Amalgamation Of Firms 4g4420

This document was ed by and they confirmed that they have the permission to share it. If you are author or own the copyright of this book, please report to us by using this report form. Report 2z6p3t

Overview 5o1f4z

& View Amalgamation Of Firms as PDF for free.

More details 6z3438

- Words: 8,372

- Pages: 22

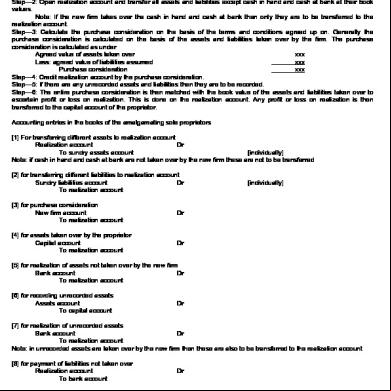

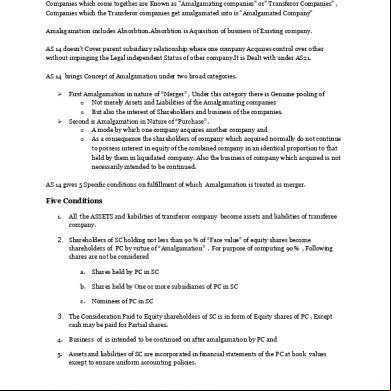

PATNERSHIP—AMALGAMATION OF FIRMS AND CONVERSION / SALE TO A COMPANY [A] WHEN TWO OR MORE PROPRIETORS FORM A NEW PARTNERSHIP: When two or more proprietors amalgamate to form a new partnership firm, it is usually desired to close the set of existing set of books and open new set of books for recording all assets and liabilities and transactions of the firm. To close the existing set of books following steps are followed: Step—1: Prepare the balance sheet of the business on the date of dissolution. Step—2: Open realization and transfer all assets and liabilities except cash in hand and cash at bank at their book values. Note: If the new firm takes over the cash in hand and cash at bank then only they are to be transferred to the realization . Step—3: Calculate the purchase consideration on the basis of the and conditions agreed up on. Generally the purchase consideration is calculated on the basis of the assets and liabilities taken over by the firm. The purchase consideration is calculated as under Agreed value of assets taken over xxx Less: agreed value of liabilities assumed xxx Purchase consideration xxx Step—4: Credit realization by the purchase consideration. Step—5: If there are any unrecorded assets and liabilities then they are to be recorded. Step—6: The entire purchase consideration is then matched with the book value of the assets and liabilities taken over to ascertain profit or loss on realization. This is done on the realization . Any profit or loss on realization is then transferred to the capital of the proprietor. ing entries in the books of the amalgamating sole proprietors [1] For transferring different assets to realization Realization Dr To sundry assets [individually] Note: if cash in hand and cash at bank are not taken over by the new firm these are not to be transferred [2] for transferring different liabilities to realization Sundry liabilities Dr To realization [3] for purchase consideration New firm To realization

Dr

[4] for assets taken over by the proprietor Capital To realization

Dr

[individually]

[5] for realization of assets not taken over by the new firm Bank Dr To realization [6] for recording unrecorded assets Assets To capital

Dr

[7] for realization of unrecorded assets Bank Dr To realization Note: in unrecorded assets are taken over by the new firm then these are also to be transferred to the realization [8] for payment of liabilities not taken over Realization To bank

Dr

[9] for recording unrecorded liabilities Capital Dr To unrecorded liability [10] for payment unrecorded liabilities Liabilities Dr To bank Note: if the unrecorded liabilities are taken over by the new firm then these are to be transferred to the realization along with other assets and liabilities

[11] for liabilities assumed by the proprietor Realization To capital

Dr

[12] for realization expenses Realization To bank

Dr

[13] for profit on realization Realization To capital

Dr

[14] for loss on realization Capital To realization

Dr

[15] for accumulated profit or reserves Reserves Accumulated profit To capital

Dr Dr

[16] for accumulated loss Capital To loss

Dr

[17] for settlement of purchase consideration by the new firm Capital in the new firm Dr To new firm [18] for final adjustment Capital To capital in the new firm To bank (if any)

Dr

ing entries in the books of the new firm The new firm records all assets and liabilities at the values it has decided to take over. If the purchase consideration payable is more than the net assets taken over (net assets= assets minus liabilities), it represents goodwill. Conversely if the purchase consideration is less than the net assets taken over then it represents capital reserve. [1] if the net assets taken over are equal to the purchase consideration, the following entry is ed Assets Dr [acquired value] To liabilities [assumed value] To partners capital [purchase consideration] [2] if the net assets acquired are more than the purchase consideration, it represents capital reserve and the following entry is ed Assets Dr [acquired value] To liabilities [assumed value] To partners capital [purchase consideration] To capital reserve [balance figure] [3] if the net assets acquired by the new firm are less than the purchase consideration it represents goodwill and the following entry is ed Assets Dr [acquired value] Goodwill Dr [balance figure] To liabilities [assumed value] To partners capital [purchase consideration]

Illustration: A and B are independent business men and their position on 31/12/1997 is reflected in the balance sheet given below: Particulars A B Particulars A B Sundry creditors for purchase 110000 47000 Stock in trade 170000 98000 Sundry creditors for expenses 750 2000 Sundry debtors 89000 37000 Bills payable 12500 - Cash at bank 13000 7500 Capital 153000 95500 Cash in hand 987 234 Furniture and fittings 2750 1766 Investments 513 -Both of them desired to form a partnership firm from 1/1/1998 on the following and conditions: [a] the capital of the firm will be Rs 300000 which would be contributed by A and B in 2:1 ratios. [b] the assets of the individual businesses will be revalued by C and at these values the firm will take them over and it will be adjusted against the contribution due by A and B. [c] C gave his valuation report as follows. Assets A—Stock in trade is to be written down by 15% and portion of the sundry debtors amounting to Rs 9000 is unrealizable and not to be assumed by the new firm. furniture and fittings are to be revalued at Rs 2000 and investments are to be taken at their market value which is Rs 1000. Assets B—stock in trade is to be written up by 10% and sundry debtors is to be assumed at 85% of their book value and rest of the assets are to be assumed at their book value. [d] the firm is not to assume any creditors other than those made for purchase. journal entries and prepare balance sheet of the new firm. Solution: Journal entries in the books of A Particulars Debit Rs Credit Rs Realization Dr 276250 To stock in trade 170000 To sundry debtors 89000 To cash in hand 13000 To cash at Bank 987 To furniture and fittings 2750 To investment 513 Sundry creditors Bills payable Creditors for Expenses To realization

Dr

New firm To realization

Dr

Dr

123250 118987 118987

Realization Dr To capital (Being the creditors for expenses not taken over by the firm transferred to capital ) Capital To realization (Loss on realization )

Dr

Capital in the new firm To new firm

Dr

Capital To capital in new firm

Dr

Realization To stock in trade To sundry debtors To cash in hand To cash at Bank To furniture and fittings

110000 12500 750

750 750 34763 34763 118987 118987 118987 118987

Journal in the books of B Particulars Dr

Debit Rs 144500

Credit Rs 98000 37000 7500 234 1766

Sundry creditors Creditors for Expenses To realization

Dr Dr

New firm To realization

Dr

47000 2000 49000 101750 101750

Realization Dr To capital (Being the creditors for expenses not taken over by the firm transferred to capital )

2000

Realization To capital (profit on realization )

Dr

4250

Capital in the new firm To new firm

Dr

Capital To capital in new firm

Dr

Liabilities Capital A B Sundry creditors Bills payable

2000

4250 101750 101750 101750 101750

Balance sheet of the firm A and B as on 1/1/1998 Rs Assets Furniture and fittings 200000 Investments 100000 Stock in trade 157000 Sundry debtors 12500 Cash at bank Cash in hand

Rs 3766 1000 252300 111450 99763 1221

Working notes Calculation of purchase consideration: Particulars

A

Assets taken over: Stock in trade Sundry debtors Cash at bank Cash in hand Furniture and fittings Investments [A] Total assets taken Liabilities assumed Sundry creditors for purchase Bills payable (as for purchase only) [B] total liabilities assumed Purchase consideration [A] – [B] Less: capital to me maintained Cash to be introduced (-) and cash to be withdrawn (+)

Particulars To balance b/d (A+B) To A’s capital

B

144500 80000 13000 987 2000 1000 -----------241487 ------------

107800 31450 7500 234 1766 ----------148750 -----------

110000 12500 ----------122500 -----------118987 200000 -----------(-)81013 ======

47000 ---------47000 ----------101750 100000 ---------(+)1750 ======

[2] Cash at bank (in the books of the firm) Rs Particulars 20500 By B’s capital 81013 By balance c/d

Rs 1750 99763

Illustration: Mr. Water and Mr. Fall carry on business individually and on 1/1/1998 they decided to form into a partnership firm on the following and conditions: [a] each partner shall have a fixed capital of Rs 10000 [b] Water’s stock is to be brought in at Rs 3250 and Fall’s stock is to be brought in at Rs 2750 as per valuation. [c] the reserve for bad debts is to be increased to 6% on debtors. [d] Fall is to dispose off his furniture and fittings to his best advantage [e] Any deficiency on the net asset brought in is to be paid into firm’s bank The balance sheet of both of them on 31/12/1997 is as follows

Balance sheet of Mr. Water Rs Assets 1810 Office furniture and fittings 10625 Plant and machinery Stock Sundry debtors Less: provision Cash at bank Cash in hand

Liabilities Sundry creditors Capital

Rs 350 5000 3400 2750 120

2630 980 75

Balance sheet of Mr. Fall Rs Assets Rs 2102 Office furniture and fittings 200 10133 Plant and machinery 5500 Stock 2800 Sundry debtors 3025 Less: provision 100 2925 Cash at bank 765 Cash in hand 45 journal entries to adjust the value of the assets before amalgamation and prepare the balance sheet of the new firm. Solution: Working notes: Statement showing additional cash to be brought in or withdrawn Value of net assets taken over Water Fall Office furniture and fittings 350 Plant and machinery 5000 5500 Stock 3250 2750 Sundry debtors 2750 3025 Cash at bank 980 765 Cash in hand 75 45 -------------------12405 12085 Less: liabilities taken over Creditors 1810 2102 Provision for bad debts 165 181 -----------------Net assets taken over 10430 9802 Less: Capital in the new firm 10000 10000 -------------------Additional cash to be withdrawn or brought in +ve/-ve +430 -198 ====== ====== Liabilities Sundry creditors Capital

Journal entries in the books of M/s. Water & Co. Particulars Dr

Debit

Credit

Capital To stock (3400-3250) To provision for debtors (old – new)

195

Capital To bank

430

Dr

430 Journal entries in the books of M/s. Fall & Co. Particulars Dr

Capital To stock (2800-2750) To provision for debtors (old – new) To furniture and fittings Bank To capital Liabilities Sundry creditors Capital Water Fall

150 45

Debit

Credit 331 50 81 200

Dr Balance sheet of M/s. Water Fall & Co. as on 1/1/1998 Rs Assets 3912 Office furniture and fittings Plant and machinery 10000 Stock 10000 Sundry debtors Less: provision Cash at bank (980+765+198-430) Cash in hand

Rs 350 10500 6000 5775 346

5429 1513 120

[B] WHEN AN EXISTING PARTNERSHIP FIRM ABSORBS A SOLE PROPIRETORSHIP When a partnership firm absorbs a sole proprietorship, the original sole proprietor gets dissolved and compensated by a share in the partnership firm acquiring it. In this case the sole proprietorship goes into liquidation and its assets and liabilities are taken over by the existing firm at agreed values. To close the existing set of books following steps are followed: Step—1: Prepare the balance sheet of the business on the date of dissolution. Step—2: Open realization and transfer all assets and liabilities except cash in hand and cash at bank at their book values. Note: If the new firm takes over the cash in hand and cash at bank then only they are to be transferred to the realization . Step—3: Calculate the purchase consideration on the basis of the and conditions agreed up on. Generally the purchase consideration is calculated on the basis of the assets and liabilities taken over by the firm. The purchase consideration is calculated as under Agreed value of assets taken over xxx Less: agreed value of liabilities assumed xxx Purchase consideration xxx Step—4: Credit realization by the purchase consideration. Step—5: If there are any unrecorded assets and liabilities then they are to be recorded. Step—6: The entire purchase consideration is then matched with the book value of the assets and liabilities taken over to ascertain profit or loss on realization. This is done on the realization . Any profit or loss on realization is then transferred to the capital of the proprietor. The following important points are to be noted [1] the assets and liabilities of sole proprietorship which are taken over by the firm are added to the respective assets and liabilities of the firm. [2] the capital of the new partner (sole proprietor) is the value of the purchase consideration agreed up on. [3] if the purchase consideration is less than the net assets taken over by the firm then the difference is to be taken as capital reserve and if the purchase consideration is more then the net assets taken over then the difference is goodwill. [4] Before amalgamation all assets and liabilities of the firm are to be revalued and any profit or loss on the revaluation is to be transferred to old partners in the old ratio. [5] Goodwill of the firm is to be d\adjusted to the old partner’s capital by crediting them in old ratio. [6] Balance of the reserve and profits are also to be credited to the old partner’s capital in the old profit sharing ratio. Illustration: following is the balance sheet of partner X and Y who share the profit and loss in the ratio of their capital and sole proprietor Z as on 31/12/1997 Particulars X&Y Z Particulars X&Y Z Capital 10000 Goodwill 2000 X 15000 -- Building 25000 Y 5000 -- Stock 10000 15000 Creditors 26000 13000 Bills receivable 5000 5000 Loan 5000 Debtors 4000 6000 Cash 2000 The partners agreed to it Z as a partner and to amalgamate his business with that of the firm on the following : [1] the new profit sharing ratio will be in the ratio of their capital [2] the building is to be appreciated by Rs 15000 and provision of 5% is to be created on debtors. [3] the goodwill of the partnership is to be put at Rs 10000 and of the sole proprietor at Rs 1500. both of them are to be recorded in the books. [4] stock of the firm is to be taken at Rs 9200 and that of the sole proprietor is to be taken at Rs 16800. You are required to prepare ledger in the books of Z and necessary journal entries in the books of X and Y and prepare the balance sheet of the new firm. Solution: working notes Calculation of purchase consideration Particulars Rs Rs Assets taken over Goodwill 1500 Stock 16800 Debtors 6000 Bills receivable 5000 29300 Less: liabilities taken over Creditors 13000 Loan 5000 Provision for debtors 300 18300 Purchase consideration 11000 In the books of Z Realization Particulars Rs Particulars Rs To goodwill 2000 By creditors 13000 To stock 15000 By loan 5000

To bills receivable To debtors To capital – profit

5000 6000 1000

By partner X and Y

In the books of partners X and Y Particulars Dr

Building To revaluation (Being value of the building appreciated by Rs 15000) Revaluation To stock To provision for debtors

Dr

11000

Debit Rs 15000

15000 1000 800 200

Revaluation Dr To X’s capital To Y’s capital (Being profit on revaluation of assets transferred to partners in capital ratio)

14000

Goodwill To X’s capital To Y’s capital (Being goodwill raised in the books)

Dr

10000

Goodwill Stock Bills receivable Debtors To creditors To Loan To provision for bad debts To Z’s capital

Dr Dr Dr Dr

Liabilities Capital X (15000+10500+7500) Y (5000+3500+2500) Z Creditors Loan

Credit Rs

10500 3500

7500 2500

Balance sheet of the new firm after absorption Rs Assets Goodwill (10000+1500) 33000 Buildings (25000+15000) 11000 Stock (9200+16800) 11000 Bills receivable 39000 Debtors (6000+4000) 5000 Less: provision @ 5% Cash in hand

1500 16800 6000 5000 5000 13000 300 11000 Rs 11500 40000 26000 10000 10000 500

9500 2000

[C] WHEN ONE EXISTING PARTNERSHIP FIRM ABSORBS ANOTHER PARTNERSHIP FIRM In this case the purchase consideration is shared by the partners of the selling firm in the ratio of their interest in the old business. At the time of closing the books of all reserves and surpluses are to be transferred to partner’s capital in the old profit sharing ratio. To close the existing set of books following steps are followed: Step—1: Prepare the balance sheet of the business on the date of dissolution. Step—2: Open realization and transfer all assets and liabilities except cash in hand and cash at bank at their book values. Note: If the new firm takes over the cash in hand and cash at bank then only they are to be transferred to the realization . Step—3: Calculate the purchase consideration on the basis of the and conditions agreed up on. Generally the purchase consideration is calculated on the basis of the assets and liabilities taken over by the firm. The purchase consideration is calculated as under Agreed value of assets taken over xxx Less: agreed value of liabilities assumed xxx Purchase consideration xxx Step—4: Credit realization by the purchase consideration. Step—5: If there are any unrecorded assets and liabilities then they are to be recorded. Step—6: The entire purchase consideration is then matched with the book value of the assets and liabilities taken over to ascertain profit or loss on realization. This is done on the realization . Any profit or loss on realization is then transferred to the capital of the proprietor. The following points are important: [1] the assets and liabilities of the liquidating firm are added to the respective heads in the existing firm [2] if the purchase consideration is less than the net assets taken over by the firm then the difference is to be taken as capital reserve and if the purchase consideration is more then the net assets taken over then the difference is goodwill.

Illustration: the balance sheet of partners PQ and RS as on 31/12/1997 are as follows: Particulars PQ RS Particulars Capital Machinery P 60000 - Furniture Q 30000 - Stock R 36000 Debtors S 24000 Investment Bank loan 10000 - Cash Bills payable 30000 40000

PQ 60000 8000 32000 18000 12000

Rs 20000 6000 24000 30000 18000 2000

PQ absorbed RS in the following [1] the value of the goodwill of RS will be Rs 12000 [2] the investment of Rs is to be sold and the amount realized will be introduced in the acquiring business, investments realized Rs 24000 [3] the stock of RS to be reduced to Rs 22000 [4] the machinery of RS will be increased by 40% [5] furniture and fittings of RS will be reduced by 10% It was further decided for PQ that following adjustments are to be made [1] assets are to be revalued as follows: [a] Goodwill Rs 16000; Stock Rs 40000; Machinery Rs 84000; furniture Rs 7200 [2] bank loan is to be repaid. Prepare ledger to close the books of RS and necessary journal entries in the books of PQ and prepare balance sheet after absorption. Solution: working notes Calculation of purchase consideration Particular Rs Rs Assets taken over Goodwill 12000 Stock 22000 Machinery 28000 Furniture 5400 Debtors 30000 Cash (2000+24000) 26000 123400 Liabilities assumed: Bills payable Purchase consideration

40000 In the books of RS Realization Rs Particulars 20000 By bills payable 6000 By PQ (purchase consideration) 24000 30000 26000

Particulars To machinery To furniture To stock To debtors To cash To partners capital R S

40000 83400

Rs 40000 83400

8700 8700 PQ

Particulars To realization

Rs

Particulars

Rs

83400

Particulars By capital in PQ

Rs 83400

Cash To balance b/d To investment Particulars To capital in PQ (b/f)

2000 24000 R 47700

Particulars By realization

Partner’s capital S Particulars 35700 By balance b/d By profit on sale of investment By realization

Rs 26000

R 36000 3000 8700

S 24000 3000 8700

In the Books of PQ Journal entries Stock Machinery To revaluation

Particular Dr Dr Dr

Revaluation To P’s capital To Q’s capital

Dr

Bank loan To cash

Dr

Goodwill To P’s capital To Q’s capital

Dr

Goodwill Stock Machinery Debtors Cash Furniture To bills payable To R’s capital To S’s capital

Dr Dr Dr Dr Dr Dr

Liabilities Capital P Q R S Bills payable

Cr Rs 8000 24000 32000

Revaluation To furniture

Particulars To balance b/d

Dr Rs

800 800 31200 15600 15600 10000 10000 16000 8000 8000 12000 22000 28000 30000 26000 5400 40000 47700 35700

Partner’s capital S Particulars 53600 By balance b/d By goodwill By profit on revaluation Balance sheet of the new firm as on 1/1/1998 Rs Assets Goodwill 47700 Machinery (84000+28000) 35700 Furniture (5400+7200) 83600 Stock(22000+40000) 53600 Debtors(18000+30000) 70000 Cash (26000+12000-10000)

R 83600

R 60000 8000 15600

S 30000 8000 15600 Rs 28000 112000 12600 62000 48000 28000

[D] WHEN TWO OR MORE PARTNERSHIP FIRM FORMS A NEW PARTNERSHIP FIRM When two or more partnership firm amalgamate to a new firm, the books of both the firms are to be closed and the assets and liabilities of both the firm are to transferred to the realization at their book value. ING ENTRIES IN THE BOOKS OF THE AMALGAMATING FIRM 1] For transferring different assets to realization Realization Dr To sundry assets

[individually]

Note: if cash in hand and cash at bank are not taken over by the new firm these are not to be transferred [2] for transferring different liabilities to realization Sundry liabilities To realization

Dr

[3] for purchase consideration New firm To realization

Dr

[4] for assets taken over by the proprietor Capital To realization

Dr

[individually]

[5] for realization of assets not taken over by the new firm Bank To realization

Dr

[6] for recording unrecorded assets Assets To capital

Dr

[7] for realization of unrecorded assets Bank To realization

Dr

Note: in unrecorded assets are taken over by the new firm then these are also to be transferred to the realization [8] for payment of liabilities not taken over Realization To bank [9] for recording unrecorded liabilities Capital To unrecorded liability [10] for payment unrecorded liabilities Liabilities To bank

Dr

Dr Dr

Note: if the unrecorded liabilities are taken over by the new firm then these are to be transferred to the realization along with other assets and liabilities [11] For liabilities assumed by the partners Realization To partners capital

Dr

[12] For realization expenses Realization To bank

Dr

[13] for profit on realization Realization To partners capital

Dr

[14] for loss on realization Partners Capital To realization

Dr

[15] for accumulated profit or reserves Reserves Accumulated profit To partners capital

Dr Dr

[16] for accumulated loss Partners Capital To loss

Dr

[17] for transferring the current of the partners Partners current To partners capital

Dr

[18] for settlement of purchase consideration by the new firm Partner’s Capital in the new firm To new firm

Dr

[18] for final adjustment Partners Capital To partner’s capital in the new firm

Dr

Illustration: A: B=1:2 and X: Y= 1:1. both amalgamate on 1/1/1998, on this date the balance sheet of both the firms are as follows: Liabilities Rs Assets Rs B’s capital 19000 Plant and machinery 10000 Sundry creditors 10000 Stock in trade 20000 Bank over draft 15000 Sundry debtors 10000 A’s capital 4000 Liabilities X’s capital Y’s capital Sundry creditors

Rs

Assets 10000 2000 9500

Rs

Goodwill Stock in trade Sundry debtors Cash in hand

5000 5000 10000 1500

Following further information is available: [1] All fixed assets are to be devalued by 20% [2] All stock in trade is to be appreciated by 50% [3] AB firm owes Rs 5000 to XY, this debts is settled at Rs 2000. [4] goodwill is to be ignored for the purpose of amalgamation [5] the fixed capital in the new firm will be: A—Rs 2000; B—Rs 3000; X—Rs 1000; Y—Rs 4000 [6] B takes over the bank over draft of AB and gifts to A the amount to be brought in by A to make his capital contribution [7] X is paid off out of cash of XY and Y brings in sufficient cash to make up his required capital contribution. necessary journal entries in the books of both the firm as on 31/12/1997. Solution: Journal entries in the books of AB and Co. Particular Rs Rs Realization Dr 40000 To plant and machinery 10000 To stock in trade 20000 To sundry debtors 10000 Sundry creditors To realization

Dr

Bank over draft To B’s capital (Being bank over draft is taken over by B)

Dr

New firm To realization

Dr

10000 10000 15000 15000 41000 41000

Realization Dr To A’s capital To B’s capital (Being profit on realization transferred to the capital of the partners) B’s capital To A’s capital (Being the share of A’s capital shared by B)

Dr

A’s capital B’s capital To capital in the new firm

Dr Dr

Realization To good will To stock in trade To sundry debtors

11000 3667 7333 2333 2333 2000 39000 41000

Journal entries in the books of XY Particular Dr

Rs

Rs 20000 5000 5000 10000

Sundry creditors To realization

Dr

New firm To realization

Dr

X’s capital Y’s capital To realization

Dr Dr

9500 9500 5000 5000 2750 2750 5500

Cash To Y’s capital

Dr

4750

X’s capital To cash X’s capital Y’s capital To capital in the new firm

Dr

6250

Dr Dr

1000 4000

4750 6250 5000 Journal in the books of new firm Particulars

Rs

Rs

B’s capital To B’s loan (being excess capital of Be transferred to loan )

36000

Plan and machinery Stock in trade Sundry debtors To sundry creditors To B’s loan To A’s capital To B’s capital To X’s capital To Y’s loan

8000 37500 17000

Dr Dr Dr

16500 36000 2000 3000 1000 4000

Balance sheet of the new firm after amalgamation Liabilities Rs Assets Capital Plant and machinery A 2000 Stock in trade B 3000 Sundry debtors X 1000 Y 4000 Creditors 16500 B’s loan 36000 Working notes: [1] computation of purchase consideration Particulars Assets taken over Plant and machinery Stock in trade Sundry debtors (XY= 10000-3000) Less: liabilities assumed Sundry creditors (AB= 10000-3000)

Particulars To plant and machinery To stock in trade To sundry debtors To goodwill To partners capital A B

36000

AB 10000 20000 10000 3667 7333

Realization XY Particulars - By creditors 5000 By new firm 10000 By capital 5000 X Y -

Rs 8000 37500 17000

AB

XY

8000 30000 10000 48000 (7000) 41000

7500 7000 14500 (9500) 5000

AB 10000 41000

XY 9500 5000

-

2750 2750

Partner’s capital Particulars A B X Y Particulars A B X y To balance b/d 4000 By balance b/d 19000 10000 2000 To realization 2750 2750 By realization 3667 7333 To A’s capital 2333 By B’s capital * 2333 To new firm 2000 39000 1000 4000 By bank over draft 15000 To cash 6250 By cash 4250 Note: The capital balance of B in new firm is Rs 3000 only, but his capital shows Rs 39000. As there is no liquid asset in the firm of AB, the new firm should transfer Rs 36000 (39000-3000), to a loan . The new capital of A in the new firm is Rs 2000 but his debit balance is Rs 333 at the time of amalgamation so, as promised B has to contribute Rs 2333 to make A’s capital

Illustration: M/s A and Co. having A and B as equal partners, decided to amalgamate with C and Co. having C and D as equal partners on the following : [1] the new firm AC and Co. is to pay Rs 12000 to each of the firm for Goodwill [2] the new firm is to take over the investment at 10% depreciation, land at Rs 66800, premises at Rs 53000, machinery at Rs 9000 and only the trade liabilities of both of the firms. Debtors being taken over at the book value. [3] Typewriters of C and Co. at written down value Rs 800 not recorded in the balance sheet is also not taken over by the new firm. [4] Bills payable pertain to trade transactions only [5] all the four partners are to bring in Rs 160000 as capital in the new firm in equal shares The following were the balance sheet of both the firms on the date of amalgamation Particulars A & Co C & Co. Particulars A & Co C & Co. Trade creditors 20000 10000 Cash 15000 12000 Bills payable 5000 - Investment 10000 8000 Bank over draft 2000 10000 Debtors 10000 A’s loan 6000 - Less: provision 1000 9000 4000 Capital Furniture 12000 6000 A 35000 - Premises 30000 B 22000 - Land 50000 C 36000 Machinery 15000 D 20000 Goodwill 9000 General reserve 8000 3000 Investment fluctuation reserve 2000 1000 journal entries in the books of both the amalgamating firms and the new firm and prepare the balance sheet of the new firm. Solution: Journal entries in the books of A and Company Particulars Rs Rs Realization Dr 86000 To investment 10000 To debtors 10000 To furniture 12000 To premises 30000 To machinery 15000 To goodwill 9000 Provision for bad debts Sundry creditors Bills payable To realization

Dr Dr Dr

1000 20000 5000

AC. & Co. To realization

Dr

A’s capital B’s capital To realization (being furniture distributed equally)

Dr Dr

6000

Realization To A’s capital To B’s capital

Dr

32000

General reserve Investment fluctuation reserve To A’s capital To B’s capital

Dr Dr

A’s loan To A’s capital

Dr

Bank over draft A’s capital To cash

Dr Dr

Cash To B’s capital

Dr

26000 80000 80000 60000

16000 16000 8000 2000 5000 5000 6000 6000 2000 16000 18000 3000 3000

Capital in AC. & Co. To AC. & Co.

Dr

A’ capital B’s capital To capital in AC. & Co.

Dr Dr

Realization To investment To debtors To furniture To land

80000 80000 40000 40000 80000

Journal entries in the books of C & Co. Particulars Dr

Rs 8000 4000 6000 50000

Provision for bad debts Bills payable To realization

Dr Dr

AC. & Co. To realization

Dr

1000 10000 11000 40000 40000

C’s capital Dr D’s capital Dr To realization (being furniture and typewriter distributed equally) Realization To A’s capital To B’s capital

Dr

General reserve Investment fluctuation reserve To C’s capital To D’s capital

Dr Dr

Bank over draft C’s capital To cash

Dr Dr

Cash To D’s capital

Dr

Capital in AC. & Co. To AC. & Co.

Dr

C’ capital D’s capital To capital in AC. & Co.

Dr Dr

Goodwill Investment Land Premises Machinery Debtors To Trade creditors To Bills payable To Provision for debtors To A’s capital To B’s capital To C’s capital To D’s capital

Rs 68000

3400 3400 6800 14000 14000 28000 3000 1000 2000 2000 10000 9000 19000 7000 7000 80000 80000 40000 40000 80000

Journal entries in the books of AC & Co. Particulars Dr (Balance figure) Dr Dr Dr Dr Dr

Rs 37000 16200 66800 53000 9000 14000

Rs

30000 5000 1000 40000 40000 40000 40000

Balance sheet of AC. & Co. Rs Assets 40000 Goodwill 40000 Investment 40000 Land 40000 Premises 30000 Machinery 5000 Debtors (Less RBD Rs 1000)

Liabilities A’s capital B’s capital C’s capital D’s capital Sundry creditors Bills payable

Working notes: Calculation of goodwill or capital reserve after amalgamation Particulars Assets taken over Goodwill Investment Land Premises Machinery Debtors

A &Co. 10000 10000 12000 30000 15000 9000 16000 16000 -

Particulars To realization To capital in AC& Co. To cash (final settlement)

A 6000 40000 16000

Particulars To realization To capital in AC& Co. To cash (final settlement)

C 3400 40000 9000

Particulars To balance b/d To B’s capital To D’s capital

A & Co 15000 3000 -

37000 16200 66800 53000 9000 13000s

A & Co.

Less liabilities taken over Trade creditors Bills payable Net assets taken over Less: purchase consideration Goodwill -ve / +ve capital reserve Particulars To investment To debtors To furniture To premises To land To machinery To goodwill To A’s capital To B’s capital To C’s capital To D’s capital

Rs

C & Co. 12000 9000 53000 9000 9000 92000

12000 7200 66800 4000 90000

20000 5000 67000 80000 -13000

10000 80000 80000 -

Realization C & Co. Particulars 8000 By provision for bad debts 4000 By trade creditors 6000 By bills payable - By M/s. AC. & Co. 50000 By A’s capital (WN 1) - By B’s capital (WN 1) - By C’s capital (WN 2) - By D’s capital (WN 2) 14000 14000 Partner’s capital B Particulars 6000 By balance b/d 40000 By realization - By A’s loan By general reserve By investment fluctuation reserve By cash (final settlement) Partner’s capital D Particulars 3400 By balance b/d 40000 By realization By general reserve By investment fluctuation reserve By type writer (WN3) By cash (final settlement) Cash C & Co. Particulars 12000 By B’s capital - By bank over draft 7000 By C’s capital

A &Co. 1000 20000 5000 80000 6000 6000 -

C & Co. 10000 80000 3000 3000 400 400

A 35000 16000 6000 4000 1000 -

B 22000 16000 4000 1000 3000

C 36000 14000 1500 500 400 -

D 20000 14000 1500 500 400 7000

A & Co 16000 2000

C & Co. 10000 9000

[1] The furniture of A & Co. is not taken over by the new firm so it has been distributed among the partners equally. [2] The furniture and typewriter of C and Co. is not taken over by the new firm so it has been distributed between C and D equally. [3] As the typewriter has not been recorded in the books it has to be credited to the capital

CONVERSION OR SALE OF A PARTNERSHIP FIRM TO A COMPANY A partnership firm may sell its business to a t stock company or it may convert its business into a company. In both the cases the partnership is dissolved. following point is to be noted; [1] the purchase consideration is satisfied by the company either in the form of shares or debentures or cash or combination of two or more 0of these. The shares may be equity or preferential or they may be issued at par or or discount. For the partnership, the issue price is relevant which may form part of purchase consideration. [2] in the absence of any agreement the share received from the company are to be distributed in the profit sharing ratio. ING ENTRIES IN THE BOOKS OF THE SELLING FIRM 1] For transferring different assets to realization Realization Dr To sundry assets [individually] Note: if cash in hand and cash at bank are not taken over by the new firm these are not to be transferred [2] for transferring different liabilities to realization Sundry liabilities To realization

Dr

[3] for purchase consideration New firm To realization

Dr

[4] for assets taken over by the proprietor Capital To realization

Dr

[5] for realization of assets not taken over by the new firm Bank To realization

Dr

[6] for recording unrecorded assets Assets To capital

Dr

[individually]

[7] for realization of unrecorded assets Bank Dr To realization Note: in unrecorded assets are taken over by the new firm then these are also to be transferred to the realization [8] for payment of liabilities not taken over Realization To bank

Dr

[9] for recording unrecorded liabilities Capital Dr To unrecorded liability [10] for payment unrecorded liabilities Liabilities Dr To bank Note: if the unrecorded liabilities are taken over by the new firm then these are to be transferred to the realization along with other assets and liabilities [11] for liabilities assumed by the partners Realization Dr To partners capital

[12] for realization expenses Realization To bank

Dr

[13] for profit on realization Realization To partners capital

Dr

[14] for loss on realization

Partners Capital To realization

Dr

[15] for accumulated profit or reserves Reserves Accumulated profit To partners capital

Dr Dr

[16] for accumulated loss Partners Capital To loss

Dr

[17] for transferring the current of the partners Partners current To partners capital

Dr

[18] for settlement of purchase consideration by the new firm Shares in purchasing company Debentures in purchasing company Cash To purchasing company

Dr Dr Dr

[18] for final adjustment Partners Capital To Shares in purchasing company To Debentures in purchasing company To Cash

Dr

ING ENTRIES IN THE BOOKS OF THE PURCHASING COMPANY The purchasing company will record all the assets and liabilities of the firm at the values at which it agreed to take over. If the purchase consideration is more than the net assets taken over by the company then the difference will be considered as goodwill and if the purchase consideration is less than the net assets then the difference will be taken as the capital reserve. For assets and liabilities taken over Assets Goodwill To liabilities To share capital To share

Dr Dr

[acquired value] [balance figure] [acquired value [face value of the shares issued] [if any]

Illustration: Star and Moon carrying on business independently. They agreed to amalgamate and form a new company Neptune Ltd. With an authorized capital of Rs 200000 divided into 40000 equity shares of Rs 5 each. On 31/12/1995, the respective balance sheet of Star and Moon were as follows: Particulars Star Moon Fixed assets 317500 182500 Current assets 163500 83875 481000 266375 Less: current liabilities 298500 90125 Representing capital 182500 176250 Additional information: [a] Revalued figures of fixed assets and current assets were as follows: Particulars Star Moon Fixed assets 355000 195000 Current assets 149750 78875 [b] the debtors and creditors include Rs 21,675 owned by Star to Moon The purchase consideration is satisfied by the issue of the following shares and debentures [1] 30000 equity shares of Neptune Ltd. to star and Moon in the proportion of their profitability of their respective business on the average net profit of last three years which were as follows: Particulars Star Moon 1993 profit 224788 136950 1994 (Loss)/ profit (1250) 171050 1995 profit 188962 179500 [2] 15 % debentures in Neptune Ltd. At par to provide an income equivalent to 8% return on capital employed in their respective capital as on 31/12/1995 after revaluation of assets. Compute the number of share and debentures to be issued and show balance sheet of Neptune Ltd. after amalgamation.

Solution: Statement showing the issue of number of Shares and Debentures Particulars [1] average profit Star Rs[ 224788-1250+188962] / 3 Moon Rs[ 136950+171050+179500] / 3 [2] equity shares to be issued [a] Ratio of distribution [b] No. Of shares (30000 in 1375: 1625 ratio) [c] amount of shares @ Rs 5 each [3] capital employed after revaluation of assets and liabilities Fixed assets Current assets Less: current liabilities Capital employed [4] debentures to be issued 8% return on capital employed Amount of 15 % debentures to be issued to yield equivalent income Star : 16500 X 100/ 15 Moon: 14700 X 100/15 Computation of purchase consideration Particulars Equity shares issued 15 % debentures Computation of capital reserve / Goodwill Particulars Net assets taken over Fixed assets Current assets

Less: purchase consideration Goodwill - ve Capital reserve + ve Final figure Goodwill -ve / Capital reserve +ve Liabilities

Reserves and Surplus Capital reserve Secured loan 15% Debentures Unsecured loans Current liabilities and provisions Current liabilities

355000 149750 504750 298500 206250

195000 78875 273875 90125 183750

16500

14700

Star

Moon

Total

Current assets, loans and advances Current assets Miscellaneous expenditures

366950

1625 16250 81250

Total 150000 108000 258000

150000

Nil

1375 13750 68750

Moon 81250 98000 179250

Investments

108000

162500

Star 68750 110000 178750

200000

32000

137500 -

98000

Balance sheet of Neptune Pvt. Ltd. As on 31/12/1998 Rs Assets Fixed assets

Share capital Authorized: 40000 equity shares @ Rs 5 Each Issued and subscribed: 30000 equity shares @ Rs 5 Each

Moon

110000

355000 149750 504750 **276825 227925 178750 49175

Less: Current liabilities

Star

195000 *57200 252200 90125 162075 179250 -17175 -

550000 206950 756950 366950 390000 358000 32000 Rs 550000 Nil 366950 Nil

Illustration: A: B: C= 5:3:2. The trail balance of the firm on 31/03/1998 was as follows. Debit balance Rs Credit balance Rs Machinery at cost 100000 Sundry creditors 64700 Stock 68700 Bills payable 20000 Sundry debtors 62000 Capital Drawings A 68000 A 25000 B 45000 B 23000 C 23000 C 17000 Depreciation on machinery 40000 Cash at bank 89300 Profit for the year ended 31/03/1998 124300 Interest on capital at 10% p.a. on the balance at beginning of the year was not provided before preparing the above trial balance. On 1/4/1998 they formed a private company with an authorized capital of Rs 200000 in shares of Rs 10 each to be divided in different class to take over the partnership business. You are informed as under: [1] Machinery is to be transferred at Rs 70000 [2] shares in company are to be issued to the partners at par, in such a number and class as will give the partners by reason of their share holdings alone, the same rights as regards interest on capital and the sharing of profit and loss as they had in partnership. [3] before transferring the business to the company the partners decided to draw cash to bring the bank balance to Rs 50000. for this purpose sufficient profit of the year is to be retained in the profit sharing ratio. [4] all assets and liabilities except machinery and bank balance are to be transferred at book value Prepare capital to show the adjustments of dissolution statement showing the numbers and class of share to be issued to the partners and a statement of additional drawings in cash, the balance sheet of the company immediately after amalgamation. Solution: Profit and loss appropriation Particulars Rs Particulars Rs To interest on capital By Net profit b/d 124300 A—Rs 6800; B—Rs 4500; C—Rs 2300 13600 To share of profit A—Rs 55350; B—Rs 33210; C—Rs 22140 110700 Statement showing the amount of additional drawings Particulars

Rs

Amount already drawn Add: to be withdrawn (89300- 50000)= 39300 in 5:3:2 Less: drawings against interest on capital Maximum amount to be drawn (5:3:2) Statement showing the amount of drawings in cash Particulars A Maximum amount to be drawn (5:3:2) 45350 Add: drawings against interest on capital 6800 Total allowable drawings against profit and interest 52150 Less amount already drawn 25000 Additional drawings to be made 27150 Statement showing the distribution of number and class of shares Particulars Total assets taken over Machinery Stock Debtors Bank Less: liabilities assumed Creditors Bills payable Net assets taken over or purchase consideration Refer note first 10% preference shares to be issued (136000) A—Rs 68000; B—Rs 45000; C—Rs 23000 Balance in equity share in 5:3:2 ratio (30000) A—Rs 15000; B—Rs 9000; C—Rs 6000

65000 39300 13600 90700 B 27210 4500 31710 23000 8710 Rs 70000 68700 62000 50000 64700 20000

C 18140 2300 20440 17000 3440 Rs

250700 84700 166000 136000 30000 166000

Note: The above consideration should be distributed in such a way that the partners should get the same amount of interest as they were getting in the firm including interest on capital. Therefore 10% preference shares are to be issued to cover the capital so as to give the same amount of interest on capital and capital in the firm and the balance is to be issued as equity shares in profit sharing ratio.

Realization Rs Particulars 100000 By provision for depreciation 68700 By sundry creditors 62000 By bills payable 50000 By new company

Particulars To machinery To stock To debtors To bank To partners capital A B C Particulars To drawings To additional drawings To 10% preference shares To equity share capital

Rs 40000 64700 20000 166000

5000 3000 2000 A 25000 27150 68000 15000

B 23000 8710 45000 9000

Partner’s capital C Particulars 17000 By balance b/d 3440 By interest on capital 23000 By balance of profit 6000 By realization

A 68000 6800 55350 5000

Balance sheet of the new company as on 31/03/1998 Rs Assets Share capital Fixed assets Authorized: Machinery 20000 shares of Rs 10 each 200000 Issued and subscribed Investments 10% preference of Rs 10 each 136000 Nil 3000 equity shares of Rs 10 each 30000 Current assets and loans and advances Reserves and surplus Stock Nil Nil Debtors Bank Current liabilities and provisions Creditors 64700 Bills payable 20000 Liabilities

Illustration: Ram: Rahim: Rogers= 5:3:2. on 31/12/1997 they On this date their balance sheet was as follows: Liabilities Rs Creditors 50000 Capital Ram 101000 Rahim 151000 Rogers 133000

B 45000 4500 33210 3000

C 23000 2300 22140 2000 Rs 70000 Nil 68700 62000 50000

decided to float a private company to take over the business.

Assets Rs Cash 6000 Bank 14000 Debtors (less: provision 2000) 58000 Stock 42000 Fixed assets at WDV 300000 Expenditure in Relation to R Pvt. Ltd. Formation expenses 12000 Bank (note:1) 3000 Note 1: in the name of R Pvt. Ltd. Deposit of par value of 300 shares of Rs 10 each subscribed equally by the partners as subscribers to the MOA and AOA. On that date R Pvt. Ltd. Took over the business for the total consideration of Rs 500000 (excluding 300 shares as subscribers of MOA and AOA). The purchase consideration is to be discharged by the issue of the equity shares at par of Rs10 each in the profit sharing ratio and 15% debentures of Rs 100 each for surplus capital. The directors of R Pvt. Ltd revalued the fixed assets at Rs 400000. prepare a statement showing the number of shares and debentures issued by R Pvt. Ltd to Ram, Rahim and Rogers and journal entries in the books of R Pvt. Ltd to show the take over of the business. Solution: Statement showing the distribution of shares and debentures Particulars Ram Capital balance 101000 Add: realization profit 59000 Total capital balance [A] 160000 Profit sharing ratio 5 Base capital (being minimum) 32000 Adjusted capital [B] 160000 Less: Initial allotment of 300 shares of Rs 10 each 1000 Additional allotment shares of Rs 10 each 159000 Debentures [A-B] of Rs 100 each -

Rahim 151000 35400 186400 3 62133 96000 1000 95000 90400

Roger 133000 23600 156600 2 78300 64000 1000 63000 92600

Particulars To cash To bank To stock To debtors To fixed assets To formation expenses To partners capital Ram Rahim Roger

Bank To equity share capital Goodwill Fixed assets Stock Debtors Preliminary expenses Bank Cash To provision for debtors To creditors To equity share capital To 15% debentures

Realization Rs Particulars 6000 By creditors 14000 By provision for debtors 42000 By new firm 60000 300000 12000

Rs 50000 2000 500000

59000 35400 23600 Journal entries in the books of R Pvt. Ltd Particulars Dr

Rs

Rs 3000 3000

Dr (balancing figure) Dr Dr Dr Dr Dr Dr

18000 400000 42000 60000 14000 6000 12000 2000 50000 318000 182000

Dr

[4] for assets taken over by the proprietor Capital To realization

Dr

[individually]

[5] for realization of assets not taken over by the new firm Bank Dr To realization [6] for recording unrecorded assets Assets To capital

Dr

[7] for realization of unrecorded assets Bank Dr To realization Note: in unrecorded assets are taken over by the new firm then these are also to be transferred to the realization [8] for payment of liabilities not taken over Realization To bank

Dr

[9] for recording unrecorded liabilities Capital Dr To unrecorded liability [10] for payment unrecorded liabilities Liabilities Dr To bank Note: if the unrecorded liabilities are taken over by the new firm then these are to be transferred to the realization along with other assets and liabilities

[11] for liabilities assumed by the proprietor Realization To capital

Dr

[12] for realization expenses Realization To bank

Dr

[13] for profit on realization Realization To capital

Dr

[14] for loss on realization Capital To realization

Dr

[15] for accumulated profit or reserves Reserves Accumulated profit To capital

Dr Dr

[16] for accumulated loss Capital To loss

Dr

[17] for settlement of purchase consideration by the new firm Capital in the new firm Dr To new firm [18] for final adjustment Capital To capital in the new firm To bank (if any)

Dr

ing entries in the books of the new firm The new firm records all assets and liabilities at the values it has decided to take over. If the purchase consideration payable is more than the net assets taken over (net assets= assets minus liabilities), it represents goodwill. Conversely if the purchase consideration is less than the net assets taken over then it represents capital reserve. [1] if the net assets taken over are equal to the purchase consideration, the following entry is ed Assets Dr [acquired value] To liabilities [assumed value] To partners capital [purchase consideration] [2] if the net assets acquired are more than the purchase consideration, it represents capital reserve and the following entry is ed Assets Dr [acquired value] To liabilities [assumed value] To partners capital [purchase consideration] To capital reserve [balance figure] [3] if the net assets acquired by the new firm are less than the purchase consideration it represents goodwill and the following entry is ed Assets Dr [acquired value] Goodwill Dr [balance figure] To liabilities [assumed value] To partners capital [purchase consideration]

Illustration: A and B are independent business men and their position on 31/12/1997 is reflected in the balance sheet given below: Particulars A B Particulars A B Sundry creditors for purchase 110000 47000 Stock in trade 170000 98000 Sundry creditors for expenses 750 2000 Sundry debtors 89000 37000 Bills payable 12500 - Cash at bank 13000 7500 Capital 153000 95500 Cash in hand 987 234 Furniture and fittings 2750 1766 Investments 513 -Both of them desired to form a partnership firm from 1/1/1998 on the following and conditions: [a] the capital of the firm will be Rs 300000 which would be contributed by A and B in 2:1 ratios. [b] the assets of the individual businesses will be revalued by C and at these values the firm will take them over and it will be adjusted against the contribution due by A and B. [c] C gave his valuation report as follows. Assets A—Stock in trade is to be written down by 15% and portion of the sundry debtors amounting to Rs 9000 is unrealizable and not to be assumed by the new firm. furniture and fittings are to be revalued at Rs 2000 and investments are to be taken at their market value which is Rs 1000. Assets B—stock in trade is to be written up by 10% and sundry debtors is to be assumed at 85% of their book value and rest of the assets are to be assumed at their book value. [d] the firm is not to assume any creditors other than those made for purchase. journal entries and prepare balance sheet of the new firm. Solution: Journal entries in the books of A Particulars Debit Rs Credit Rs Realization Dr 276250 To stock in trade 170000 To sundry debtors 89000 To cash in hand 13000 To cash at Bank 987 To furniture and fittings 2750 To investment 513 Sundry creditors Bills payable Creditors for Expenses To realization

Dr

New firm To realization

Dr

Dr

123250 118987 118987

Realization Dr To capital (Being the creditors for expenses not taken over by the firm transferred to capital ) Capital To realization (Loss on realization )

Dr

Capital in the new firm To new firm

Dr

Capital To capital in new firm

Dr

Realization To stock in trade To sundry debtors To cash in hand To cash at Bank To furniture and fittings

110000 12500 750

750 750 34763 34763 118987 118987 118987 118987

Journal in the books of B Particulars Dr

Debit Rs 144500

Credit Rs 98000 37000 7500 234 1766

Sundry creditors Creditors for Expenses To realization

Dr Dr

New firm To realization

Dr

47000 2000 49000 101750 101750

Realization Dr To capital (Being the creditors for expenses not taken over by the firm transferred to capital )

2000

Realization To capital (profit on realization )

Dr

4250

Capital in the new firm To new firm

Dr

Capital To capital in new firm

Dr

Liabilities Capital A B Sundry creditors Bills payable

2000

4250 101750 101750 101750 101750

Balance sheet of the firm A and B as on 1/1/1998 Rs Assets Furniture and fittings 200000 Investments 100000 Stock in trade 157000 Sundry debtors 12500 Cash at bank Cash in hand

Rs 3766 1000 252300 111450 99763 1221

Working notes Calculation of purchase consideration: Particulars

A

Assets taken over: Stock in trade Sundry debtors Cash at bank Cash in hand Furniture and fittings Investments [A] Total assets taken Liabilities assumed Sundry creditors for purchase Bills payable (as for purchase only) [B] total liabilities assumed Purchase consideration [A] – [B] Less: capital to me maintained Cash to be introduced (-) and cash to be withdrawn (+)

Particulars To balance b/d (A+B) To A’s capital

B

144500 80000 13000 987 2000 1000 -----------241487 ------------

107800 31450 7500 234 1766 ----------148750 -----------

110000 12500 ----------122500 -----------118987 200000 -----------(-)81013 ======

47000 ---------47000 ----------101750 100000 ---------(+)1750 ======

[2] Cash at bank (in the books of the firm) Rs Particulars 20500 By B’s capital 81013 By balance c/d

Rs 1750 99763

Illustration: Mr. Water and Mr. Fall carry on business individually and on 1/1/1998 they decided to form into a partnership firm on the following and conditions: [a] each partner shall have a fixed capital of Rs 10000 [b] Water’s stock is to be brought in at Rs 3250 and Fall’s stock is to be brought in at Rs 2750 as per valuation. [c] the reserve for bad debts is to be increased to 6% on debtors. [d] Fall is to dispose off his furniture and fittings to his best advantage [e] Any deficiency on the net asset brought in is to be paid into firm’s bank The balance sheet of both of them on 31/12/1997 is as follows

Balance sheet of Mr. Water Rs Assets 1810 Office furniture and fittings 10625 Plant and machinery Stock Sundry debtors Less: provision Cash at bank Cash in hand

Liabilities Sundry creditors Capital

Rs 350 5000 3400 2750 120

2630 980 75

Balance sheet of Mr. Fall Rs Assets Rs 2102 Office furniture and fittings 200 10133 Plant and machinery 5500 Stock 2800 Sundry debtors 3025 Less: provision 100 2925 Cash at bank 765 Cash in hand 45 journal entries to adjust the value of the assets before amalgamation and prepare the balance sheet of the new firm. Solution: Working notes: Statement showing additional cash to be brought in or withdrawn Value of net assets taken over Water Fall Office furniture and fittings 350 Plant and machinery 5000 5500 Stock 3250 2750 Sundry debtors 2750 3025 Cash at bank 980 765 Cash in hand 75 45 -------------------12405 12085 Less: liabilities taken over Creditors 1810 2102 Provision for bad debts 165 181 -----------------Net assets taken over 10430 9802 Less: Capital in the new firm 10000 10000 -------------------Additional cash to be withdrawn or brought in +ve/-ve +430 -198 ====== ====== Liabilities Sundry creditors Capital

Journal entries in the books of M/s. Water & Co. Particulars Dr

Debit

Credit

Capital To stock (3400-3250) To provision for debtors (old – new)

195

Capital To bank

430

Dr

430 Journal entries in the books of M/s. Fall & Co. Particulars Dr

Capital To stock (2800-2750) To provision for debtors (old – new) To furniture and fittings Bank To capital Liabilities Sundry creditors Capital Water Fall

150 45

Debit

Credit 331 50 81 200

Dr Balance sheet of M/s. Water Fall & Co. as on 1/1/1998 Rs Assets 3912 Office furniture and fittings Plant and machinery 10000 Stock 10000 Sundry debtors Less: provision Cash at bank (980+765+198-430) Cash in hand

Rs 350 10500 6000 5775 346

5429 1513 120

[B] WHEN AN EXISTING PARTNERSHIP FIRM ABSORBS A SOLE PROPIRETORSHIP When a partnership firm absorbs a sole proprietorship, the original sole proprietor gets dissolved and compensated by a share in the partnership firm acquiring it. In this case the sole proprietorship goes into liquidation and its assets and liabilities are taken over by the existing firm at agreed values. To close the existing set of books following steps are followed: Step—1: Prepare the balance sheet of the business on the date of dissolution. Step—2: Open realization and transfer all assets and liabilities except cash in hand and cash at bank at their book values. Note: If the new firm takes over the cash in hand and cash at bank then only they are to be transferred to the realization . Step—3: Calculate the purchase consideration on the basis of the and conditions agreed up on. Generally the purchase consideration is calculated on the basis of the assets and liabilities taken over by the firm. The purchase consideration is calculated as under Agreed value of assets taken over xxx Less: agreed value of liabilities assumed xxx Purchase consideration xxx Step—4: Credit realization by the purchase consideration. Step—5: If there are any unrecorded assets and liabilities then they are to be recorded. Step—6: The entire purchase consideration is then matched with the book value of the assets and liabilities taken over to ascertain profit or loss on realization. This is done on the realization . Any profit or loss on realization is then transferred to the capital of the proprietor. The following important points are to be noted [1] the assets and liabilities of sole proprietorship which are taken over by the firm are added to the respective assets and liabilities of the firm. [2] the capital of the new partner (sole proprietor) is the value of the purchase consideration agreed up on. [3] if the purchase consideration is less than the net assets taken over by the firm then the difference is to be taken as capital reserve and if the purchase consideration is more then the net assets taken over then the difference is goodwill. [4] Before amalgamation all assets and liabilities of the firm are to be revalued and any profit or loss on the revaluation is to be transferred to old partners in the old ratio. [5] Goodwill of the firm is to be d\adjusted to the old partner’s capital by crediting them in old ratio. [6] Balance of the reserve and profits are also to be credited to the old partner’s capital in the old profit sharing ratio. Illustration: following is the balance sheet of partner X and Y who share the profit and loss in the ratio of their capital and sole proprietor Z as on 31/12/1997 Particulars X&Y Z Particulars X&Y Z Capital 10000 Goodwill 2000 X 15000 -- Building 25000 Y 5000 -- Stock 10000 15000 Creditors 26000 13000 Bills receivable 5000 5000 Loan 5000 Debtors 4000 6000 Cash 2000 The partners agreed to it Z as a partner and to amalgamate his business with that of the firm on the following : [1] the new profit sharing ratio will be in the ratio of their capital [2] the building is to be appreciated by Rs 15000 and provision of 5% is to be created on debtors. [3] the goodwill of the partnership is to be put at Rs 10000 and of the sole proprietor at Rs 1500. both of them are to be recorded in the books. [4] stock of the firm is to be taken at Rs 9200 and that of the sole proprietor is to be taken at Rs 16800. You are required to prepare ledger in the books of Z and necessary journal entries in the books of X and Y and prepare the balance sheet of the new firm. Solution: working notes Calculation of purchase consideration Particulars Rs Rs Assets taken over Goodwill 1500 Stock 16800 Debtors 6000 Bills receivable 5000 29300 Less: liabilities taken over Creditors 13000 Loan 5000 Provision for debtors 300 18300 Purchase consideration 11000 In the books of Z Realization Particulars Rs Particulars Rs To goodwill 2000 By creditors 13000 To stock 15000 By loan 5000

To bills receivable To debtors To capital – profit

5000 6000 1000

By partner X and Y

In the books of partners X and Y Particulars Dr

Building To revaluation (Being value of the building appreciated by Rs 15000) Revaluation To stock To provision for debtors

Dr

11000

Debit Rs 15000

15000 1000 800 200

Revaluation Dr To X’s capital To Y’s capital (Being profit on revaluation of assets transferred to partners in capital ratio)

14000

Goodwill To X’s capital To Y’s capital (Being goodwill raised in the books)

Dr

10000

Goodwill Stock Bills receivable Debtors To creditors To Loan To provision for bad debts To Z’s capital

Dr Dr Dr Dr

Liabilities Capital X (15000+10500+7500) Y (5000+3500+2500) Z Creditors Loan

Credit Rs

10500 3500

7500 2500

Balance sheet of the new firm after absorption Rs Assets Goodwill (10000+1500) 33000 Buildings (25000+15000) 11000 Stock (9200+16800) 11000 Bills receivable 39000 Debtors (6000+4000) 5000 Less: provision @ 5% Cash in hand

1500 16800 6000 5000 5000 13000 300 11000 Rs 11500 40000 26000 10000 10000 500

9500 2000

[C] WHEN ONE EXISTING PARTNERSHIP FIRM ABSORBS ANOTHER PARTNERSHIP FIRM In this case the purchase consideration is shared by the partners of the selling firm in the ratio of their interest in the old business. At the time of closing the books of all reserves and surpluses are to be transferred to partner’s capital in the old profit sharing ratio. To close the existing set of books following steps are followed: Step—1: Prepare the balance sheet of the business on the date of dissolution. Step—2: Open realization and transfer all assets and liabilities except cash in hand and cash at bank at their book values. Note: If the new firm takes over the cash in hand and cash at bank then only they are to be transferred to the realization . Step—3: Calculate the purchase consideration on the basis of the and conditions agreed up on. Generally the purchase consideration is calculated on the basis of the assets and liabilities taken over by the firm. The purchase consideration is calculated as under Agreed value of assets taken over xxx Less: agreed value of liabilities assumed xxx Purchase consideration xxx Step—4: Credit realization by the purchase consideration. Step—5: If there are any unrecorded assets and liabilities then they are to be recorded. Step—6: The entire purchase consideration is then matched with the book value of the assets and liabilities taken over to ascertain profit or loss on realization. This is done on the realization . Any profit or loss on realization is then transferred to the capital of the proprietor. The following points are important: [1] the assets and liabilities of the liquidating firm are added to the respective heads in the existing firm [2] if the purchase consideration is less than the net assets taken over by the firm then the difference is to be taken as capital reserve and if the purchase consideration is more then the net assets taken over then the difference is goodwill.

Illustration: the balance sheet of partners PQ and RS as on 31/12/1997 are as follows: Particulars PQ RS Particulars Capital Machinery P 60000 - Furniture Q 30000 - Stock R 36000 Debtors S 24000 Investment Bank loan 10000 - Cash Bills payable 30000 40000

PQ 60000 8000 32000 18000 12000

Rs 20000 6000 24000 30000 18000 2000

PQ absorbed RS in the following [1] the value of the goodwill of RS will be Rs 12000 [2] the investment of Rs is to be sold and the amount realized will be introduced in the acquiring business, investments realized Rs 24000 [3] the stock of RS to be reduced to Rs 22000 [4] the machinery of RS will be increased by 40% [5] furniture and fittings of RS will be reduced by 10% It was further decided for PQ that following adjustments are to be made [1] assets are to be revalued as follows: [a] Goodwill Rs 16000; Stock Rs 40000; Machinery Rs 84000; furniture Rs 7200 [2] bank loan is to be repaid. Prepare ledger to close the books of RS and necessary journal entries in the books of PQ and prepare balance sheet after absorption. Solution: working notes Calculation of purchase consideration Particular Rs Rs Assets taken over Goodwill 12000 Stock 22000 Machinery 28000 Furniture 5400 Debtors 30000 Cash (2000+24000) 26000 123400 Liabilities assumed: Bills payable Purchase consideration

40000 In the books of RS Realization Rs Particulars 20000 By bills payable 6000 By PQ (purchase consideration) 24000 30000 26000

Particulars To machinery To furniture To stock To debtors To cash To partners capital R S

40000 83400

Rs 40000 83400

8700 8700 PQ

Particulars To realization

Rs

Particulars

Rs

83400

Particulars By capital in PQ

Rs 83400

Cash To balance b/d To investment Particulars To capital in PQ (b/f)

2000 24000 R 47700

Particulars By realization

Partner’s capital S Particulars 35700 By balance b/d By profit on sale of investment By realization

Rs 26000

R 36000 3000 8700

S 24000 3000 8700

In the Books of PQ Journal entries Stock Machinery To revaluation

Particular Dr Dr Dr

Revaluation To P’s capital To Q’s capital

Dr

Bank loan To cash

Dr

Goodwill To P’s capital To Q’s capital

Dr

Goodwill Stock Machinery Debtors Cash Furniture To bills payable To R’s capital To S’s capital

Dr Dr Dr Dr Dr Dr

Liabilities Capital P Q R S Bills payable

Cr Rs 8000 24000 32000

Revaluation To furniture

Particulars To balance b/d

Dr Rs

800 800 31200 15600 15600 10000 10000 16000 8000 8000 12000 22000 28000 30000 26000 5400 40000 47700 35700

Partner’s capital S Particulars 53600 By balance b/d By goodwill By profit on revaluation Balance sheet of the new firm as on 1/1/1998 Rs Assets Goodwill 47700 Machinery (84000+28000) 35700 Furniture (5400+7200) 83600 Stock(22000+40000) 53600 Debtors(18000+30000) 70000 Cash (26000+12000-10000)

R 83600

R 60000 8000 15600

S 30000 8000 15600 Rs 28000 112000 12600 62000 48000 28000

[D] WHEN TWO OR MORE PARTNERSHIP FIRM FORMS A NEW PARTNERSHIP FIRM When two or more partnership firm amalgamate to a new firm, the books of both the firms are to be closed and the assets and liabilities of both the firm are to transferred to the realization at their book value. ING ENTRIES IN THE BOOKS OF THE AMALGAMATING FIRM 1] For transferring different assets to realization Realization Dr To sundry assets

[individually]

Note: if cash in hand and cash at bank are not taken over by the new firm these are not to be transferred [2] for transferring different liabilities to realization Sundry liabilities To realization

Dr

[3] for purchase consideration New firm To realization

Dr

[4] for assets taken over by the proprietor Capital To realization

Dr

[individually]

[5] for realization of assets not taken over by the new firm Bank To realization

Dr

[6] for recording unrecorded assets Assets To capital

Dr

[7] for realization of unrecorded assets Bank To realization

Dr

Note: in unrecorded assets are taken over by the new firm then these are also to be transferred to the realization [8] for payment of liabilities not taken over Realization To bank [9] for recording unrecorded liabilities Capital To unrecorded liability [10] for payment unrecorded liabilities Liabilities To bank

Dr

Dr Dr

Note: if the unrecorded liabilities are taken over by the new firm then these are to be transferred to the realization along with other assets and liabilities [11] For liabilities assumed by the partners Realization To partners capital

Dr

[12] For realization expenses Realization To bank

Dr

[13] for profit on realization Realization To partners capital

Dr

[14] for loss on realization Partners Capital To realization

Dr

[15] for accumulated profit or reserves Reserves Accumulated profit To partners capital

Dr Dr

[16] for accumulated loss Partners Capital To loss

Dr

[17] for transferring the current of the partners Partners current To partners capital

Dr

[18] for settlement of purchase consideration by the new firm Partner’s Capital in the new firm To new firm

Dr

[18] for final adjustment Partners Capital To partner’s capital in the new firm

Dr

Illustration: A: B=1:2 and X: Y= 1:1. both amalgamate on 1/1/1998, on this date the balance sheet of both the firms are as follows: Liabilities Rs Assets Rs B’s capital 19000 Plant and machinery 10000 Sundry creditors 10000 Stock in trade 20000 Bank over draft 15000 Sundry debtors 10000 A’s capital 4000 Liabilities X’s capital Y’s capital Sundry creditors

Rs

Assets 10000 2000 9500

Rs

Goodwill Stock in trade Sundry debtors Cash in hand

5000 5000 10000 1500

Following further information is available: [1] All fixed assets are to be devalued by 20% [2] All stock in trade is to be appreciated by 50% [3] AB firm owes Rs 5000 to XY, this debts is settled at Rs 2000. [4] goodwill is to be ignored for the purpose of amalgamation [5] the fixed capital in the new firm will be: A—Rs 2000; B—Rs 3000; X—Rs 1000; Y—Rs 4000 [6] B takes over the bank over draft of AB and gifts to A the amount to be brought in by A to make his capital contribution [7] X is paid off out of cash of XY and Y brings in sufficient cash to make up his required capital contribution. necessary journal entries in the books of both the firm as on 31/12/1997. Solution: Journal entries in the books of AB and Co. Particular Rs Rs Realization Dr 40000 To plant and machinery 10000 To stock in trade 20000 To sundry debtors 10000 Sundry creditors To realization

Dr

Bank over draft To B’s capital (Being bank over draft is taken over by B)

Dr

New firm To realization

Dr

10000 10000 15000 15000 41000 41000

Realization Dr To A’s capital To B’s capital (Being profit on realization transferred to the capital of the partners) B’s capital To A’s capital (Being the share of A’s capital shared by B)

Dr

A’s capital B’s capital To capital in the new firm

Dr Dr

Realization To good will To stock in trade To sundry debtors

11000 3667 7333 2333 2333 2000 39000 41000

Journal entries in the books of XY Particular Dr

Rs

Rs 20000 5000 5000 10000

Sundry creditors To realization

Dr

New firm To realization

Dr

X’s capital Y’s capital To realization

Dr Dr

9500 9500 5000 5000 2750 2750 5500

Cash To Y’s capital

Dr

4750

X’s capital To cash X’s capital Y’s capital To capital in the new firm

Dr

6250

Dr Dr

1000 4000

4750 6250 5000 Journal in the books of new firm Particulars

Rs

Rs

B’s capital To B’s loan (being excess capital of Be transferred to loan )

36000

Plan and machinery Stock in trade Sundry debtors To sundry creditors To B’s loan To A’s capital To B’s capital To X’s capital To Y’s loan

8000 37500 17000

Dr Dr Dr

16500 36000 2000 3000 1000 4000

Balance sheet of the new firm after amalgamation Liabilities Rs Assets Capital Plant and machinery A 2000 Stock in trade B 3000 Sundry debtors X 1000 Y 4000 Creditors 16500 B’s loan 36000 Working notes: [1] computation of purchase consideration Particulars Assets taken over Plant and machinery Stock in trade Sundry debtors (XY= 10000-3000) Less: liabilities assumed Sundry creditors (AB= 10000-3000)

Particulars To plant and machinery To stock in trade To sundry debtors To goodwill To partners capital A B

36000

AB 10000 20000 10000 3667 7333

Realization XY Particulars - By creditors 5000 By new firm 10000 By capital 5000 X Y -

Rs 8000 37500 17000

AB

XY

8000 30000 10000 48000 (7000) 41000

7500 7000 14500 (9500) 5000

AB 10000 41000

XY 9500 5000

-

2750 2750

Partner’s capital Particulars A B X Y Particulars A B X y To balance b/d 4000 By balance b/d 19000 10000 2000 To realization 2750 2750 By realization 3667 7333 To A’s capital 2333 By B’s capital * 2333 To new firm 2000 39000 1000 4000 By bank over draft 15000 To cash 6250 By cash 4250 Note: The capital balance of B in new firm is Rs 3000 only, but his capital shows Rs 39000. As there is no liquid asset in the firm of AB, the new firm should transfer Rs 36000 (39000-3000), to a loan . The new capital of A in the new firm is Rs 2000 but his debit balance is Rs 333 at the time of amalgamation so, as promised B has to contribute Rs 2333 to make A’s capital

Illustration: M/s A and Co. having A and B as equal partners, decided to amalgamate with C and Co. having C and D as equal partners on the following : [1] the new firm AC and Co. is to pay Rs 12000 to each of the firm for Goodwill [2] the new firm is to take over the investment at 10% depreciation, land at Rs 66800, premises at Rs 53000, machinery at Rs 9000 and only the trade liabilities of both of the firms. Debtors being taken over at the book value. [3] Typewriters of C and Co. at written down value Rs 800 not recorded in the balance sheet is also not taken over by the new firm. [4] Bills payable pertain to trade transactions only [5] all the four partners are to bring in Rs 160000 as capital in the new firm in equal shares The following were the balance sheet of both the firms on the date of amalgamation Particulars A & Co C & Co. Particulars A & Co C & Co. Trade creditors 20000 10000 Cash 15000 12000 Bills payable 5000 - Investment 10000 8000 Bank over draft 2000 10000 Debtors 10000 A’s loan 6000 - Less: provision 1000 9000 4000 Capital Furniture 12000 6000 A 35000 - Premises 30000 B 22000 - Land 50000 C 36000 Machinery 15000 D 20000 Goodwill 9000 General reserve 8000 3000 Investment fluctuation reserve 2000 1000 journal entries in the books of both the amalgamating firms and the new firm and prepare the balance sheet of the new firm. Solution: Journal entries in the books of A and Company Particulars Rs Rs Realization Dr 86000 To investment 10000 To debtors 10000 To furniture 12000 To premises 30000 To machinery 15000 To goodwill 9000 Provision for bad debts Sundry creditors Bills payable To realization

Dr Dr Dr

1000 20000 5000

AC. & Co. To realization

Dr

A’s capital B’s capital To realization (being furniture distributed equally)

Dr Dr

6000

Realization To A’s capital To B’s capital

Dr

32000

General reserve Investment fluctuation reserve To A’s capital To B’s capital

Dr Dr

A’s loan To A’s capital

Dr

Bank over draft A’s capital To cash

Dr Dr

Cash To B’s capital

Dr

26000 80000 80000 60000

16000 16000 8000 2000 5000 5000 6000 6000 2000 16000 18000 3000 3000

Capital in AC. & Co. To AC. & Co.

Dr

A’ capital B’s capital To capital in AC. & Co.

Dr Dr

Realization To investment To debtors To furniture To land

80000 80000 40000 40000 80000

Journal entries in the books of C & Co. Particulars Dr

Rs 8000 4000 6000 50000

Provision for bad debts Bills payable To realization

Dr Dr

AC. & Co. To realization

Dr

1000 10000 11000 40000 40000

C’s capital Dr D’s capital Dr To realization (being furniture and typewriter distributed equally) Realization To A’s capital To B’s capital

Dr

General reserve Investment fluctuation reserve To C’s capital To D’s capital

Dr Dr

Bank over draft C’s capital To cash

Dr Dr

Cash To D’s capital

Dr

Capital in AC. & Co. To AC. & Co.

Dr

C’ capital D’s capital To capital in AC. & Co.

Dr Dr

Goodwill Investment Land Premises Machinery Debtors To Trade creditors To Bills payable To Provision for debtors To A’s capital To B’s capital To C’s capital To D’s capital

Rs 68000

3400 3400 6800 14000 14000 28000 3000 1000 2000 2000 10000 9000 19000 7000 7000 80000 80000 40000 40000 80000

Journal entries in the books of AC & Co. Particulars Dr (Balance figure) Dr Dr Dr Dr Dr

Rs 37000 16200 66800 53000 9000 14000

Rs

30000 5000 1000 40000 40000 40000 40000

Balance sheet of AC. & Co. Rs Assets 40000 Goodwill 40000 Investment 40000 Land 40000 Premises 30000 Machinery 5000 Debtors (Less RBD Rs 1000)

Liabilities A’s capital B’s capital C’s capital D’s capital Sundry creditors Bills payable

Working notes: Calculation of goodwill or capital reserve after amalgamation Particulars Assets taken over Goodwill Investment Land Premises Machinery Debtors

A &Co. 10000 10000 12000 30000 15000 9000 16000 16000 -

Particulars To realization To capital in AC& Co. To cash (final settlement)

A 6000 40000 16000

Particulars To realization To capital in AC& Co. To cash (final settlement)

C 3400 40000 9000

Particulars To balance b/d To B’s capital To D’s capital

A & Co 15000 3000 -

37000 16200 66800 53000 9000 13000s

A & Co.

Less liabilities taken over Trade creditors Bills payable Net assets taken over Less: purchase consideration Goodwill -ve / +ve capital reserve Particulars To investment To debtors To furniture To premises To land To machinery To goodwill To A’s capital To B’s capital To C’s capital To D’s capital

Rs

C & Co. 12000 9000 53000 9000 9000 92000

12000 7200 66800 4000 90000

20000 5000 67000 80000 -13000

10000 80000 80000 -