YEARS OF SCIENTIFIC STUDY COMBINED WITH THE EXPERIENCE OF YEARS

Financial Analysis

We ‘see’ things but do not ‘observe’

We ‘write’ things but do not ‘say’

Financial Analysis

Why Analysis ?

To get a true & fair view ?? Perspectives may vary with the Analysis is a prerogative of the decision maker Analysis for decision making

The approach for analysis ?

Objective Meaningful

The BALT approach to Financial Analysis

BANKING

ING

LEGAL

TAXATION

Financial Statements - the components

Statement of profit & loss (P&L ) Statement of assets and liabilities (Balance Sheet), Cash flow statements Explanatory schedules or notes forming part of these statements Earnings per Share (EPS) statements Report by the Board of Directors Directors’ Responsibility Statements

Financial Statements - the components

Auditors’ Report

Notes to s Observations & Qualifications, if any Report as per CARO 2003

CARO 2003 Company Auditors Report Order, 2003 Applicable to all companies except

Banking Companies Insurance Companies Section 25 companies Private companies with PUC

+ Reserves <= Rs.50 lakh Public Deposits - NIL Loan from Bank/FIs <= Rs.10 lakh Annual sales turnover <= Rs. 5 Cr.

CARO 2003 - relevance for banks

Disposal of fixed assets Has it affected the going concern ? Records of inventory & physical verification Conducted ? Properly ed for ? Loans (secured / unsecured) taken / granted ? Interest, Repayment, Conduct, Transactions - Regular? Accepted deposits from public ? Provision of sec. 58A & 58AA complied with ? Deposit of undisputed statutory dues Regular in payment ? Arrears ? Is it a sick company under SICA ? Provision of sec. 58A & 58AA complied with ? Whether defaulted in repayments to banks / FIs ?

Extent & period ?

Financial Statements Other important information

Contingent liabilities

Off balance sheet items

Market information

Building Blocks of Financial Statements

Fundamental concepts

Local ing Standards

International ing Standards

US GAAP

Structure of presentation of Balance Sheet Liabilities

Assets

Capital & Reserves

Fixed Assets

Secured Loan Unsecured Loan

Investments Current Assets, Loans & Advances Miscellaneous expenses to the extent not written off Total

Current Liabilities & Provisions Total

Structure of presentation of Balance Sheet (as required for analysis) Liabilities

Assets

Short term Bank borrowing Cash & Bank balance Other Current Liabilities (incldg. Trade Creditors, Provisions etc.) Term Liabilities

Inventories, Receivables etc. (assets chargeable to Bank)

Net Worth

Net Block (Fixed Assets less Depreciation) Intangible Assets Total

Total

Other Current Assets

What is the difference between the styles of presentation ?

From the promoter’s perspective

Permanency of liabilities and assets

From the banker’s perspective

Currency of liabilities and assets

This is the reason why from the point of view of a Credit Analyst :

classification of Assets and Liabilities as Current and non-Current assumes considerable importance.

The Credit Analyst may therefore have to restructure the financial statements

according to his needs i.e. making a meaningful analysis of the figures for his decision making

To make the analysis meaningful, it may be necessary to : include delete, or reclassify

some items of expenses, assets or liabilities

We may call it recasting, reclassification or restructuring of the financial statements

Current Assets

Current Assets are assets like Cash, Bank balances and other resources that are reasonably expected to be realized or consumed within one year of the date of the Balance sheet. Thus, Current Assets include : Cash Bank balances Inventory holding comprising of Raw Material, Semi - Finished goods, Finished goods, consumables etc. Advance payment made Prepaid expenses Advance Tax etc. Margin deposited against BG for WC purposes etc.

Current Liabilities

Similarly, Current Liabilities are those obligations of the enterprise that are reasonably expected to be liquidated within one year from the date of the Balance sheet, either through the resources classed as Current Assets, or through the creation of other Current Liabilities. Accordingly, Current Liabilities include : Bank borrowings for Working capital purposes Other short term credits Trade Credits Expenses due but not paid Provisions made for expenses / losses Advance payment received Instalment of Term Loan due within a year etc.

However, there may be cases where :

The maturity period of any of the Current assets and Current Liabilities may be more than a year

Thus, the one year temporal standard to determine the validity of “Current-ness” may not be universally valid

Therefore, what may be Current or non-Current also depends on the core business activity marked by technological requirements and trading practices

Tips for re-classification Value of an asset – lower of the market value or reported value Assessed value < reported value ?? Create provision New provision carved out of Net worth i.e. Capital and Reserves.

Should we carry an asset which is no more relevant ?? Take out of the Balance Sheet Make adjustments against Net Worth.

Revaluation – company perspective Balance Sheet Liabilities

Year 1

Capital & general reserve

500

Revaluation reserve

500

Amount in Rs. Lakh Year 2 Assets 700 Fixed assets (including revaluation) 400

Other liabilities (including bank loan)

1000

1000 Other assets

Total

2000

2100

(Note : year 1 – on revaluation ; year 2 – one year after revaluation)

Year 1 1700

Year 2 1400 (1700300)

300

700

2000

2100

Revaluation – Bank perspective Profit & Loss

(Rs. lakh)

Profit before depreciation

400

Less depreciation

200

Profit after depreciation

200

Liabilities Capital & general reserve Other liabilities (including bank loan) Total

Year 1

Year 2 Assets

Year 1

Year 2

500

700 Fixed assets

1200

1000

1000

1000 Other assets

300

700

1500

1700

1500

1700

Deferred Tax issues

Stems from a difference in approach in ing vs. Taxation ing Deferred Tax Liabilities

Mostly from depreciation

Deferred Tax assets

Mostly from VRS issues

Example A company has purchased an instrument for use in the Research & Development department at a cost of Rs.10 Cr. The company would use SLM rate of depreciation @ Rs.2 Cr. per annum. The Income Tax laws however permit full depreciation during the first year for such instruments. How would the company treat this from the point of view of Deferred Tax liability ?

Deferred Tax Issues Sl. No. Year end 1. 2. 3. 4.

PBDT (say) Depreciation (as per Companies Act) PBT Provision for Tax (@ 40%)

5 6. 7. 8. 9.

PBDT Depreciation (as per Income Tax Act) PBT Provision for Tax (@ 40%) Deferred Tax liability created

10.

Balance of DTL as appearing in the BS

I

II

III

IV

V

12 2 10 4

12 2 10 4

12 2 10 4

12 2 10 4

12 2 10 4

12 12 12 12 12 10 0 0 0 0 2 12 12 12 12 0.8 4.8 4.8 4.8 4.8 3.2 ( 4 – 0.8) 3.2

2.4 1.6 0.8

0

Analysis of Financial Statements

Analysis of financial statements is necessary to gauze the financial health of a unit. Analysis can be done by means of : Percent of Sales method Trend analysis Ratio analysis Funds flow analysis Cash flow analysis Break even analysis etc.

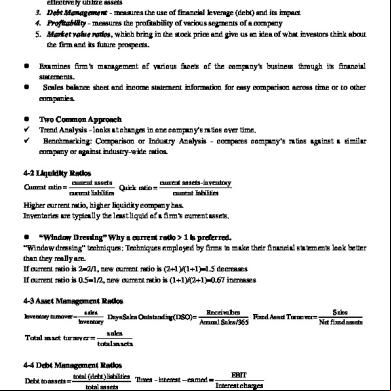

Ratio Analysis

Most important generic ratios of relevance in credit analysis Liquidity ratios / indicators Gearing levels Profitability ratios Coverage ratios Return on Capital / Investments / Assets Turnover / Holding ratios

Liquidity Indicators

Current ratio

Acid test / Quick ratio

NWC (Net Working Capital)

Cash Generation

The rationale of Current Ratio

How Current is the Current Ratio ?

Does it indicate ‘Liquidity’ ? the concept of recovery by disposal of the concept of ‘Current-ness’ of liabilities The conflict between Prescriptive & definitions The conflict between ‘Operating ‘Funding’ concept Does not take care of recent developments

Deferred tax CENVAT receivables

CA assets and Conceptual Cycle’ vs. ing

Net Working Capital Current Liabilities

Current Assets Net Working Capital

Other Liabilities

Other Assets

Gearing ratio

Indicates stability

TOL / TNW

Debt Equity ratio (TTL / TNW)

Consider the following A business enterprise has submitted the following projected estimates with a request to provide short-term (cash credit) and term loan facilities of Rs.3.00 lakh and Rs.4.00 lakh respectively. The B/S and ratios looks like the following Liabilities

Amount

Assets

Amount

Capital

100

Fixed assets

500

Unsecured loan

150

Current assets

500

Term loan

400

Trade credit Cash credit Total

50 300 1000

Total

1000

Total Debt / Equity Ratio

(TOL / TNW)

900 / 100

9:1

Long Term Debt / Equity

(TTL / TNW)

400 / 100

4:1

CA / CL

500 / 500

1:1

Current Ratio

You refuse the proposal The entrepreneur comes back with a proposal that the fixed assets would be acquired on lease by arrangement with an NBFC. Resubmits the proposal for WC credit facilities only. Liabilities Capital

Amount

100

Unsecured loan

50

Trade credit

50

Cash credit

300

Total Total Debt / Equity Ratio

Long Term Debt / Equity

Current Ratio

500

Assets

Amount

Current Assets

500

Total

500

(TOL / TNW)

400 / 100

4:1

(TTL / TNW)

NA

NA

CA / CL

500 / 400

1.25 : 1

Gearing ratio - stability

TOL

TNW Stable

TOL

TNW

Unstable

Coverage Ratios

Cash Accrual Repayment Obligations

Important Coverage ratios

Debt Service Coverage ratio Interest Coverage ratio

Ratio Analysis (contd..) Although any number of ratios can be taken out, at least the following ratios should be calculated and interpreted for the purpose of Decision Making and Pricing :

Working Capital facilities

Current ratio TOL / TNW (Total Debt / Equity ) ratio PAT / Net Sales ( Total profitability ratio) PBDIT / Interest ( Interest Coverage ratio) PBDIT / Total Assets ( ROCE or ROA) ratio (Inventory + Receivables) / Net sales (in days) ratio

Ratio Analysis (contd..) Term loan facilities

Project Debt / Equity ratio

TOL / TNW

Gross Debt Service Coverage ratio

THANK YOU

The basic question

What do we finance ?

Cost ? or Asset ?

We finance Cost

Asset is a Security Cover guaranteed by legal rights or charges

The corollary

Two principles of financing

Cash flow backed financing

Lender gets a legal charge on the cash flow

Asset backed financing

Lender gets a legal charge on the assets created

Asset backed financing The concept of security

Primary security

Assets created out of bank finance

Collateral security

Any other asset charged to the bank against the loan

The basic question

Whom do we finance ?

How do we judge him ?

Borrower The 3 ‘C’s Capital, Capacity & Character

The judgment requires and makes use of Prudence, Due diligence & Analysis

Credit Appraisal The process of decision making in Credit by undertaking Informed Analysis using Prudence, Due diligence & Conservatism

Informed Analysis

Attribute based

Financial statements based

Please count every ‘F’ in the following text FINISHED FILES ARE THE RESULT OF YEARS OF SCIENTIFIC STUDY COMBINED WITH THE EXPERIENCE OF YEARS

Financial Analysis

We ‘see’ things but do not ‘observe’

We ‘write’ things but do not ‘say’

Financial Analysis

Why Analysis ?

To get a true & fair view ?? Perspectives may vary with the Analysis is a prerogative of the decision maker Analysis for decision making

The approach for analysis ?

Objective Meaningful

The BALT approach to Financial Analysis

BANKING

ING

LEGAL

TAXATION

Financial Statements - the components

Statement of profit & loss (P&L ) Statement of assets and liabilities (Balance Sheet), Cash flow statements Explanatory schedules or notes forming part of these statements Earnings per Share (EPS) statements Report by the Board of Directors Directors’ Responsibility Statements

Financial Statements - the components

Auditors’ Report

Notes to s Observations & Qualifications, if any Report as per CARO 2003

CARO 2003 Company Auditors Report Order, 2003 Applicable to all companies except

Banking Companies Insurance Companies Section 25 companies Private companies with PUC

+ Reserves <= Rs.50 lakh Public Deposits - NIL Loan from Bank/FIs <= Rs.10 lakh Annual sales turnover <= Rs. 5 Cr.

CARO 2003 - relevance for banks

Disposal of fixed assets Has it affected the going concern ? Records of inventory & physical verification Conducted ? Properly ed for ? Loans (secured / unsecured) taken / granted ? Interest, Repayment, Conduct, Transactions - Regular? Accepted deposits from public ? Provision of sec. 58A & 58AA complied with ? Deposit of undisputed statutory dues Regular in payment ? Arrears ? Is it a sick company under SICA ? Provision of sec. 58A & 58AA complied with ? Whether defaulted in repayments to banks / FIs ?

Extent & period ?

Financial Statements Other important information

Contingent liabilities

Off balance sheet items

Market information

Building Blocks of Financial Statements

Fundamental concepts

Local ing Standards

International ing Standards

US GAAP

Structure of presentation of Balance Sheet Liabilities

Assets

Capital & Reserves

Fixed Assets

Secured Loan Unsecured Loan

Investments Current Assets, Loans & Advances Miscellaneous expenses to the extent not written off Total

Current Liabilities & Provisions Total

Structure of presentation of Balance Sheet (as required for analysis) Liabilities

Assets

Short term Bank borrowing Cash & Bank balance Other Current Liabilities (incldg. Trade Creditors, Provisions etc.) Term Liabilities

Inventories, Receivables etc. (assets chargeable to Bank)

Net Worth

Net Block (Fixed Assets less Depreciation) Intangible Assets Total

Total

Other Current Assets

What is the difference between the styles of presentation ?

From the promoter’s perspective

Permanency of liabilities and assets

From the banker’s perspective

Currency of liabilities and assets

This is the reason why from the point of view of a Credit Analyst :

classification of Assets and Liabilities as Current and non-Current assumes considerable importance.

The Credit Analyst may therefore have to restructure the financial statements

according to his needs i.e. making a meaningful analysis of the figures for his decision making

To make the analysis meaningful, it may be necessary to : include delete, or reclassify

some items of expenses, assets or liabilities

We may call it recasting, reclassification or restructuring of the financial statements

Current Assets

Current Assets are assets like Cash, Bank balances and other resources that are reasonably expected to be realized or consumed within one year of the date of the Balance sheet. Thus, Current Assets include : Cash Bank balances Inventory holding comprising of Raw Material, Semi - Finished goods, Finished goods, consumables etc. Advance payment made Prepaid expenses Advance Tax etc. Margin deposited against BG for WC purposes etc.

Current Liabilities

Similarly, Current Liabilities are those obligations of the enterprise that are reasonably expected to be liquidated within one year from the date of the Balance sheet, either through the resources classed as Current Assets, or through the creation of other Current Liabilities. Accordingly, Current Liabilities include : Bank borrowings for Working capital purposes Other short term credits Trade Credits Expenses due but not paid Provisions made for expenses / losses Advance payment received Instalment of Term Loan due within a year etc.

However, there may be cases where :

The maturity period of any of the Current assets and Current Liabilities may be more than a year

Thus, the one year temporal standard to determine the validity of “Current-ness” may not be universally valid

Therefore, what may be Current or non-Current also depends on the core business activity marked by technological requirements and trading practices

Tips for re-classification Value of an asset – lower of the market value or reported value Assessed value < reported value ?? Create provision New provision carved out of Net worth i.e. Capital and Reserves.

Should we carry an asset which is no more relevant ?? Take out of the Balance Sheet Make adjustments against Net Worth.

Revaluation – company perspective Balance Sheet Liabilities

Year 1

Capital & general reserve

500

Revaluation reserve

500

Amount in Rs. Lakh Year 2 Assets 700 Fixed assets (including revaluation) 400

Other liabilities (including bank loan)

1000

1000 Other assets

Total

2000

2100

(Note : year 1 – on revaluation ; year 2 – one year after revaluation)

Year 1 1700

Year 2 1400 (1700300)

300

700

2000

2100

Revaluation – Bank perspective Profit & Loss

(Rs. lakh)

Profit before depreciation

400

Less depreciation

200

Profit after depreciation

200

Liabilities Capital & general reserve Other liabilities (including bank loan) Total

Year 1

Year 2 Assets

Year 1

Year 2

500

700 Fixed assets

1200

1000

1000

1000 Other assets

300

700

1500

1700

1500

1700

Deferred Tax issues

Stems from a difference in approach in ing vs. Taxation ing Deferred Tax Liabilities

Mostly from depreciation

Deferred Tax assets

Mostly from VRS issues

Example A company has purchased an instrument for use in the Research & Development department at a cost of Rs.10 Cr. The company would use SLM rate of depreciation @ Rs.2 Cr. per annum. The Income Tax laws however permit full depreciation during the first year for such instruments. How would the company treat this from the point of view of Deferred Tax liability ?

Deferred Tax Issues Sl. No. Year end 1. 2. 3. 4.

PBDT (say) Depreciation (as per Companies Act) PBT Provision for Tax (@ 40%)

5 6. 7. 8. 9.

PBDT Depreciation (as per Income Tax Act) PBT Provision for Tax (@ 40%) Deferred Tax liability created

10.

Balance of DTL as appearing in the BS

I

II

III

IV

V

12 2 10 4

12 2 10 4

12 2 10 4

12 2 10 4

12 2 10 4

12 12 12 12 12 10 0 0 0 0 2 12 12 12 12 0.8 4.8 4.8 4.8 4.8 3.2 ( 4 – 0.8) 3.2

2.4 1.6 0.8

0

Analysis of Financial Statements

Analysis of financial statements is necessary to gauze the financial health of a unit. Analysis can be done by means of : Percent of Sales method Trend analysis Ratio analysis Funds flow analysis Cash flow analysis Break even analysis etc.

Ratio Analysis

Most important generic ratios of relevance in credit analysis Liquidity ratios / indicators Gearing levels Profitability ratios Coverage ratios Return on Capital / Investments / Assets Turnover / Holding ratios

Liquidity Indicators

Current ratio

Acid test / Quick ratio

NWC (Net Working Capital)

Cash Generation

The rationale of Current Ratio

How Current is the Current Ratio ?

Does it indicate ‘Liquidity’ ? the concept of recovery by disposal of the concept of ‘Current-ness’ of liabilities The conflict between Prescriptive & definitions The conflict between ‘Operating ‘Funding’ concept Does not take care of recent developments

Deferred tax CENVAT receivables

CA assets and Conceptual Cycle’ vs. ing

Net Working Capital Current Liabilities

Current Assets Net Working Capital

Other Liabilities

Other Assets

Gearing ratio

Indicates stability

TOL / TNW

Debt Equity ratio (TTL / TNW)

Consider the following A business enterprise has submitted the following projected estimates with a request to provide short-term (cash credit) and term loan facilities of Rs.3.00 lakh and Rs.4.00 lakh respectively. The B/S and ratios looks like the following Liabilities

Amount

Assets

Amount

Capital

100

Fixed assets

500

Unsecured loan

150

Current assets

500

Term loan

400

Trade credit Cash credit Total

50 300 1000

Total

1000

Total Debt / Equity Ratio

(TOL / TNW)

900 / 100

9:1

Long Term Debt / Equity

(TTL / TNW)

400 / 100

4:1

CA / CL

500 / 500

1:1

Current Ratio

You refuse the proposal The entrepreneur comes back with a proposal that the fixed assets would be acquired on lease by arrangement with an NBFC. Resubmits the proposal for WC credit facilities only. Liabilities Capital

Amount

100

Unsecured loan

50

Trade credit

50

Cash credit

300

Total Total Debt / Equity Ratio

Long Term Debt / Equity

Current Ratio

500

Assets

Amount

Current Assets

500

Total

500

(TOL / TNW)

400 / 100

4:1

(TTL / TNW)

NA

NA

CA / CL

500 / 400

1.25 : 1

Gearing ratio - stability

TOL

TNW Stable

TOL

TNW

Unstable

Coverage Ratios

Cash Accrual Repayment Obligations

Important Coverage ratios

Debt Service Coverage ratio Interest Coverage ratio

Ratio Analysis (contd..) Although any number of ratios can be taken out, at least the following ratios should be calculated and interpreted for the purpose of Decision Making and Pricing :

Working Capital facilities

Current ratio TOL / TNW (Total Debt / Equity ) ratio PAT / Net Sales ( Total profitability ratio) PBDIT / Interest ( Interest Coverage ratio) PBDIT / Total Assets ( ROCE or ROA) ratio (Inventory + Receivables) / Net sales (in days) ratio

Ratio Analysis (contd..) Term loan facilities

Project Debt / Equity ratio

TOL / TNW

Gross Debt Service Coverage ratio

THANK YOU